British Pound Outlook: GBP/USD

GBP/USD struggles to retrace the decline following the Federal Reserve interest rate decision even as the Bank of England (BoE) keeps the Bank Rate at 4.75%, and the exchange rate continue to give back the recovery from the November low (1.2487) should it track the negative slope in the 50-Day SMA (1.3019).

GBP/USD Holds Below Pre-Fed Levels Even as BoE Keeps Bank Rate Steady

GBP/USD remains vulnerable to a bear-flag formation as it continues to hold below the moving average, and it seems as though there’s a growing dissent with the Monetary Policy Committee (MPC) as ‘recent developments added to the argument for a gradual approach to the withdrawal of policy restrictiveness.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

The minutes from the BoE’s meeting suggest the central bank will continue to unwind its restrictive policy in 2025 as ‘three members preferred a 0.25 percentage point reduction in Bank Rate at this meeting,’ and a growing number of MPC officials may prepare UK households and businesses for lower interest rates as ‘the most recent data developments pointed to sluggish demand and a weakening labour market.’

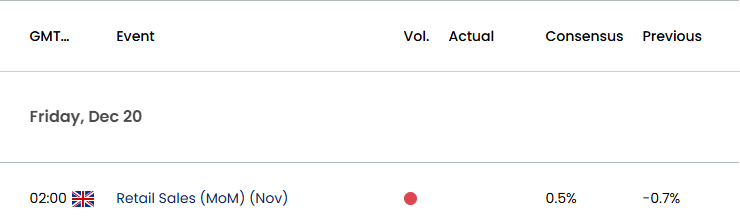

UK Economic Calendar

In turn, the British Pound may face headwinds ahead of the next BoE meeting on February 6, 2025, but the update to the UK Retail Sales report may prop up GBP/USD over the remainder of the week as household spending is expected to increase 0.5% in November after contracting 0.7% the month prior.

With that said, a positive development may spur a bullish reaction in the British Pound, but a weaker-than-expected UK Retail Sales report may push the exchange rate towards the November low (1.2487) as a bear-flag appears to be unfolding.

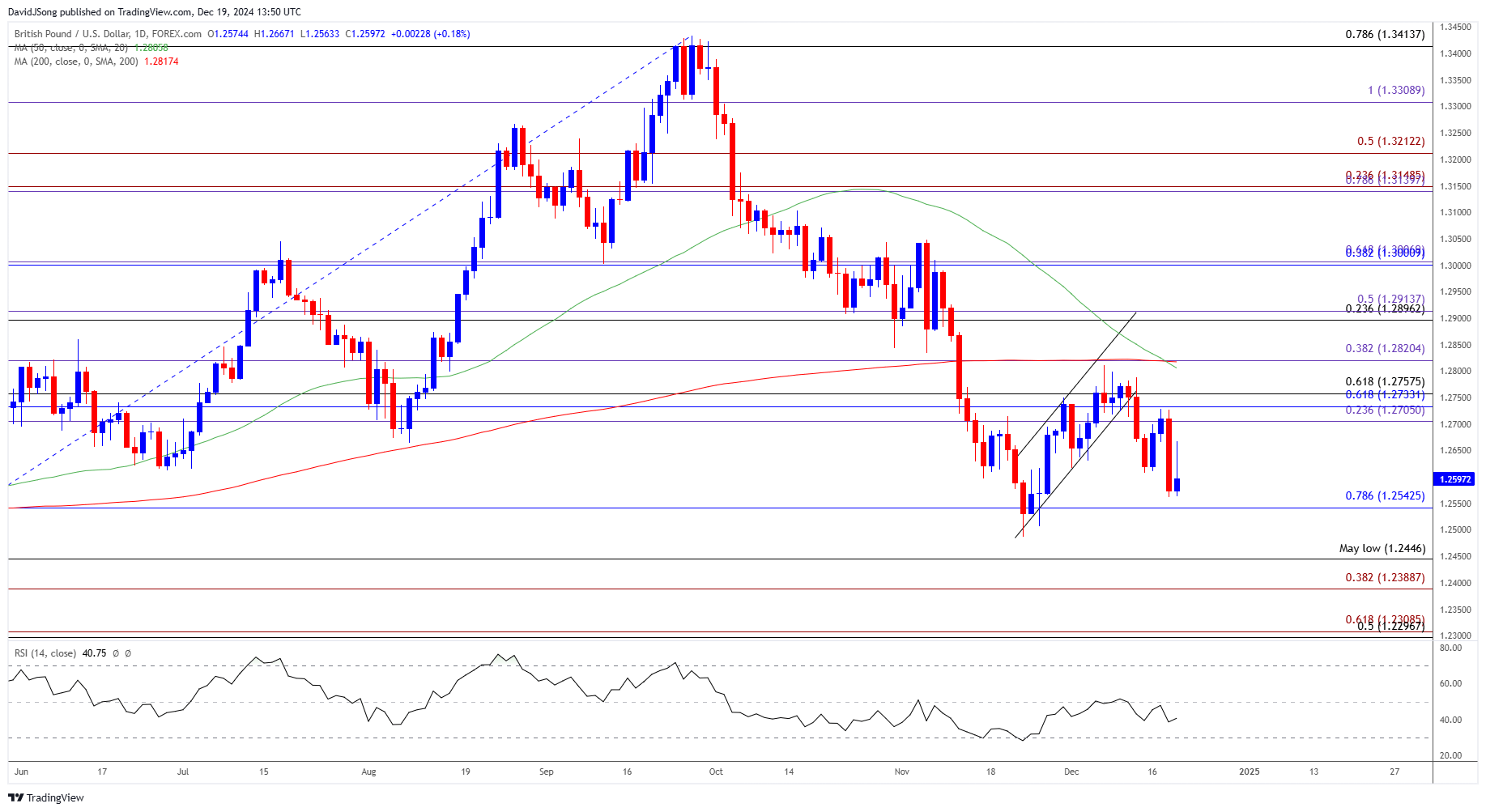

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- Keep in mind, GBP/USD registered a fresh monthly low (1.2562) after failing to push back above the 1.2710 (23.6% Fibonacci extension) to 1.2760 (61.8% Fibonacci retracement) zone, and lack of momentum to hold above 1.2540 (78.6% Fibonacci retracement) may lead to a test of the November low (1.2487).

- Next area of interest comes in around 1.2390 (38.2% Fibonacci extension) to 1.2446 (May low), but failure to break/close below 1.2540 (78.6% Fibonacci retracement) may keep GBP/USD within the November range.

- Need a close above the 1.2710 (23.6% Fibonacci extension) to 1.2760 (61.8% Fibonacci retracement) zone to bring 1.2820 (38.2% Fibonacci extension) back on the radar, with the next region of interest coming in around 1.2900 (23.6% Fibonacci retracement) to 1.2910 (50% Fibonacci extension).

Additional Market Outlooks

US Dollar Forecast: AUD/USD Approaches November 2023 Low

USD/CAD Pullback Keeps RSI Below Overbought Territory

US Dollar Forecast: EUR/USD Attempts to Halt Five-Day Selloff

Gold Price Forecast: Bullion Remains Below Pre-US Election Prices

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong