GBP/USD rises ahead of US GDP

- No UK data, focus on USD

- US GDP forecast to slow to 2% QoQ annualized

- GBPUSD rises towards 1.25

GBP/USD is rising for a second straight day as it grinds higher towards 1.25. There is no high-impacting UK economic data due to be released today, and there are no Bank of England speakers scheduled. As a result, the focus is expected to be on the USD and US GDP data.

The US dollar traded under pressure in recent sessions amid concerns over recession in the US. While US durable goods orders jumped, the underlying trend showed weakness in demand for US-made goods, pointing to a softer manufacturing sector. Earlier in the week USD consumer confidence fell to a nine-month low.

Attention now tends to US GDP data for further clues over a possible slowdown in the world's largest economy expectations are for GDP to rise 2% QoQ annualized, a slowdown from 2.4%. Weak growth could fuel downturn concerns.

The data comes ahead of core PCE inflation figures tomorrow and the FOMC rate decision next week.

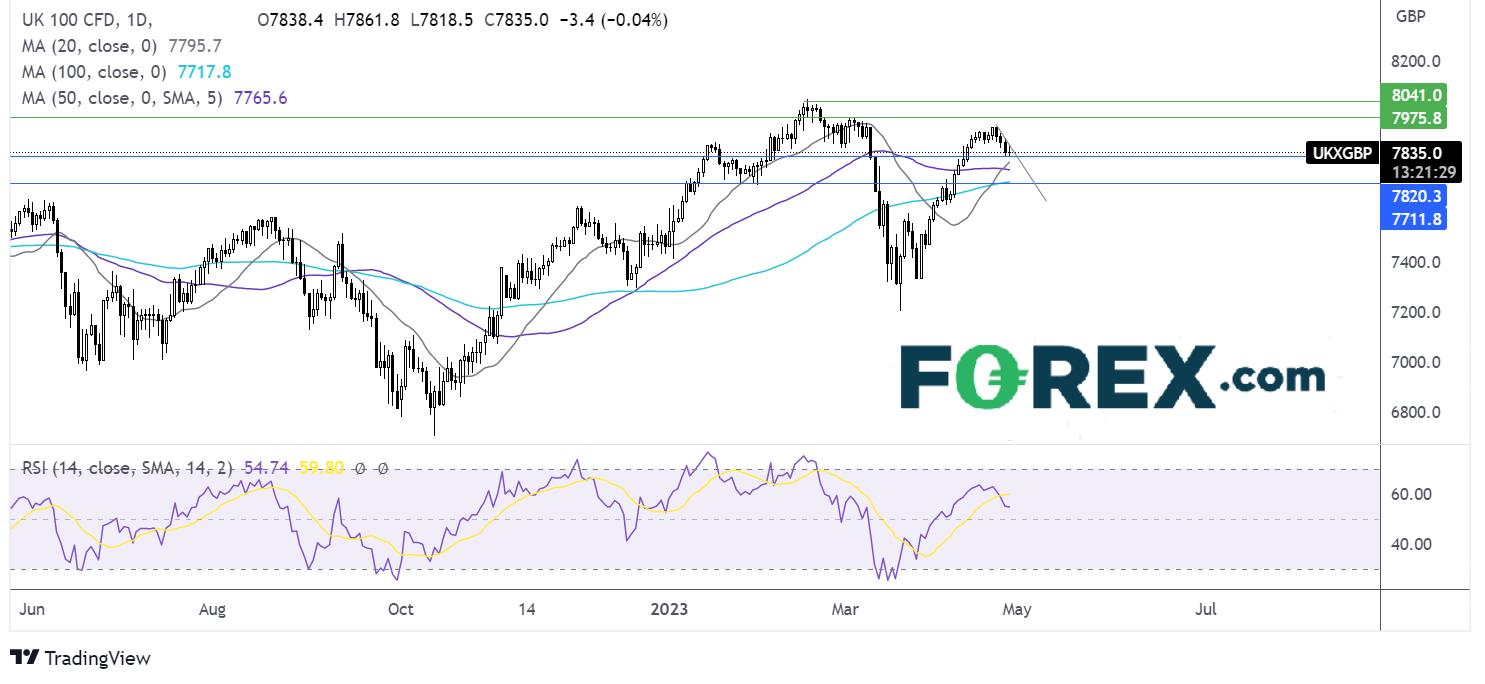

Where next for GDPUSD?

GBPUSD has risen off the rising trendline support at 1.24, rising back above the 20 sma. This, combined with the RSI above 50 keeps buyers hopeful of gains. Buyers will look for a rise above 1.2515, yesterday’s high, to attack 1.2545, the 2023 high, signalling a breakout. Above here, 1.26 comes into play.

On the flip side. Sellers could look for a fall below 1.24 yesterday’s low and 1.2385 the weekly low negate the near-term uptrend and open the door to 1.2275 the April low.

FTSE struggles for direction, Barclays jumps

- Barclays rises 3% as profits jump 27%

- NIM rises to 3.2%

- FTSE finds support at 7818

The FTSE is set to open lower with earnings in focus as investors digest the latest figures from Barclays.

The bank posted a 27% rise in profits as rising interest rates offset weakness in the investment banking arm.

Net profits rose to £1.8 billion up from £1.4 billion in the same period in 2022, beating forecasts by around £400 million. Meanwhile, revenue jumped 11% to £7.2 billion, ahead of the £6.8 billion forecast.

UK interest rates at a 15-year high in the UK resulted in a solid rise in net interest margin. At the same time, bad loan reserves are not accelerating as dramatically as feared. Barclays set aside £524 million for bad loans and said that there was a limited deterioration, with impairments still at a historically low level.

With the cost of living crisis ongoing, inflation still in double digits and the BoE set to hike rates further, there is still a potential for bad loan charges to increase further in coming quarters.

The investment banking arm was the weak link, with profits falling. Equity trading profits tumbled 33%, while fixed-income trading rose 9%. Advisory fees were also harder to come by, dropping 7%.

The results come as jitters surrounding the banking sector remain, particularly stateside, where regional banks are showing heavy deposit outflows.

Looking ahead, there is no high impacting UK economic data US earnings and GDP data could drive sentiment.

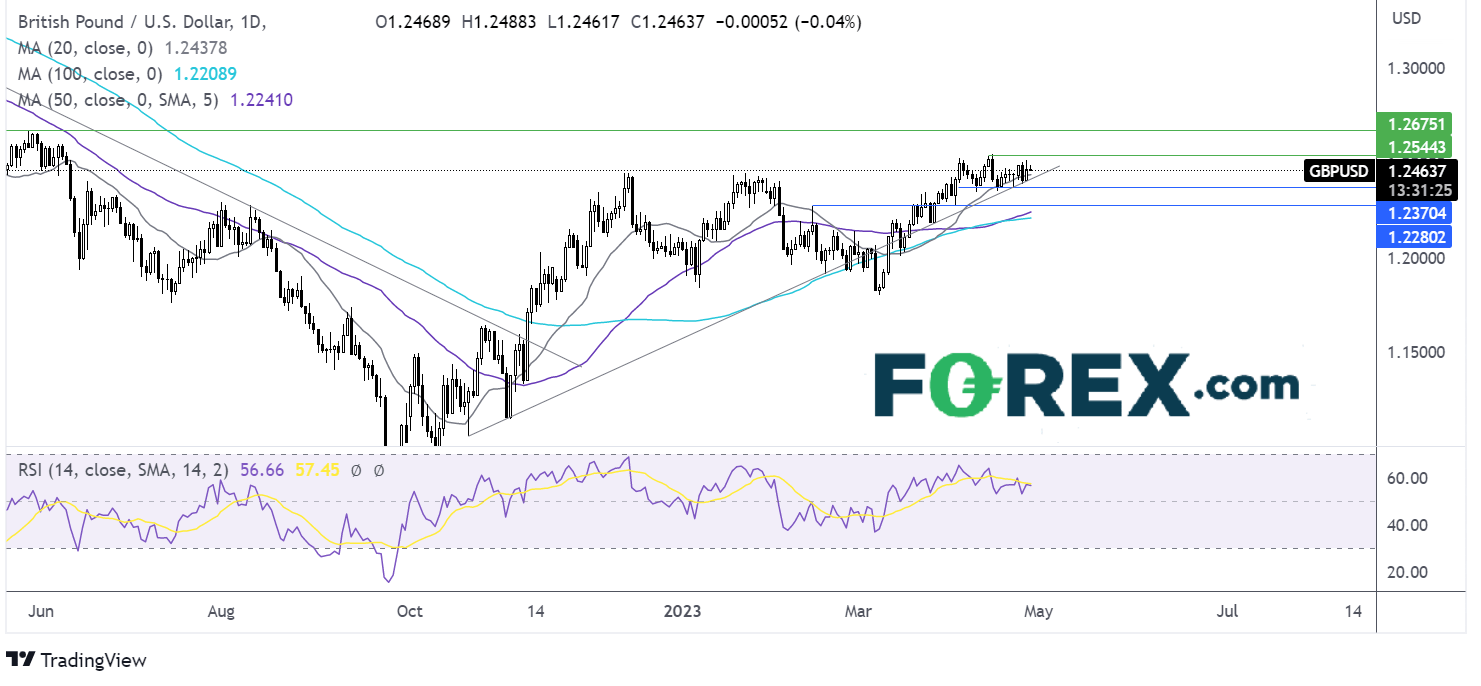

Where next for the FTSE100?

The FTSE has been trending lower across the week but closed off the low yesterday, and the doji candle today highlight the indecision.

Sellers will look for a fall below 7818 to create a lower low and expose the 20 sma at 7795 and 7700 the late January low, and the 100 sma.

On the flipside, buyers could be encouraged by the 20 sma rising above the 50 sma and the RSI above 50. A break above the falling trendline at 7860 could signal a breakout and brings 7940 the April high.