Key Events

- US Consumer confidence, FOMC Minutes (Tuesday)

- US Prelim GDP, Core PCE, and Unemployment claims (Wednesday)

- German Prelim CPI m/m (Thursday)

- Tokyo Core CPI, Eurozone Core CPI (Friday)

GBP

UK inflation surged from 1.7% to 2.3% in November, yet GBPUSD remains under pressure due to the Bank of England’s gradual interest rate cut plan. The dollar’s strength continues to weigh heavily on the pound, creating a strong bearish outlook on broader charts. However, in the short term, key support levels mentioned in the analysis below may influence near-term moves.

Euro

The euro recently found support at 1.0330 after weaker-than-expected eurozone PMI data, with both manufacturing and services falling below the 50-expansion metric. Ahead of this week’s CPI reports, Germany’s CPI is expected to decline to -2.4%, while the eurozone’s core CPI is forecast to rise from 2.7% to 2.8%, with annual CPI increasing from 2% to 2.3%.

JPY

From the Yen’s perspective, critical levels against the dollar rally are back in the headlines, alongside BOJ intervention risks if the Yen surpasses the 157 and 160-mark. Slight rebound levels for the yen against the dollar can be seen on the charts in a similar manner to that of the pound and the euro. As per Ueda’s latest remarks, policies will be adjusted based on the development of economic conditions.

Technical Analysis: Quantifying Uncertainties

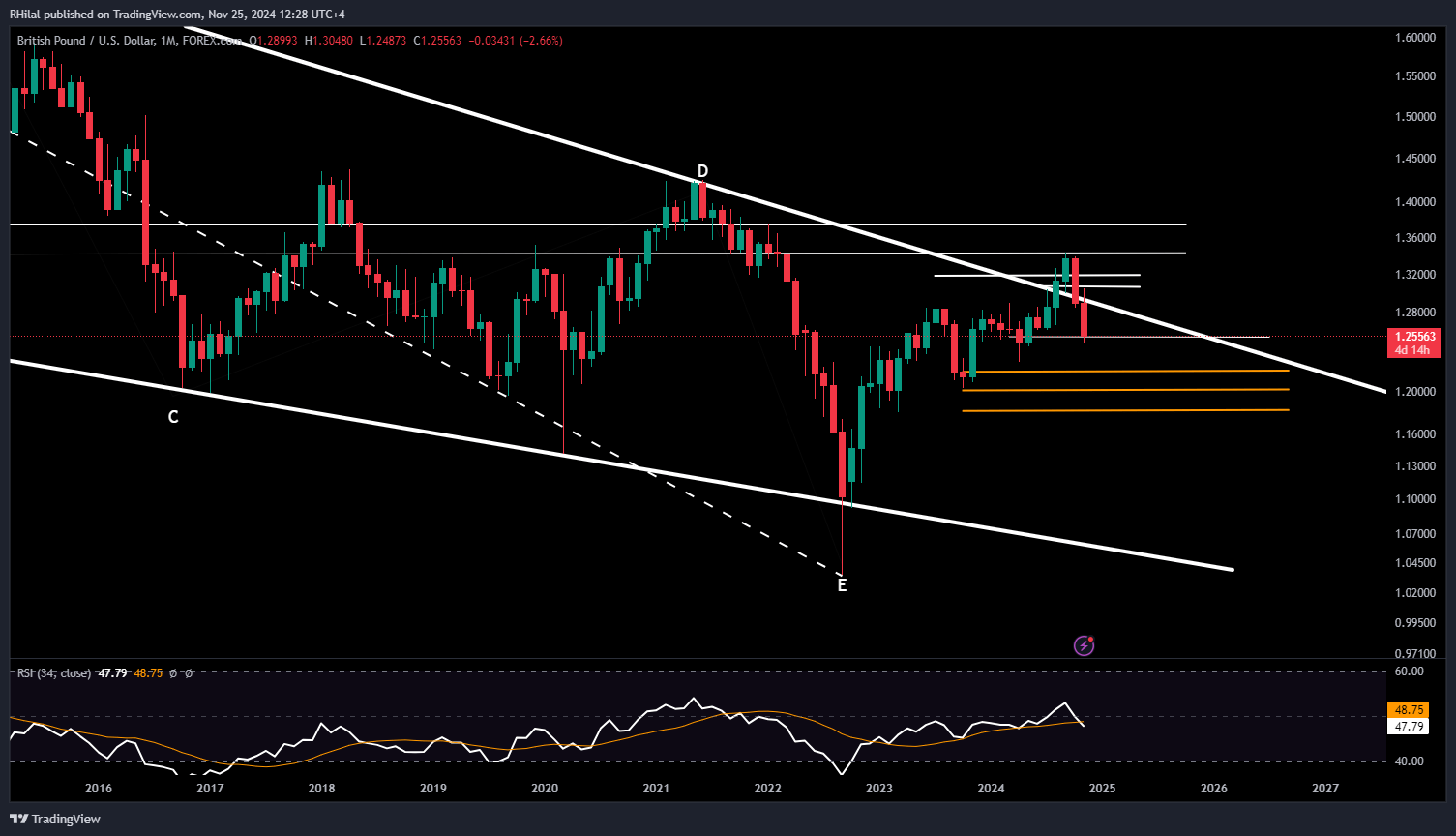

GBPUSD Outlook: Weekly Time Frame – Log Scale

Source: Tradingview

The GBPUSD’s firm drop back inside its 15-year consolidation, respecting the reversal sentiment of the bearish engulfing pattern at the 1.34 resistance zone, is pointing to potential drops towards levels 1.22, 1.20, and 1.18, given a decisive close below the 1.2480 mark. From the upside, climbing back above the 1.29 mark may revive the uptrend, potentially aligning with resistance levels at 1.3040, 1.3140, and 1.34 before establishing new yearly highs towards 1.37.

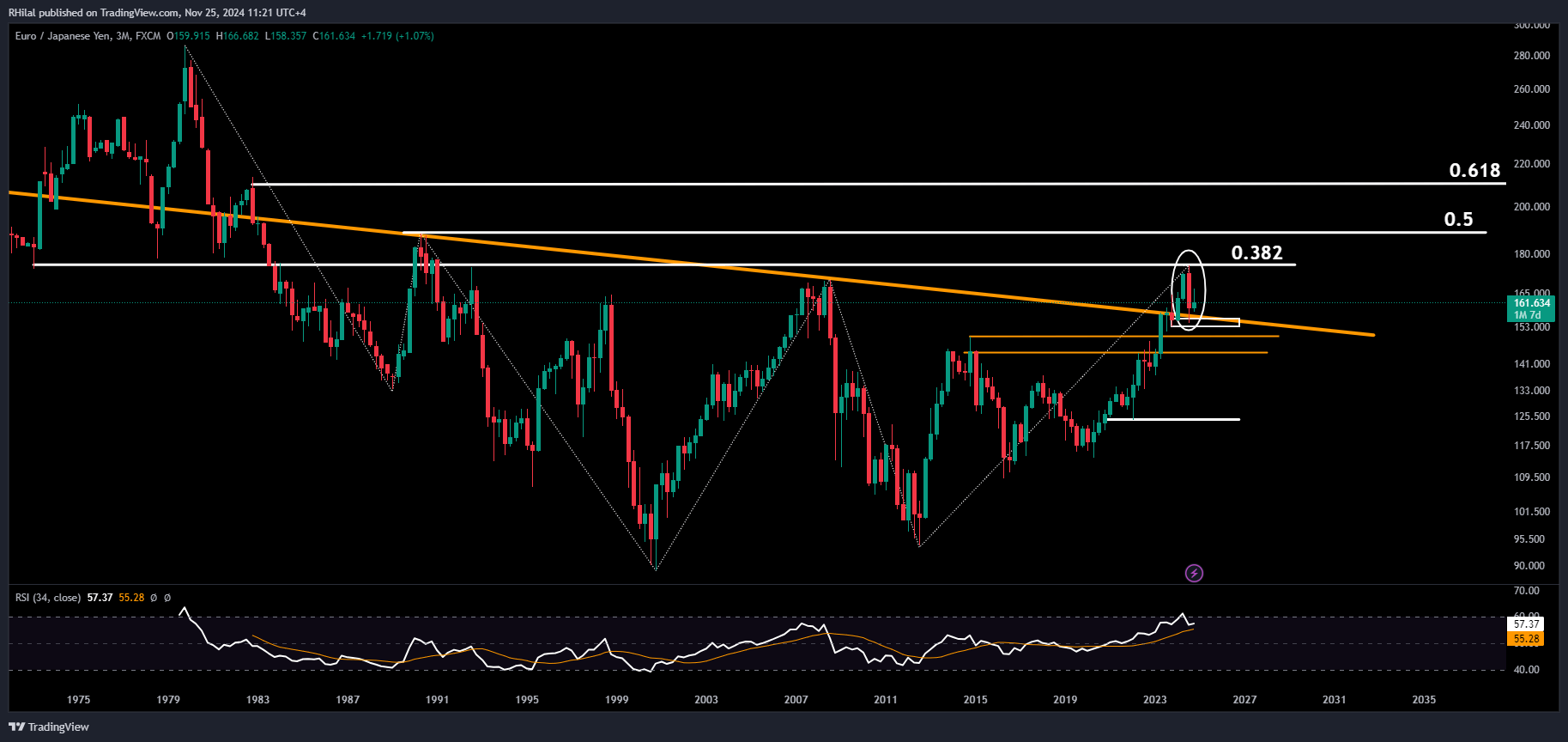

EURJPY Outlook: Monthly Time Frame – Log Scale

Source: Tradingview

EURJPY is retesting the trendline connecting the 1990 and 2008 highs, aligning with the critical 154 support zone from October 2023. While this support level holds significance, a bearish engulfing pattern and overbought RSI raise the likelihood of a reversal.

Bullish Scenario: A break above the 175.40 high could extend gains to 188.20, the 50% Fibonacci retracement of the 1979–2000 downtrend, with further potential toward 208, aligning with the golden 0.618 Fibonacci level.

Bearish Scenario: A close below 153 could trigger a correction toward the 149.80 support, aligning with the October 2014 high, with further downside potential at 144.

--- Written by Razan Hilal, CMT on X: @Rh_waves