GBP/USD Key Points

- GBP/USD is the strongest major currency pair this week, benefitting from soft US data and stronger-than-expected UK readings.

- For this week, traders will key in on Wednesday’s UK CPI report, as well as the UK jobs report on Thursday and Friday’s Retail Sales reading

- GBP/USD could pull back off 1-year highs at 1.3000 given the 17-year high in speculative long positioning, per the CFTC’s COT report.

Helped along by last week’s cooler-than-expected US CPI report, the US dollar is the weakest major currency so far this month.

Indeed, traders believe that the combination of falling inflation and a recent uptick in initial unemployment claims will push the Federal Reserve to cut interest rates more aggressively than traders had anticipated a few months ago (though still well less than expected at the start of the year). According to Bloomberg, traders are pricing in about 50/50 odds that we see three 25bps interest rate cuts from the Fed this year, in September, October, and November.

Against that monetary policy backdrop, the US dollar’s weakness is not particularly surprising.

At the same time, the British pound has been the strongest major currency this week, boosted by a run of better-than-expected UK economic data. Last week’s May GDP reading came in at 0.4% m/m, showing twice as much growth as the 0.2% reading expected by economists. Last month’s retail sales report was similarly stronger than expected.

For this week, traders will key in on Wednesday’s UK CPI report, as well as the UK jobs report on Thursday and Friday’s Retail Sales reading; if these updates confirm the ongoing strength in the UK economy, GBP/USD could build on its already stellar month.

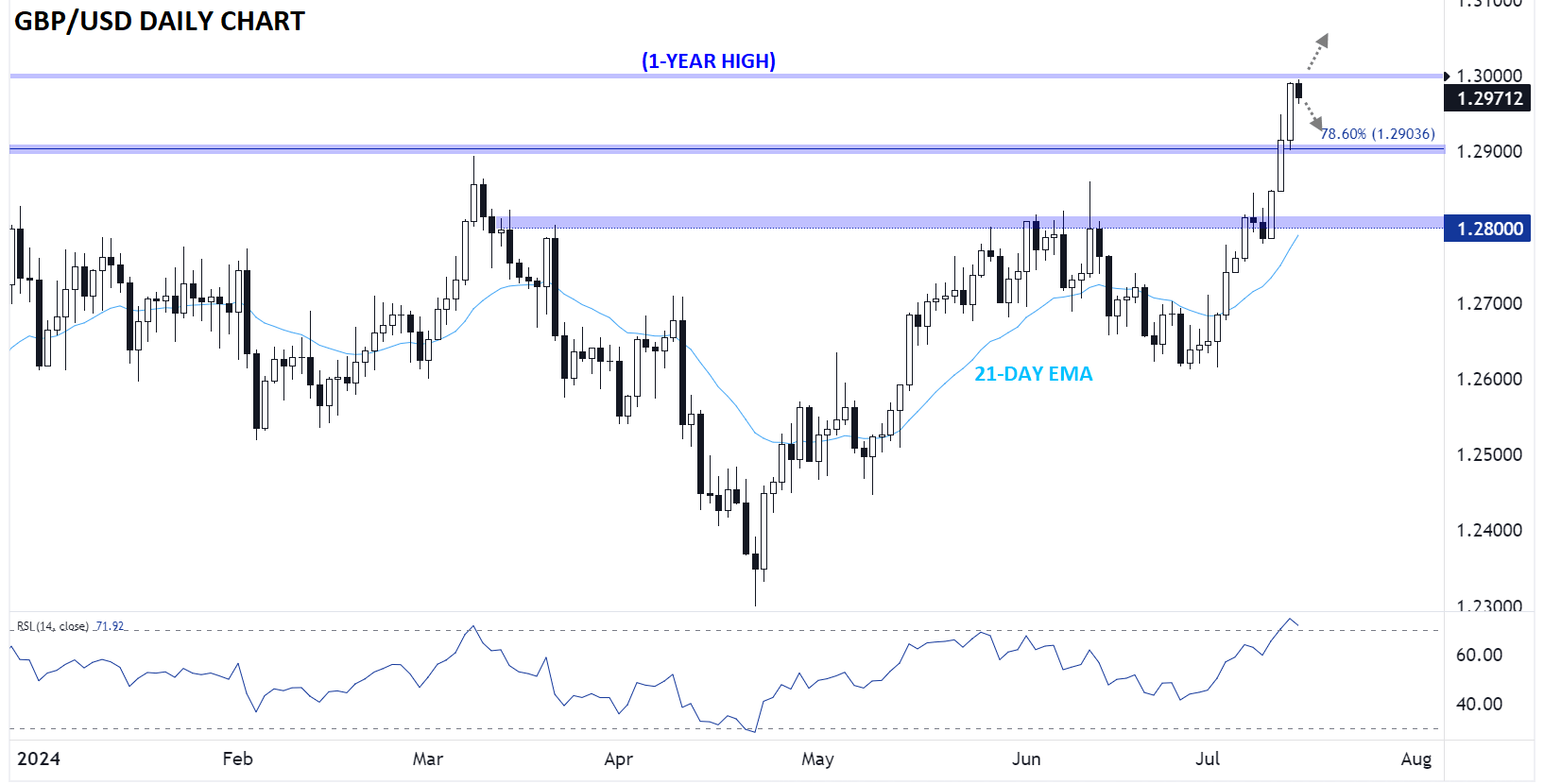

British Pound Technical Analysis – GBP/USD Daily Chart

Source: TradingView, StoneX

Speaking of GBP/USD, Cable has rallied in 10 of the last 12 days, taking the pair up to its highest level in nearly a full year. For this week, the key level to watch will be psychological resistance at 1.3000: If that level, which also represents the late July 2023 high, is convincingly broken, GBP/USD could make a run at its 2+ year high near 1.3150 next.

Meanwhile, given the pound’s 17-year high in net speculative long positioning and the overbought RSI, a profit-taking dip off this resistance level would be logical, especially if this week’s UK data disappoints. In that scenario, previous-resistance turned-support near 1.2900 will be the key level to watch.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX