The GBP fell along with other risk assets this afternoon on reports Iran was launching a ballistic missile attack against Israel, with Jerusalem later confirming the news. This comes after Israel escalated its military operations against Tehran-backed Hezbollah in southern Lebanon. With risk appetite waning somewhat, the GBP/USD forecast is facing increased uncertainty following three consecutive months of gains. After maintaining stability in recent trading sessions, the cable has seen a slight pullback at the start of the new quarter, partly due to hawkish comments from Federal Reserve Chair Jerome Powell and reduced risk appetite. This week’s key event is the US non-farm payrolls report on Friday, and ahead of it we have had some mixed signals from the jobs market.

Mixed signals from US labour market

US data released today pointed to a mixed picture. While the employment component of the ISM manufacturing PMI fell sharply, the JOLTS Job Openings showed a surprising read to provide a positive-looking leading indicator of overall employment. The latter came in at 8.04 million, much better than 7.64 million expected, while the previous month was revised higher to 7.71 million. But this was offset to some degree by the ISM employment component of the manufacturing sector. This contract by 2.1 points to 43.9 from 46.0 the month before, suggesting the pace of contraction has accelerated. The employment component fell along with new orders and production, while the headline PMI remained in the contractionary territory at 47.2 against expectations of a small bounce.

Looking forward to the rest of the week, the focus will remain on US data, including the monthly jobs report, which could play a pivotal role in the short-term direction of the cable. Although the broader trend for the US dollar has been bearish, the GBP/USD forecast shows signs of possible retracement if the upcoming US data doesn't favour further dollar weakening.

GBP/USD forecast: Technical analysis

Source: TradingView.com

Source: TradingView.com

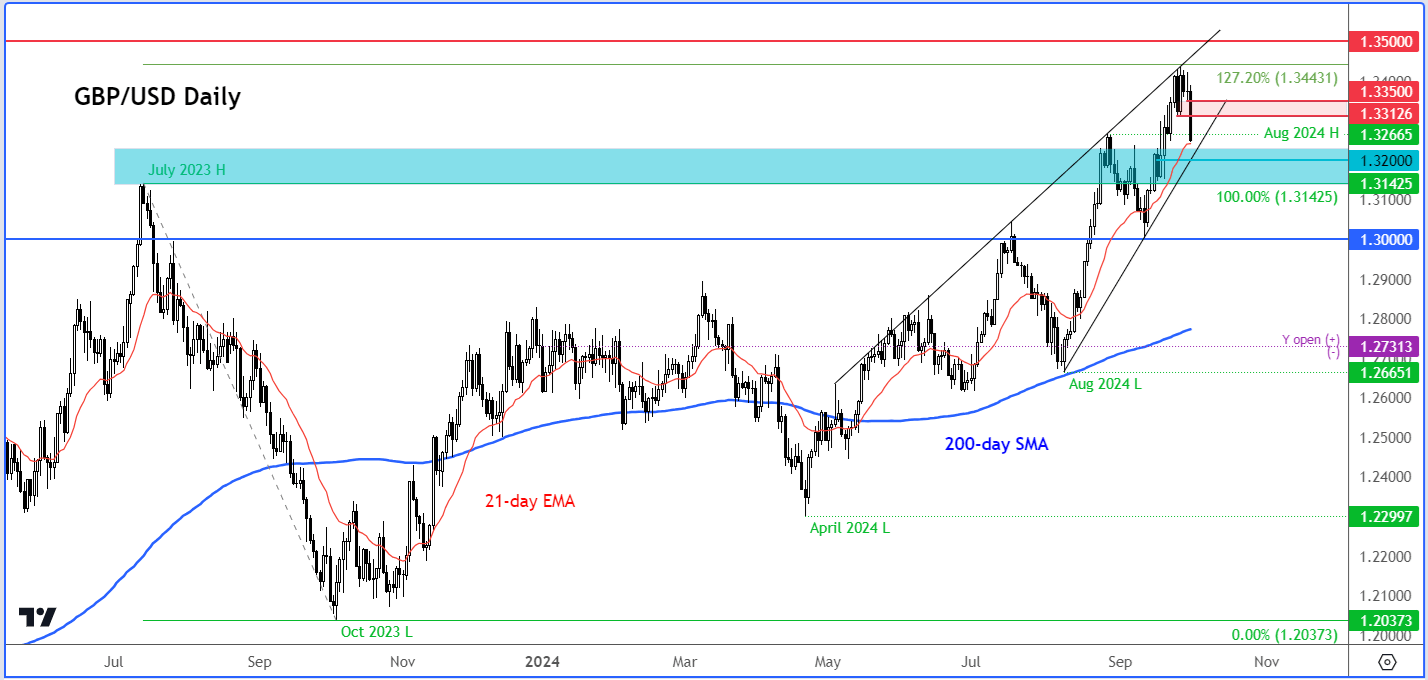

From a technical perspective, the GBP/USD’s short-term trend has weakened somewhat after the pair lost its entire gains from the week before. Last week saw the cable near the crucial 1.35-1.40 resistance zone. Historically, this range has acted as a strong ceiling since the 2016 Brexit vote, repeatedly halting upward momentum. Momentum indicators, such as the Relative Strength Index (RSI), were already suggesting that the pair was at overbought levels, so some weakness was due anyway.

At the time of writing, the GBP/USD was testing a key short-term support around 1.3265, which was resistance back in August. If this level breaks down decisively, then the next potential support to watch is at 1.3200, marking the bullish trend line, followed by 1.3142, the high point from July.

In terms of resistance, the now broken support at 1.3312-1.3350 area is the most important hurdle to watch.

In summary, the broader trend of the US dollar is no longer as weak as it was last week, which means the GBP/USD forecast remains highly uncertain, with the near-term direction heavily reliant on incoming US economic data this week and on geopolitics.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R