FTSE 100 inches higher after stronger economic growth

- UK GDP rose 0.4% MoM in May, up from 0% in April

- August rate cut expectations are revised lower

- Water companies rise after Ofwhat’s price increase

- FTSE rises but stays below the falling trendline

The FTSE is edging higher after UK GDP data showed that the economy grew more quickly than expected in May potentially reducing the chances of an August rate cut and as water firm rose.

UK GDP grew 0.4% in May, double the 0.2% rate forecast and up from 0% in April.

Delving deeper into the numbers, a sharp rebound in the construction sector helped boost growth.

The data, combined with hawkish comments from Bank of England policymakers this week, has seen the market rein in rate cut expectations. BoE chief economist Huw Pill yesterday said that he was uncomfortable with persistent inflation, referring to sticky service sector inflation and wage growth. The market is now pricing in just a 50% probability of a rate cut in August, down from 60% at the start of the week.

As a result, the pound is trading at its highest level in four months, bringing a less favorable exchange rate to the multinationals that make up most of the UK index. Housebuilders are under pressure because of the prospect of interest rates remaining higher for longer.

Meanwhile, water firm Severn Trent and United Utilities are leading the move higher after the regulator Ofwat’s draft determination. The regulator has proposed that water bills rise by an average of 21% over five years alongside a spending package of £88 billion by water companies.

Attention will now turn to US inflation data, which is expected to show that inflation cooled in June. The UK index.

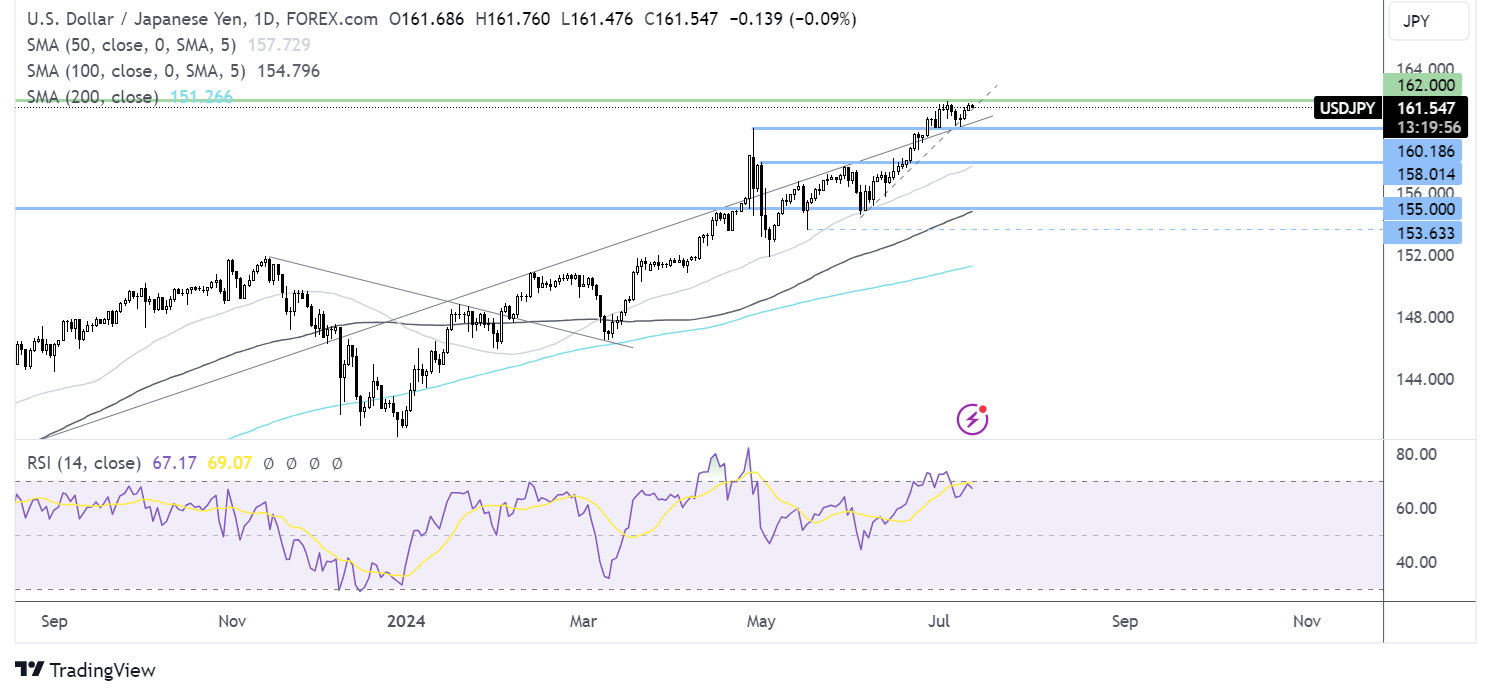

FTSE 100 forecast – technical analysis

The FTSE faced rejection at 8285, the falling trendline resistance, and rebounded lower to 8150. Sellers need to take out this level to extend the downtrend. A break below 8150 opens the door to 8000.

Buyers will need to rise above 8260, the falling trendline support, and 8285, the July high, to extend gains towards 8365, the late June high.

USD/JPY looks to US CPI data

- US CPI is expected to ease to 3.1% YoY from 3.3%

- Market prices in a 72% probability of a September rate cut

- USD/JPY holds steady around 161.80

USD/JPY is holding steady just below a 38-year high as investors await US inflation data. Expectations are for inflation to cool to 3.1%, down from 3.3%, while core inflation is set to hold steady at 3.4%. However, on a monthly basis, core inflation is expected to rise at just 0.2%, in line with last month, marking the smallest two-month increase since summer last year.

The data comes after Federal Reserve Chair Jerome Powell testified before Congress this week. Powell acknowledged that progress had been made on cooling inflation and noted a weakening in the labor market. Powell reiterated that policymakers want to see more good data before starting to cut rates.

The market is eager for a rate cut and interpreted Powell's appearance as dovish. This pulled the USD lower against its major peers and helped stocks reach record highs.

Cooler-than-expected inflation could cement September rate cut expectations. The market is pricing in a 72% probability of a rate cut in September up from 45% just a month ago.

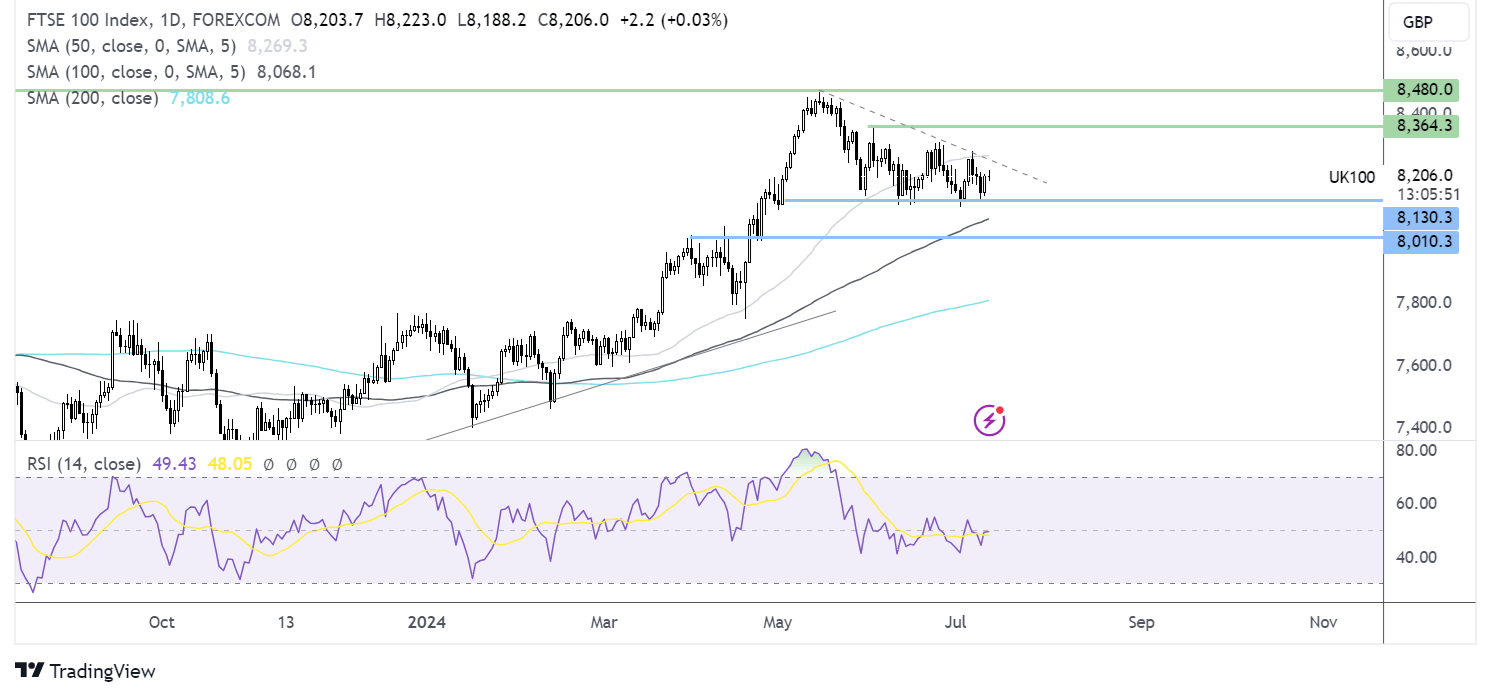

USD/JPY forecast – technical analysis

USD/JPY trades are hovering near a 38-year high at 161.80. Weaker inflation could pull the USD lower, bringing the pair down to test 160.20, the weekly low, the rising trendline support, and the April high.

A break below here opens the door to 158.00, the May high.

On the flip side, buyers will look to rise above 162.00 to extend gains to fresh 38-year highs.