Expectations

In a close vote of 5 to 4, the Monetary Policy Committee reduced the Bank Rate from a 16-year high of 5.25% to 5% during the meeting last month. Governor Andrew Bailey, however, stressed the need for further "careful" reductions in borrowing costs.

According to a poll of 65 economists surveyed between September 6 and 11, the Bank Rate will most likely remain at 5% at the next meeting, although they are likely to be reduced further in November.

The Bank of England is taking a more cautious approach to lowering interest rates than the Federal Reserve or the ECB because services inflation is still high. This highlights that the committee will likely vote to keep interest rates the same this month. However, if indications of decreased wage/price expectations start to appear in the official figures, that might start to alter the rate cuts to earlier than later.

BoE started first but might remain higher for longer compared to the EU and USA

Although the Bank of England began reducing interest rates before the Federal Reserve, it is evident from the tone of the August meeting and the remarks that followed that policymakers do not want the markets to go crazy believing that there will be a rapid easing cycle.

The inflation of services explains some of such caution. Similar to wage growth, it is still higher than that of the US and the eurozone at 5.2%. That is, to be sure, significantly less than the Bank's most recent estimate, note that July's figure was actually below expectations. However, similar to the previous positive shocks, this is mostly due to volatility in the BoE's component parts and signifies that more data is necessary to take accurate decisions.

Where do we go from here?

By the end of the year, the markets are currently pricing in about two more quarter-point reductions, which would lower the base rate to 4.5%. However, according to the most recent Reuters survey, analysts are being more careful.

65 percent of respondents to the news agency's study stated they anticipate the Bank of England making just one more decrease in 2024. Based on the poll results, November appears to be the most likely month for the cut.

During his recent speech at Jackson Hole, Governor Andrew Bailey outlined three possible scenarios for "persistent" inflation. These scenarios included a scenario in which services inflation naturally declines, independent of the BoE's actions, and another in which it might be discovered that wage and price setting behaviour might have permanently changed in a way that will drive interest rates higher for longer.

That only represents the committee's clearly growing division on the direction of rates and where they should go in the future.

Nonetheless, Bailey appears to be currently moving toward a more dovish assessment of the inflation picture.

Faster cuts are expected beyond November

By November, it will become increasingly evident at which point rate cuts can accelerate to match the levels of the ECB and the FED. The Bank's Decision Maker Panel poll although by a thin margin, increasing votes for a rate cut and show that so far, a rate cut in this year still remains on the table.

Sterling might face some weakness

The BoE's broad trade-weighted sterling index is currently up around 3.5% year to date, indicating that sterling has had a strong 2024, where rate differences have undoubtedly contributed. If things change, then the possibility increases that the sterling may begin to suffer if the BoE does begin to lower and catch up with the Fed and, to a lesser extent, the European Central Bank. Regardless, currently economists anticipate a more dovish stance from the BoE, by year's end.

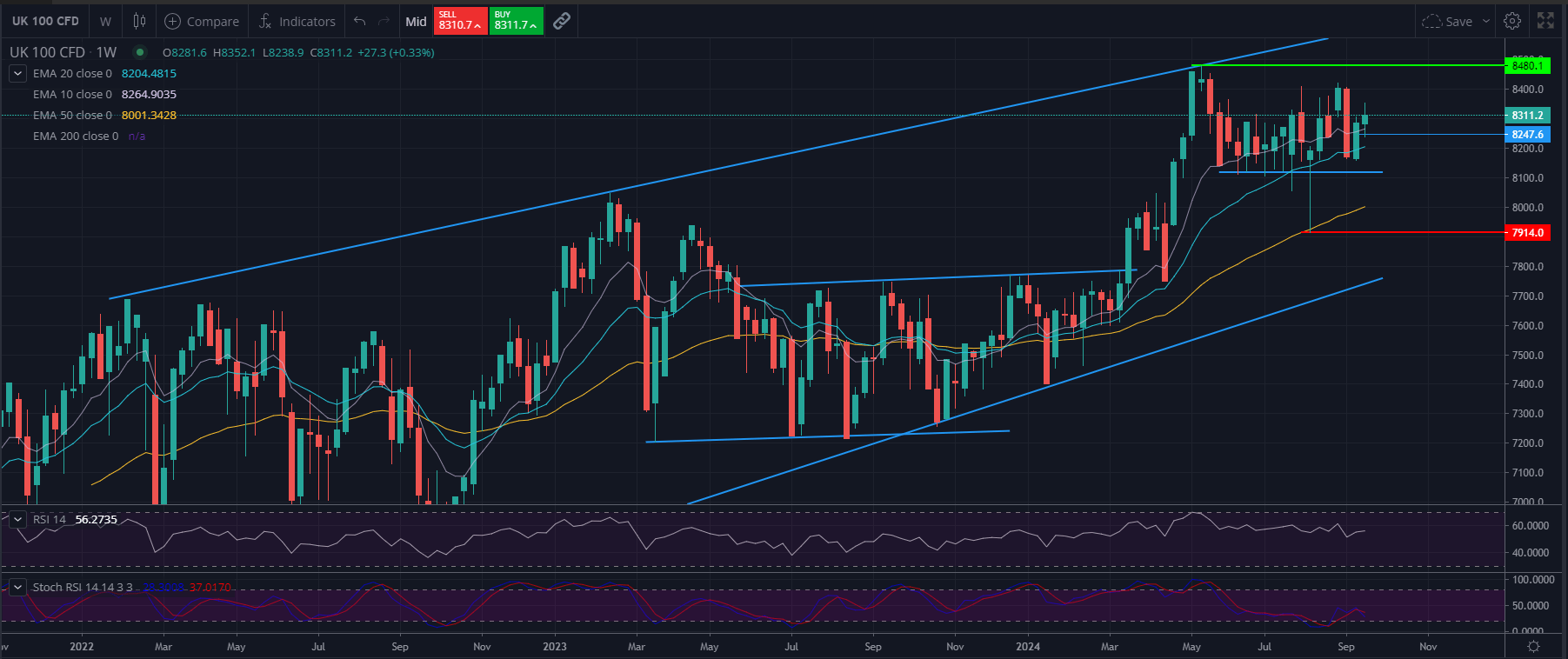

FTSE- Technical analysis

The FTSE is currently in a medium-term rising trend channel. Investors have gradually purchased the index at greater prices, which can be interpreted as positive news for the market. Since the rectangle formation has been broken through to the upside in March 2024 at the price of 7790, the price has since increased significantly to the top of the channel. The new rectangle formation we are experiencing over the last 3 months continues to signal a bullish bias. This can be said due to the price being above all the EMAs (10, 20, 50, 200). The RSI is also around the 60 level and the Stochastic RSI is around the center level. Support for the index is found at 7914, while resistance is found at 8480. For the medium term, the indicators are evaluated as technically positive overall, with exception the Stochastic RSI curve which has been declining slightly in the last and current trading week.