French PM Michel Barnier’s Government Loses Confidence Vote

French Prime Minister Michel Barnier’s centrist minority government was toppled on Wednesday in a historic no-confidence vote, marking the first such event in France in more than 60 years. The vote deepens the political crisis in France and raises significant uncertainty about the country’s governance and its upcoming 2025 budget.

Key Details

- Vote Outcome:

- 331 lawmakers in France’s 577-seat National Assembly voted to remove Barnier’s government.

- The motion passed with the combined support of far-left and far-right opposition parties, who were united in opposition to Barnier’s use of special powers to pass budget measures without a parliamentary vote.

- Immediate Aftermath:

- Speaker Yael Braun-Pivet confirmed that Barnier must submit his resignation to President Emmanuel Macron, who will now determine the next steps.

- Barnier’s controversial budget measures sought €60 billion in savings to reduce France’s public deficit, currently at 6.1% of GDP, closer to the EU-mandated limit of 3%.

Political Fallout

- Public and Parliamentary Backlash:

- Barnier’s austerity measures were widely criticized for disproportionately affecting poorer citizens, sparking anger across party lines.

- Far-right leader Marine Le Pen stated the pressure is now on Macron, though she stopped short of calling for his resignation.

- Mathilde Panot, leader of the hard-left France Unbowed (LFI), demanded early presidential elections to resolve the crisis.

- Macron’s Response:

- The president is expected to address the nation in a televised speech Thursday evening.

- Macron must decide whether to appoint a new prime minister capable of securing cross-party support, or keep Barnier and his ministers as a caretaker government while exploring legal options to pass the budget.

Next Steps

- Parliamentary Dynamics:

- France cannot hold a new parliamentary election before July.

- Any new prime minister would face similar challenges in passing legislation through a divided parliament.

- Budgetary Options:

- A caretaker government could propose emergency legislation to extend the 2024 budget provisions into 2025.

- Alternatively, Macron’s government might invoke special powers to pass the 2025 budget by decree—a legally contentious move with significant political risks.

Broader Implications

- Economic Concerns:

- France’s public finances remain strained, with a deficit significantly above EU targets.

- Political uncertainty could hinder investor confidence and economic stability.

- EU Stability:

- As one of Europe’s leading economies, France’s political turmoil adds uncertainty to the broader EU economic landscape, especially with Germany’s ongoing economic challenges and growing global trade tensions.

- Global Reaction:

- International markets and neighboring governments will closely watch Macron’s next moves, given France’s role as a key EU leader.

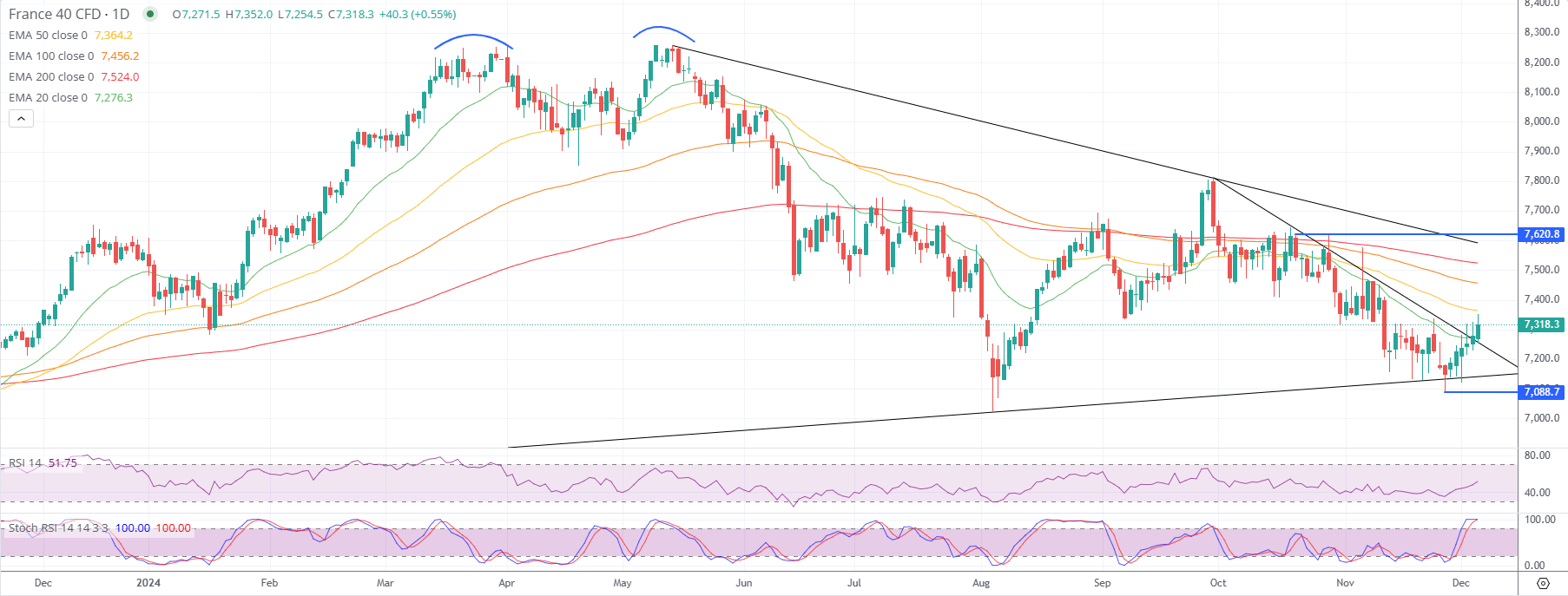

France 40 (CAC 40) Technical analysis - daily chart:

1. Current Price Action and Trend:

- The France 40 is trading at 7,318.3, recovering from a recent low near 7,088.7 and testing the downward trendline resistance.

- The index remains in a broader descending triangle pattern, indicating consolidation with a potential breakout on the horizon.

2. Support and Resistance Levels:

- Resistance:

- The immediate resistance is at 7,364.2 (aligned with the EMA 50). A breakout above this level would strengthen the bullish case.

- The next key resistance lies at 7,456.2 (EMA 100) and 7,620.8, marking a critical level for a potential trend reversal.

- A breakout above 7,620.8 would confirm bullish momentum and open the path toward 7,800.

- Support:

- Immediate support is at 7,276.3 (EMA 20), which is providing dynamic support for the ongoing recovery.

- The next support is at 7,088.7, which marks the recent low and the lower boundary of the descending triangle.

- A breakdown below 7,088.7 would signal a deeper correction, targeting 7,000 or lower.

3. Moving Averages:

- The EMA 20 at 7,276.3 is rising and providing immediate support.

- The EMA 50 at 7,364.2 and EMA 100 at 7,456.2 are acting as resistance, with the price attempting to reclaim these levels.

- The EMA 200 at 7,524.0 serves as a long-term resistance and a key level for confirming a bullish reversal.

4. RSI and Stochastic RSI:

- The RSI is at 51.75, indicating a neutral-to-slightly bullish sentiment. It suggests there is room for further upside if the price breaks resistance levels.

- The Stochastic RSI is at 100.00, signaling overbought conditions. This suggests that the index may face short-term resistance or consolidation.

5. Key Observations:

- The index is currently at the downward trendline of the descending triangle. A breakout above this line would indicate a bullish reversal.

- A rejection at the trendline resistance could lead to a retest of the 7,276.3 or 7,088.7 support levels.

Thesis:

Scenario 1: Bullish Breakout:

- If the France 40 Index breaks above 7,364.2 and sustains, it could target 7,456.2 and eventually test 7,620.8.

- A breakout above 7,620.8 would confirm bullish momentum and open the way toward 7,800.

Scenario 2: Rejection and Pullback:

- Overbought conditions on the Stochastic RSI suggest a potential pullback if the price fails to break the downward trendline.

- A failure to hold 7,276.3 would lead to a retest of 7,088.7, and a breakdown below this level would signal further bearish pressure toward 7,000.

Conclusion

The fall of Barnier’s government marks a pivotal moment for France, ushering in a period of political and economic uncertainty. Macron’s leadership and strategic decisions in the coming days will be crucial in addressing the immediate budgetary concerns. A breakout above 7,364.2 would signal further upside toward 7,620.8, while a rejection could lead to a pullback toward 7,276.3 or lower.

Latest market news

Yesterday 07:55 PM

Yesterday 05:50 PM

Yesterday 05:30 PM

Yesterday 05:06 PM