FOMC Meeting Key Takeaways

- Traders and economists confidently expect the Fed to reduce interest rates by 25bps to the 4.25-4.50% range.

- The Summary of Economic Projections and any Powell comments about a prolonged “pause” to the interest rate cutting cycle will be the potential market moving releases.

- EUR/USD has carved out a narrow range between 1.0470 and 1.0600 and unless the Fed delivers a meaningful surprise of some sort, that range may carry over.

When is the FOMC Meeting?

The December 2024 FOMC meeting will conclude on Wednesday, December 18th at 2:00 ET.

Fed Chairman Powell’s press conference will begin at 2:30 ET.

What are the FOMC Interest Rate Expectations?

Traders and economists confidently expect the Fed to reduce interest rates by 25bps to the 4.25-4.50% range.

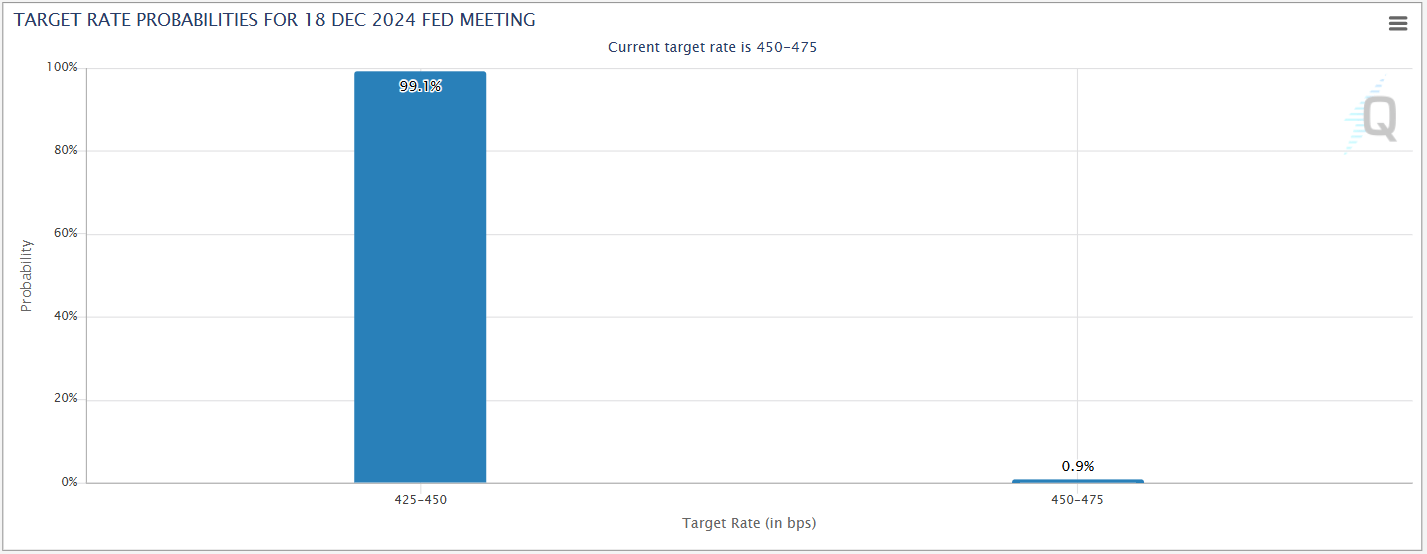

As of writing midday Wednesday, Fed Funds futures traders are pricing in 99% odds of a 25bps interest rate cut per CME FedWatch:

Source: CME FedWatch

With a 25bps interest rate cut essentially fully discounted, this aspect of the FOMC meeting will not be a significant market mover in and of itself; instead traders will key in on the central bank’s monetary policy statement, Summary of Economic Projections (including the infamous “dot plot” of interest rate expectations), and Fed Chairman Powell press conference.

FOMC Meeting Forecast

As noted above, much of the market-moving “oomph” from this month’s interest rate decision has been discounted, but that doesn’t mean that traders should tune out from the FOMC meeting. In particular, the biggest question traders will be asking is “Will the Fed pause its interest rate cutting cycle…and for how long?”

Heading into the meeting, traders are pricing in a highly likely pause in January (~80%+ per CME FedWatch), but less than coinflip odds that the Fed will leave interest rates unchanged in March (~40% implied probability).

One big uncertainty for Jerome Powell and company is the potential changes that Donald Trump’s second term will bring. Specifically, the potential for expansionary fiscal policy from an extension of the tax cuts, easier regulation, protectionist trade policy, and reduced immigration could all impact inflation and the jobs market, and by extension, Fed policy in the years to come. At the margin, this uncertainty may push the committee to be more cautious with future decisions until the proverbial “lay of the land” is better understood, and it could lead to a slower reduction in interest rates to avoid a potential acceleration of inflation.

Another key aspect of the meeting to monitor will be the FOMC’s Summary of Economic Projections (SEP). The so-called “terminal rate,” which represents the ultimate interest rate target for Jerome Powell and company, may rise from 2.9% at the last meeting to closer to 3% this time around; one key theme (and a potential surprise for 2025) is the continued move higher in the terminal rate, implying fewer interest rate cuts to get back a “neutral” interest rate in the US. Outside of the terminal rate, expect the committee to reduce its projections for unemployment while upgrading its forecast for growth and inflation in an acknowledgement of the resilience of the US economy.

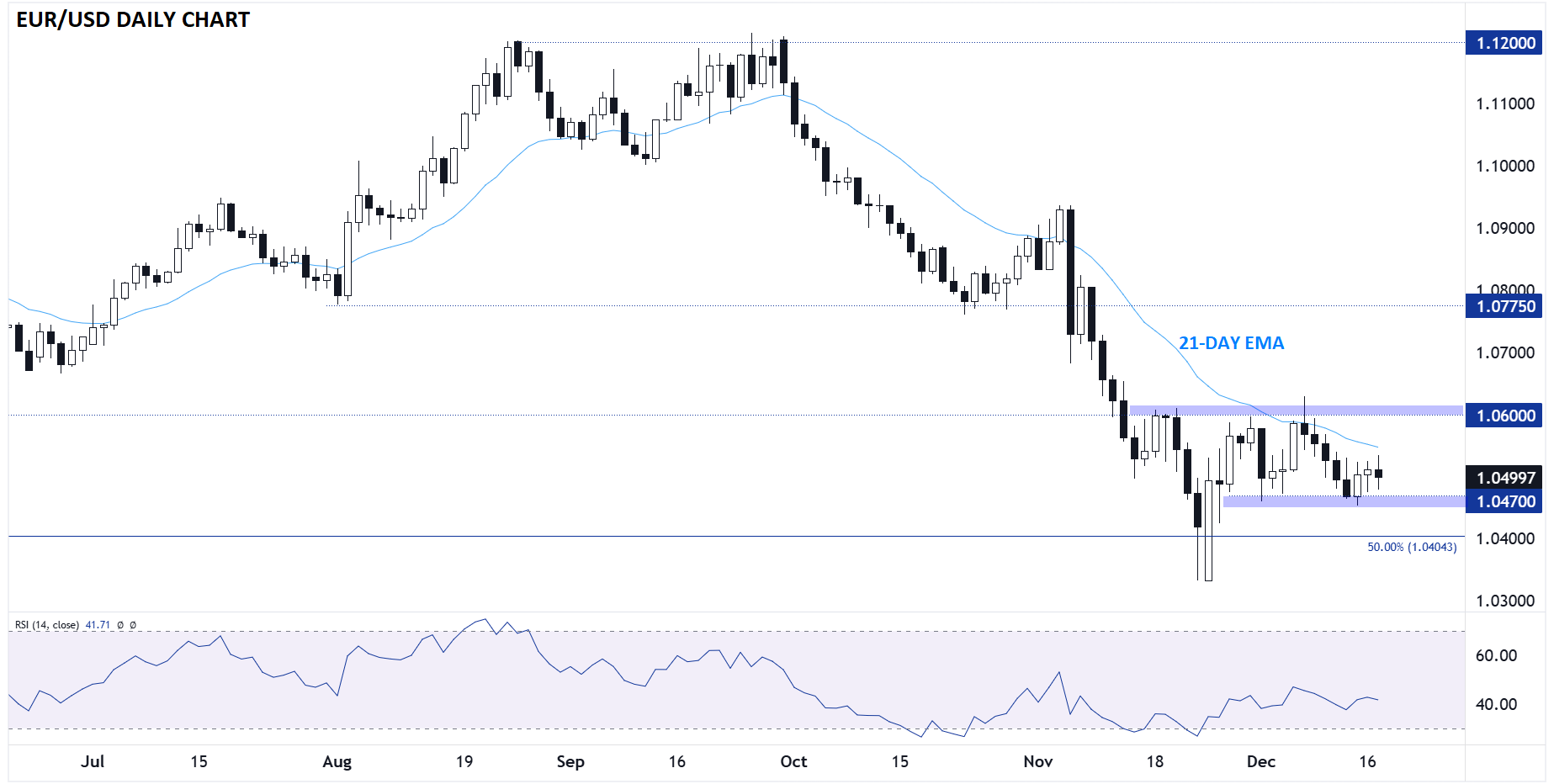

US Dollar Technical Analysis – EUR/USD Daily Chart

Source: TradingView, StoneX

From a technical perspective, EUR/USD has been trending lower since the start of Q4, though the downside momentum has mostly stalled so far in December. The world’s most widely-traded currency pair has carved out a relatively narrow range between 1.0470 support and resistance at 1.0600 over the last couple of weeks, and unless the Fed delivers a meaningful surprise of some sort, that range may carry over into the lower-liquidity holiday conditions next week.

If we do see a downside break, a quick move toward at least 1.0400 is possible, with the potential for more fundamentally- and technically-driven downside heading into the new year. Meanwhile, a bullish reaction to the Fed meeting could well be limited to 1.0600 given the general outperformance of the US economy and lack of additional catalysts.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX