Next week brings three major central bank meetings, none of which seem to be on the same page policy wise. The Fed are expected to cut by 25bp and potentially set the record straight on another ‘50bp’ cut November, whereas there’s also an outside chance the BOJ may surprise with an interest rate hike given their renewed hawkish narrative. And while the Bank of England are expected to hold rates, a soft set of inflation figures could bring forward bets of a November cut.

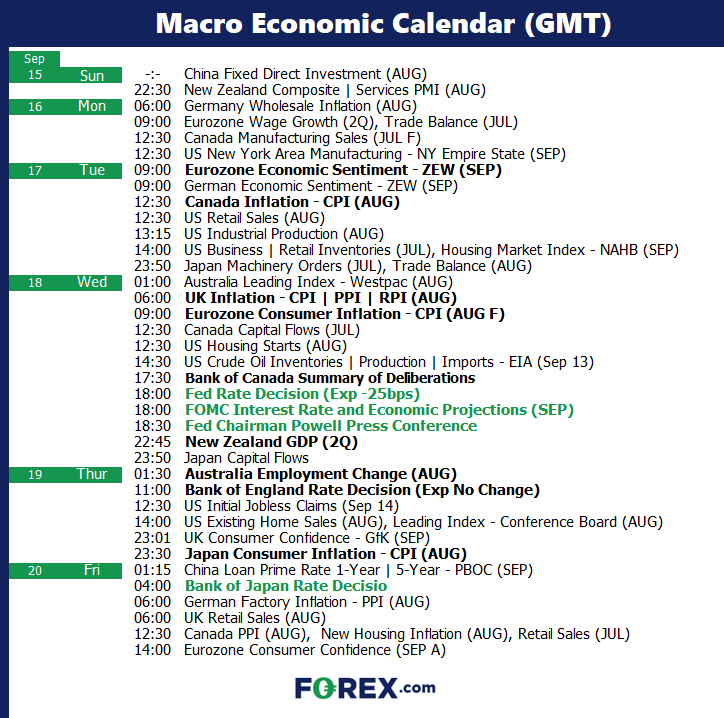

The Week Ahead: Calendar

The Week Ahead: Key themes and events

- FOMC meeting, staff forecasts and press conference

- Bank of Japan interest rate decision

- UK inflation, BOE meeting

FOMC meeting, staff forecasts and press conference

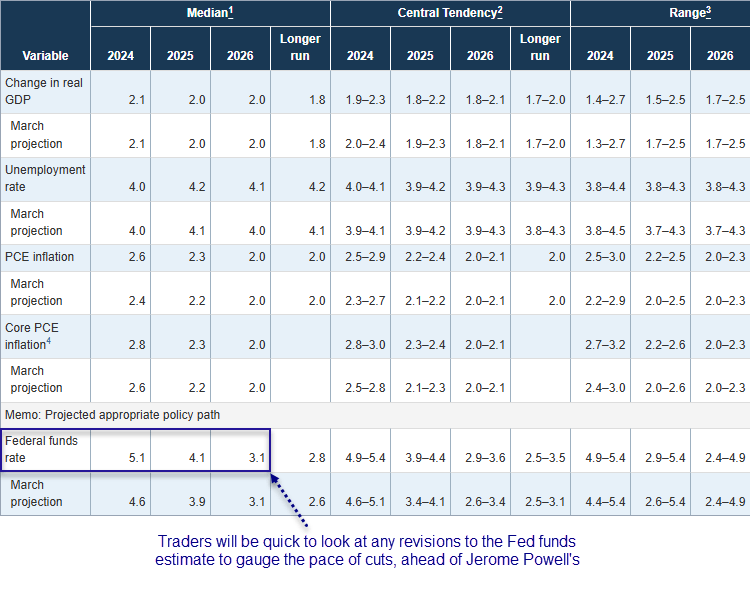

We finally get to stop talking about a well-telegraphed September rate cut of 25bp. It has been priced in by markets for a few months, and it would do the Fed more damage than good to not cut by 25bp next week.

Besides, the debate has evolved into whether the Fed will cut by 50bp in November. Recent data suggests they won’t, but the Fed should be in a position to define those expectations further via their staff forecasts and press conference next week. My guess is that they’ll take a cautious approach given the tick higher in core CPI and lower unemployment. And as money markets are still veering towards 100bp of cuts by December, it could trigger another round of strength for yields and the US dollar if they scale back expectations to 25bp increments in November and December.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones, AUD/USD, AUD/JPY, China A50, Hang Seng

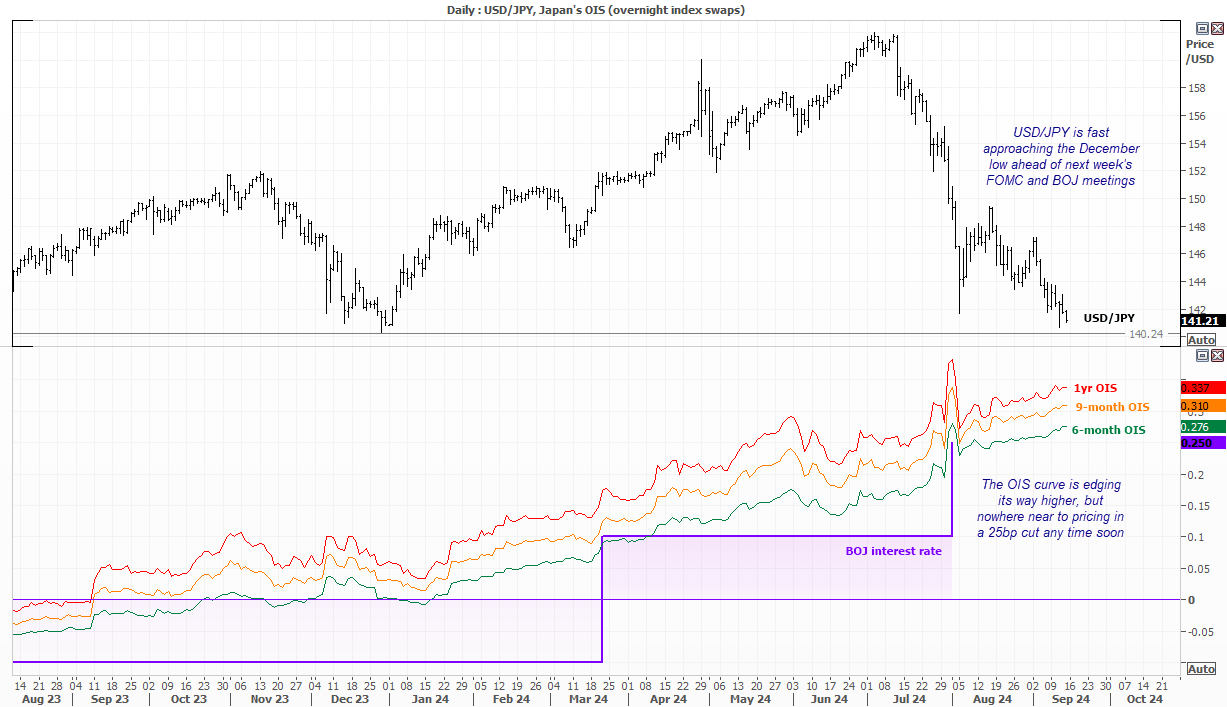

Bank of Japan interest rate decision

It has been a turbulent time for markets and BOJ policy. The USD/JPY selloff began picking up its pace in July as weak US data paved the way for a dovish Fed and the BOJ finally began making hawkish noises. Yet market turbulence alongside a yen that likely appreciated too quickly saw the BOJ reverse course, and revert to a dovish tone due to said market turbulence.

This has sent USD/JPY below 142, and within striking distance of its December low. A dovish FOMC meeting coupled with a hawkish BOJ could send it markedly beneath 140. But will the BOJ act next week?

With the Wall Street selloff in the rear-view mirror, the BOJ are back with the hawkish vibes ahead of next week’s meeting. In fact, one hawkish BOJ member this week suggested that the central bank needs to raise rates to 1% by the end of the next fiscal year. With rates at 0.25%, that could indicate two more 25bp hikes by the end of March, assuming the BOJ hike by 25bp next week.

Yet with wholesale inflation missing the mark, it removes some pressure from the BOJ hike in September. ING economists currently back a hike to arrive in December, and market pricing thinks odds of a 25bpo hike are slim. Still, never drop your guard where the BOJ is concerned as a hike could send USD/JPY to fresh cycle lows.

Trader’s watchlist: USD/JPY, AUD/JPY, EUR/JPY, Nikkei

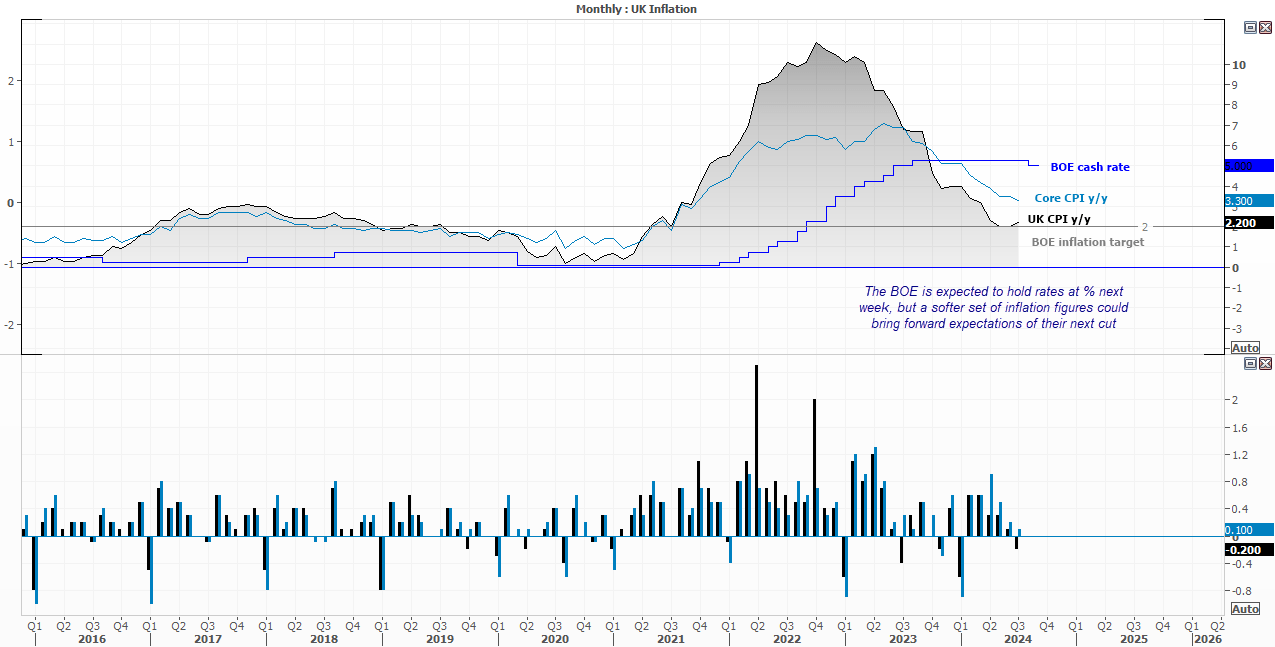

UK inflation, BOE meeting

The consensus is for the BOE to hold their interest rate next week, to mark a pause just one meeting after their first cut. All economists polled by Reuters think they’ll hold rates at 5% next week, and Goldman Sachs think they’ll next cut in November. Still, UK inflation data on Wednesday could reshape these expectations if the figures treat everyone to some refreshingly low numbers.

Trader’s watchlist: GBP/USD, GBP/JPY, EUR/GBP, FTSE 100

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge