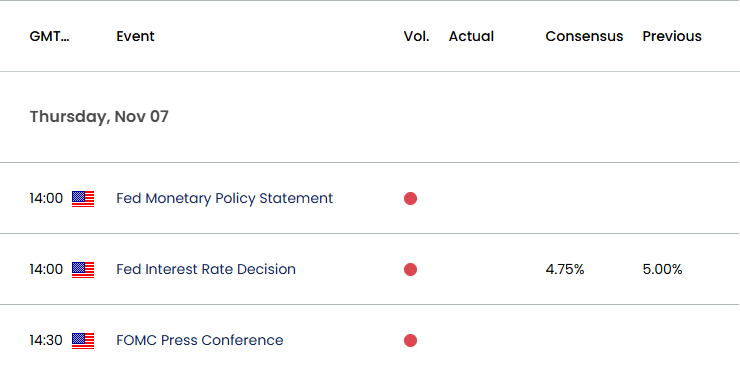

Federal Open Market Committee (FOMC) Interest Rate Decision

The Federal Reserve lowered the US benchmark interest rate by 50bp in September to a fresh threshold of 4.75% to 5.00%.

US Economic Calendar – September 18, 2024

At the same time, the update to the Summary of Economic Projections (SEP) revealed that ‘the median participant projects that the appropriate level of the federal funds rate will be 4.4 percent at the end of this year and 3.4 percent at the end of 2025.’

The Fed acknowledged that ‘these median projections are lower than in June, consistent with the projections for lower inflation and higher unemployment,’ with the central bank going onto say that ‘these projections, however, are not a Committee plan or decision.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

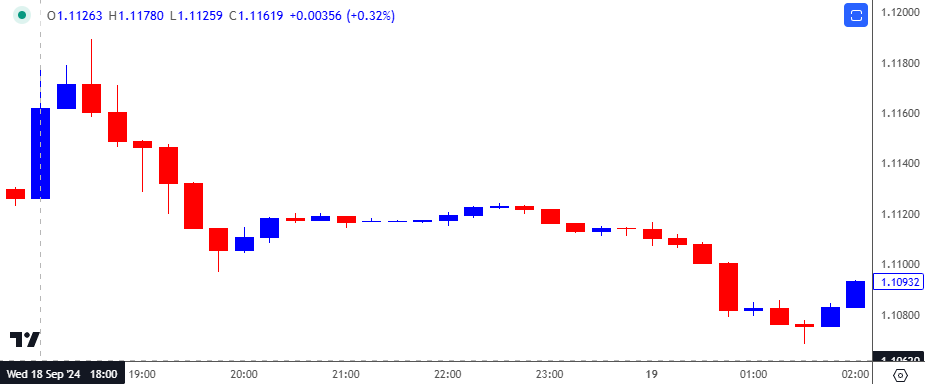

EUR/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

The US Dollar struggled to hold its ground following the Fed rate-cut, with EUR/USD climbing to a session high of 1.1189, but the market reaction was short lived as the exchange rate ended the day at 1.1119. Nevertheless, EUR/USD pushed higher over the remainder of the week to close at 1.1163.

Looking ahead, the Fed is expected to deliver a 25bp rate cut in November, and Chairman Jerome Powell and Co. may prepare US households and businesses for a further decline in US interest rates as the central bank pursues a neutral stance.

With that said, more of the same from the FOMC may produce headwinds for the US Dollar should the committee retain a dovish forward guidance, but a hawkish rate-cut may generate a bullish reaction in the Greenback as it raises the scope of seeing the Fed on hold at its last meeting for 2024.

Additional Market Outlooks

Monetary vs Fiscal Policy: Implications for FX Markets

US Dollar Forecast: USD/JPY Vulnerable to Looming Fed Rate Cut

AUD/USD Recovery Pulls RSI Away from Oversold Territory

USD/CAD Reverses Ahead of 2022 High with Fed Rate Decision on Tap

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong