US Dollar Outlook: EUR/USD

EUR/USD may consolidate ahead of the European Central Bank (ECB) interest rate decision on October 17 as the exchange rate holds above the weekly low (1.0900) to pull the Relative Strength Index (RSI) away from oversold territory.

EUR/USD Outlook Hinges on ECB Interest Rate Decision

The selloff from the start of October seems to be stalling as EUR/USD struggles to extend the series of lower highs and lows from earlier this week, but developments coming out of the ECB meeting may produce headwinds for the Euro as the central bank is expected to deliver another 25bp rate cut.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Euro Area Economic Calendar

The ECB is anticipated to lower interest rates for the third time this year as the Euro Area Consumer Price Index (CPI) falls below 2% for the first time since 2021, and the Governing Council may continue to shift gears in the months ahead as President Christine Lagarde and Co. pledge to ‘follow a data dependent and meeting-by-meeting approach to determining the appropriate level and duration of restriction.’

With that said, EUR/USD may continue to give back the advance from the August low (1.0778) as the ECB further unwinds its restrictive policy, but a hawkish rate cut may prop up the exchange rate as the Governing Council pursues a more gradual approach than its US counterpart in adjusting monetary policy.

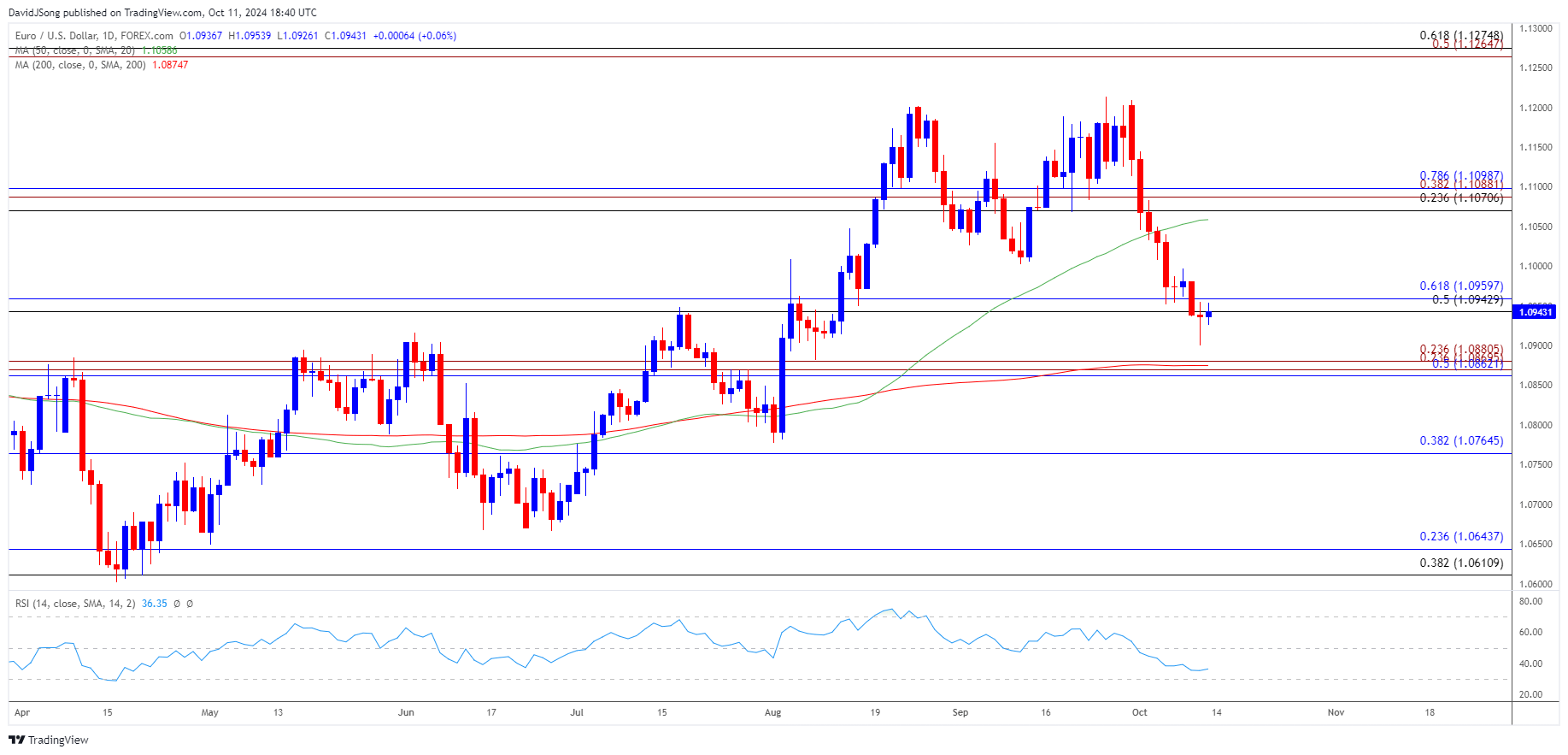

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- Keep in mind, EUR/USD pushed below the September low (1.1002) after failing to hold above the 50-Day SMA (1.1059), and the weakness in the exchange rate may persist as it no longer tracks the positive slope in the moving average.

- A break/close below the 1.0860 (50% Fibonacci retracement) and 1.0880 (23.6% Fibonacci extension) region may push EUR/USD towards the August low (1.0778), with the next area of interest coming in around 1.0770 (38.2% Fibonacci retracement).

- Nevertheless, EUR/USD may attempt to retrace the decline from the start of the month as it no longer carves a series of lower highs and lows but need a close above the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) area to bring the 1.1070 (23.6% Fibonacci retracement) to 1.1100 (78.6% Fibonacci retracement) zone back on the radar.

Additional Market Outlooks

Gold Price Forecast: Bullion Breaks Out of Bull Flag Formation

USD/CAD Rally Pushes RSI Up Against Overbought Zone

Australian Dollar Forecast: AUD/USD Bearish Price Series Persists

USD/JPY Defends Post-NFP Reaction with CPI Report in Focus

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong