EUR/USD Talking Points:

- Sellers have made a push this week, leading to fresh two-year-lows in EUR/USD.

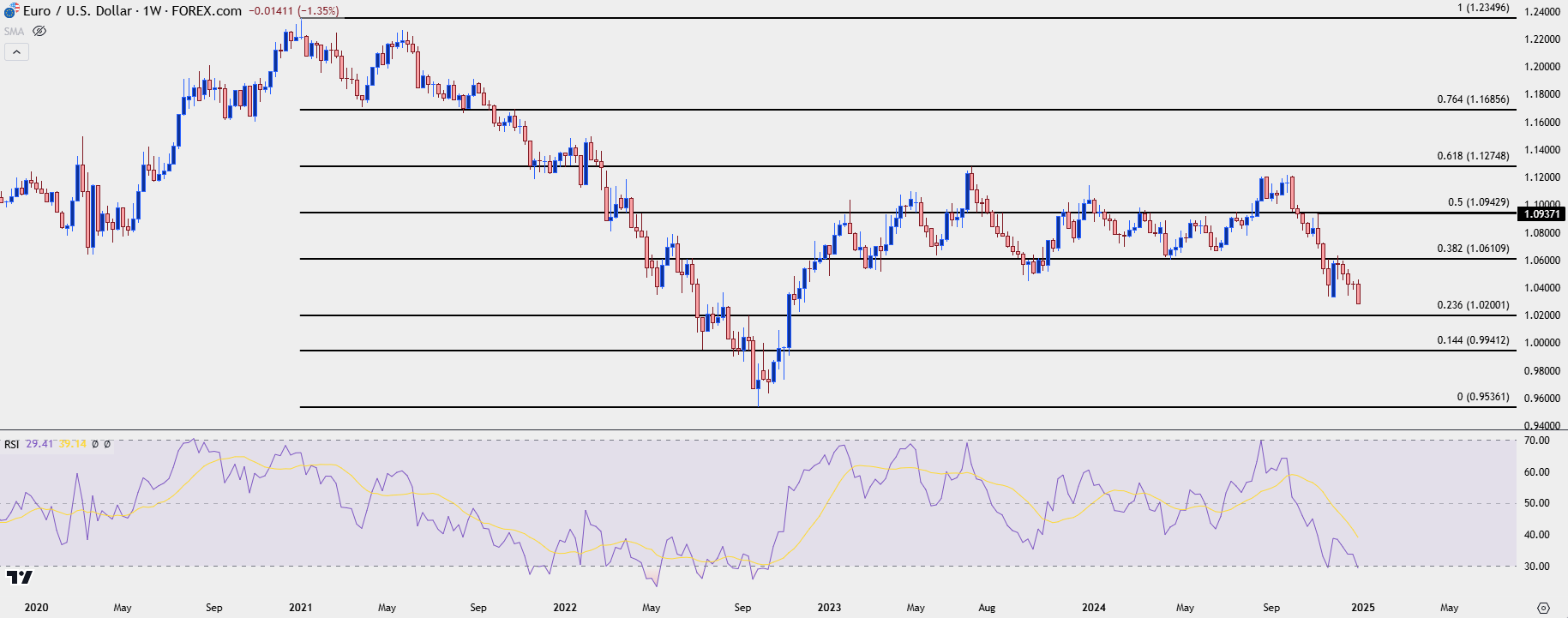

- For next levels below, there’s a Fibonacci level at 1.0200 that’s of interest, as this is the 23.6% retracement of the same setup that caught the high in 2023, before showing support-turned-resistance last year at the 38.2% retracement.

- I’ll be looking at EUR/USD in-depth in the Tuesday webinar, and you’re welcome to sign up: Click here for registration information.

- You’re welcome to access the EUR/USD forecast from the link below:

EUR/USD bears are getting a fast start to 2025 trade, setting a fresh two-year-low for the currency pair. While December produced a higher-low above the November swing for the pair, and 2024 saw EUR/USD close at a trendline projection from that higher-low, sellers have made a push over the past three days and prices are now probing below the 1.0300 level for the first time since November of 2022, when the pair was recovering from its first ever parity test that year.

EUR/USD Daily Price Chart

EUR/USD Next Supports

The parity level is an obvious point of interest for the pair, and this is when one Euro would share the same value as one U.S. Dollar and the pair would print at 1.0000. But there’s only been one instance of such and at the time, the Fed was hiking rates aggressively in 75 bp increments while the ECB had only started to adjust rates higher. And when the pair did plunge below parity, it didn’t hold for long as there was a shift at both the Fed and ECB with the FOMC softening rate hikes and the ECB ramping up to 75 bp moves.

But before parity comes into the picture there’s another level of interest plotted at 1.0200. This is the 23.6% Fibonacci retracement of the 2021-2022 major move and that Fibonacci setup has produced a few different notable inflections. The 61.8% retracement of that study is what caught the high in 2023 trade: and then in 2024 the 38.2% retracement of that same study set support in April and then lower-high resistance in December. There was also interplay at the 50% mark which set the July high before sellers held the November high just six pips inside of that price.

Given the current oversold reading showing on weekly RSI, that 1.0200 level could be a level of interest for bounce plays, or perhaps even reversal scenarios.

EUR/USD Weekly Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

--- written by James Stanley, Senior Strategist