Week Ahead:

- US Employment Data: JOLTS, ADP, Non-Farm Payrolls (NFP)

- Inflation Indicators: US Core PCE, European & German Flash CPI (Y/Y estimates)

As Governor Bailey recently noted, "disinflation has taken place faster than we expected in the UK and elsewhere." This statement reflects the sharp drop in UK and EU inflation, now sitting below central bank targets at 1.7%. This dovish outlook has led to bearish trends in both the EURUSD and GBPUSD pairs, pushing them toward critical support levels at 1.0760 and 1.29, respectively.

Looking ahead, next week’s high volatility risks stem from key US employment indicators, including the non-farm payrolls, the Fed’s preferred inflation gauge (core PCE), along with German CPI and the Flash Eurozone CPI (core and y/y estimates). These events could significantly influence market direction for both pairs.

Technically Speaking

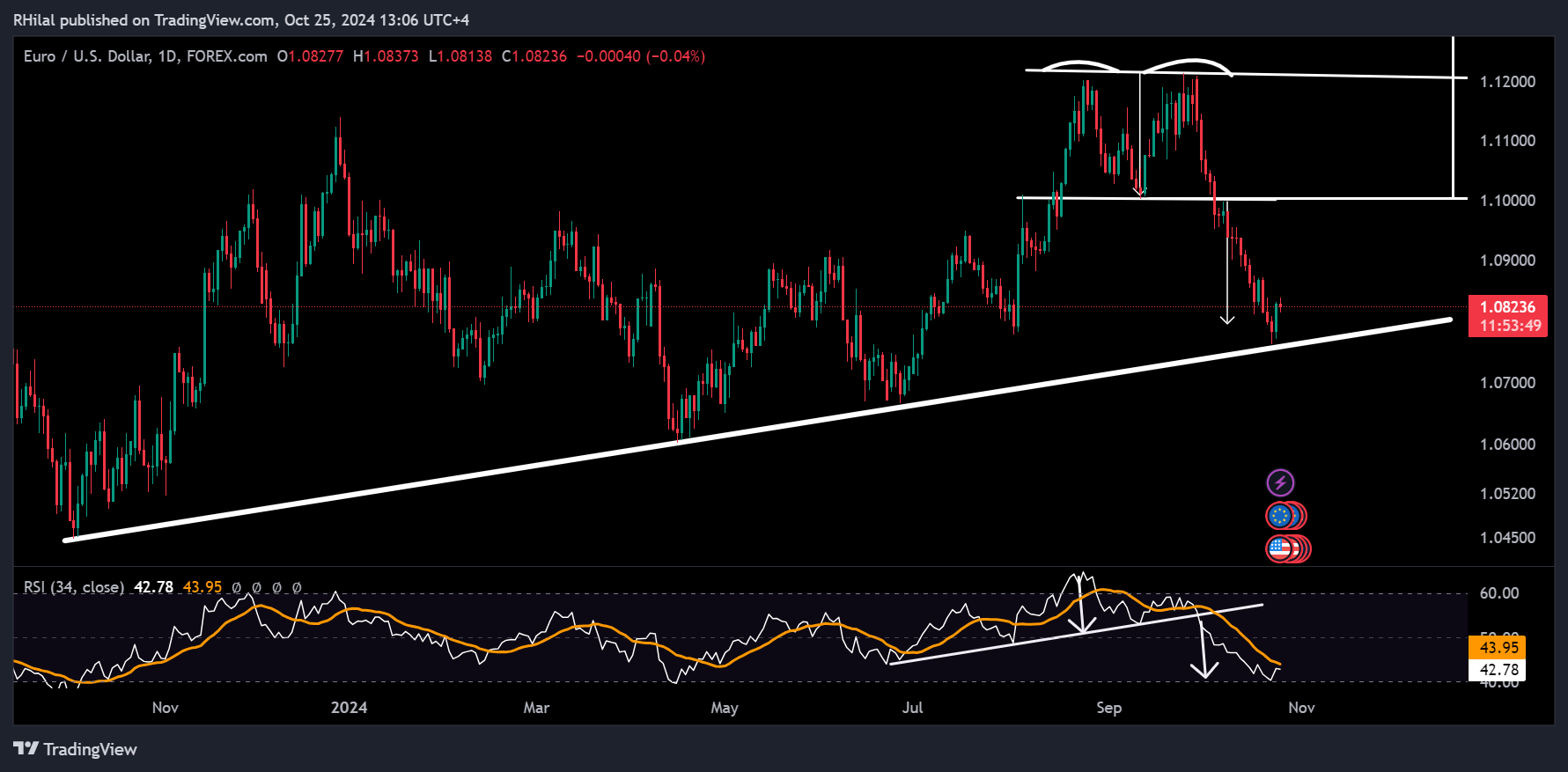

EURUSD Analysis: Daily Time Frame – Log Scale

Source: Tradingview

Changing chart perspectives and going back to the simple TA patterns, the bearish pressures from the European indicators, bullish pressures from the US indicators, and double top pattern formation at the 1.1220 resistance, pushed the EURUSD pair towards the trendline connecting the consecutive higher lows between Oct 2023 (1.0450), April 2024 (1.06), and June 2024 (1.0660).

From a relative strength index perspective, momentum touched down at oversold levels tracing the target for a head and shoulders pattern formation between June 2024 and October 2024.

The current trends are at a critical point, with the potential for a turnaround as we enter a pivotal week packed with key inflation and employment data from both the US and EU, just ahead of the US election week.

Key Resistance Levels: 1.0880 – 1.09 – 1.10

Key Support Levels below 1.07: 1.0660 – 1.06

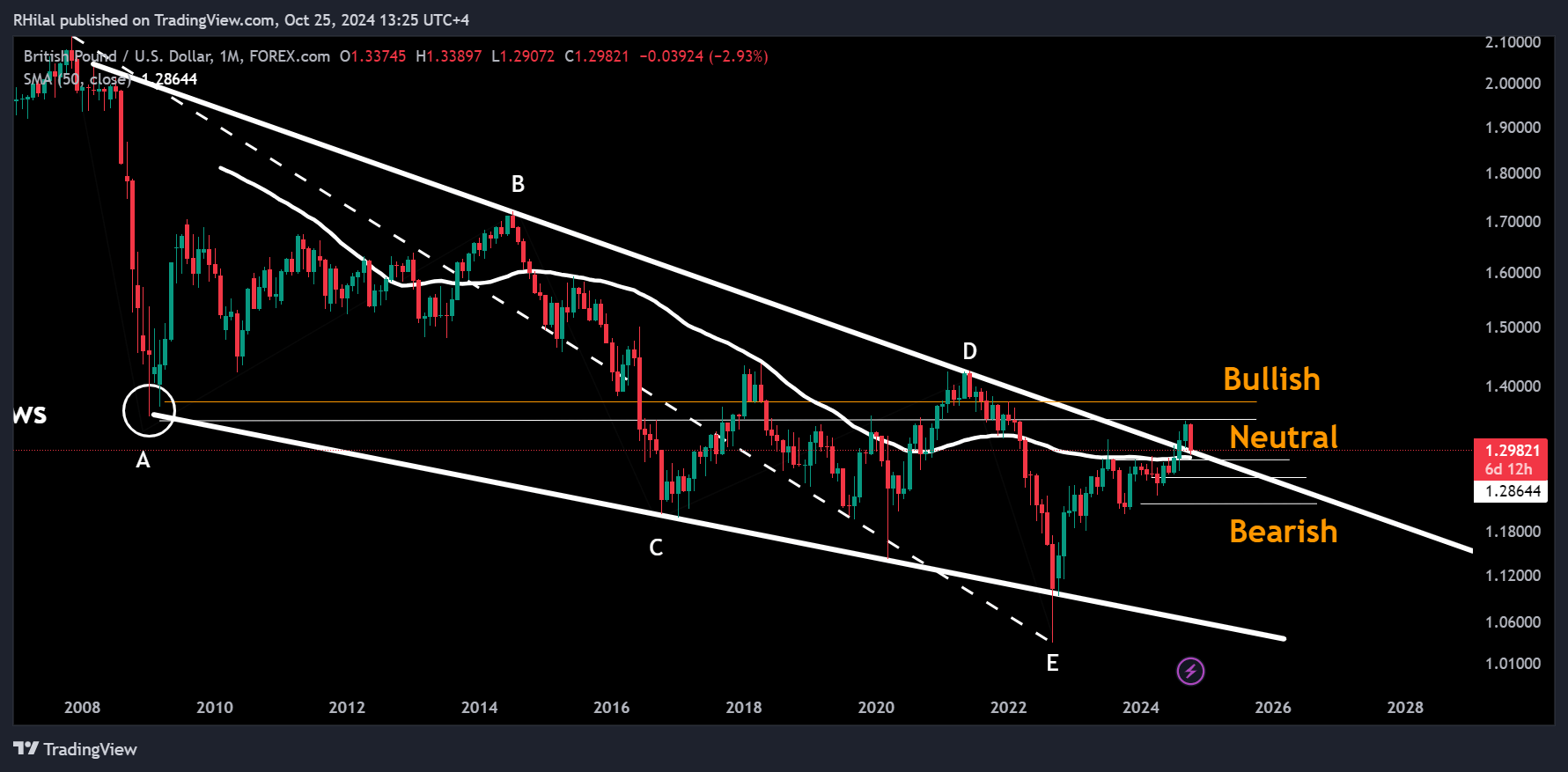

GBPUSD Analysis: 3Day Time Frame – Log Scale

Source: Tradingview

In a similar track to the EURUSD, the GBPUSD traced a pullback last week towards the upper border of its 15-year consolidation. Although the 1.30 mark was breached, the 1.29 stands as a solid support alongside the 50-period simple moving average on the monthly time frame.

A bearish engulfing pattern can be seen as well, and a solid support zone holds, amplifying a critical spot for the pound’s next move between a bullish scenario continuation or the transition towards a bearish tone next week.

Key Resistance levels: 1.33 - 1.3440 – 1.37

Key Support levels: 1.29 – 1.2830 – 1.2570

--- Written by Razan Hilal, CMT – on X: @Rh_waves