Key Events

- Eurozone Flash CPI: Climbed from 1.7% to 2%, hitting the ECB’s target

- US Core PCE: Increased to 0.3% for the first time since April 2024, supporting a more cautious rate cut approach

- US Elections: A Trump victory raises concerns over a stronger dollar and inflation risks

- FOMC Rate Cut: Markets anticipate a 25-bps rate cut for Thursday’s meeting

Eurozone Inflation and Growth Data Recap

Recent Eurozone data supported a rebound in EURUSD above 1.08, driven by positive figures in preliminary Euro GDP, which reached a one-year high of 0.4%, and a boost in German CPI to a seven-month high at 0.4%.

The flash CPI estimate also rose to the ECB’s target of 2%, up from 1.7%. These indicators have recharged EURUSD’s momentum from oversold levels, allowing it to retest the 1.09 mark. This rally, however, will be tested by US election results in a close race and the FOMC decision with a potential 25bps rate cut.

US Elections and FOMC: Potential Volatility for the US Dollar

The general market consensus is leaning toward a bullish dollar reaction (bearish EURUSD) with a Trump win in comparison to a Harris win, due to concerns over his aggressive tariff policies and inflation implications. Beyond the election, the Fed’s Thursday meeting will provide insights into economic conditions, especially after the recent uptick in Core PCE to 0.3% for the first time since April 2024 and a significant drop in US non-farm payrolls to 2021 lows, affected by a challenging hurricane season.

Quantifying Uncertainty with Technical Analysis

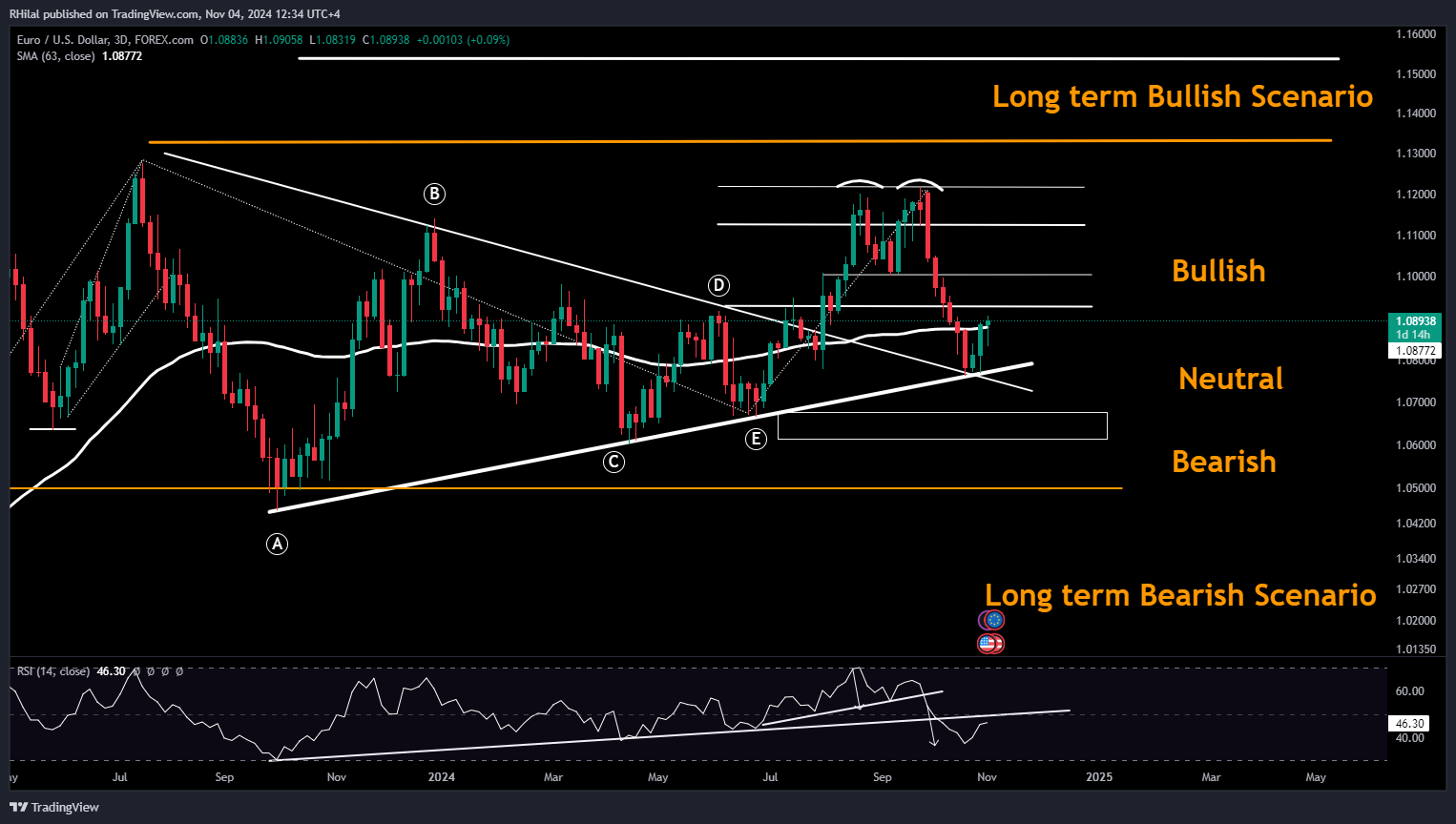

EURUSD Forecast: 3Day Time Frame – Log Scale

Source: Tradingview

Retesting the thrust (triangle border convergence point) of the triangle extending between the highs EURUSD recently rebounded to 1.09, retesting the triangle convergence point between the July 2023 highs and June 2024 lows.

The current price action on a 3-day chart remains above the 50-period SMA, with potential resistance at the 1.0920 area. Given the volatility risks this week, scenarios are as follows:

Bullish Scenario

Short-term resistance: 1.0920, 1.10, 1.1140

Long-term resistance: 1.1220, 1.1320

Bearish Scenario

Short-term support: 1.0830, 1.0780

Long-term support: 1.0680, 1.06, 1.05

— Written by Razan Hilal, CMT – on X: @Rh_waves