The EUR/USD poked its head above the June high of 1.0916 to reach its best level since March, after the US Empire State Manufacturing Index came out weaker than expected earlier. The US dollar has remained under pressure against most major currencies, albeit not so much against the likes of the New Zealand dollar following last week’s dovish RBNZ meeting. Still, against the likes of the euro and pound, as well as gold, the greenback has fallen further after last week’s weaker-than-expected US CPI data boosted expectations that the Federal Reserve will loosen its monetary policy at its September meeting. Already cutting rates in June, the European Central Bank will be in focus again this week. This time, no rate cuts are expected from the ECB, which, together with reduced political uncertainty in Europe and weakness in US data, should all help to keep the euro supported against the US dollar, maintaining the short-term EUR/USD forecast in bulls’ favour.

EUR/USD forecast: Key macro highlights this week

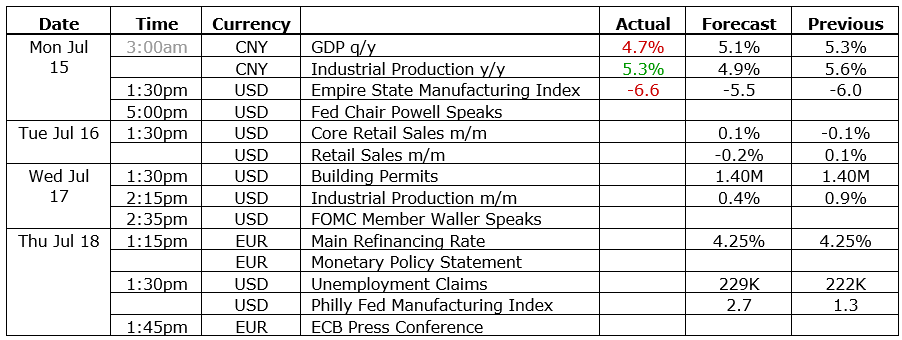

Apart from retail sales and a handful of other macro pointers, the US economic calendar is quite quiet this week. The same could be said about Europe’s data calendar had it not been for the ECB policy decision on Thursday. Here are this week’s key macro highlights, relevant to the EUR/USD pair:

Already, we have seen the Empire State Manufacturing Index print a below-expected -6.6 reading this week, which helped to keep the pressure on the US dollar. But it is all about retail sales on Tuesday, when building permits and industrial production data will be published too.

US retail sales expected to fall

The health of the US consumer is deteriorating, as was reflected by last month’s release of the May retail sales estimate, which came in at just +0.1% month-over-month. That followed a downwardly revised 0.2% fall in April. Sales at gasoline stations were particularly weak last time, falling 2.2%, while those at furniture stores, an indication of demand for long-lasting goods, slipped 1.1%. Meanwhile, recent data releases have mostly surprised to the downside and inflation has cooled more than expected. If retail sales again disappoint, then the odds of a September rate cut could surge, especially in light of last week’s weaker consumer inflation data (and UoM’s Inflation Expectations survey).

ECB rate decision

The European Central Bank’s next rate decision is on Thursday, July 18 at 13:15 BST. Don’t expect any fireworks this time, after it delivered its first rate cut in June. That decision was built up so much by the ECB that they simply had to cut even if policymakers were unsure about the path of inflation. Indeed, the minutes of that meeting have since revealed greater uncertainty in ECB staffs’ outlook for inflation, while private consumption showed no convincing evidence of picking up either. The ECB will remain data-dependent, something which Christine Lagarde highlighted at the last press conference in June and said there will be no pre-commitment to a particular rate path. So, don’t expect another rate cut at this meeting, but watch out for clues about the next move.

EUR/USD forecast: Technical analysis

Source: TradingView.com

The EUR/USD has broken above a couple of bearish trend lines that were there from July and December of last year. Rates have also moved and stayed above their 21-day exponential and 200-day simple moving averages. The technical EUR/USD forecast is therefore bullish as things stand. But given that it had struggled around the current levels between 1.0900 to 1.1000 area earlier this year, I wouldn’t be surprised if it hangs around for a few days here, potentially until the ECB rate decision is out of the way. Still, the short-term path of least resistance is clearly to the upside, so I wouldn’t necessarily look for bearish trades here unless the charts tell me otherwise. Key short-term support is now seen between 1.0840-1.0865 area, followed by 1.0800, where the 200-day average now resides.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R