EUR/USD Key Points

- The US Dollar continued to strengthen last week following hot inflation data, whereas Eurozone GDP shows continued stagnation.

- For this week, Eurozone PMIs and central bank speakers will be the big focus.

- EUR/USD remains just within its bearish trend, hinting at a potential retest of 1.0700 support this week.

EUR/USD Fundamental Analysis

The dominant theme of the past week, as it has been for all of 2024 so far, was ongoing strength in the US dollar. Stronger-than-expected inflation readings from both a consumer (CPI) and producer (PPI) level drove the greenback higher against most of its major rivals as traders continue to push back their expectations for Fed rate hikes.

Meanwhile, on the European continent, there were essentially no top-tier economic reports last week, so central bankers mostly busied themselves by reiterating that the European Central Bank (ECB) remains data dependent and unwilling to cut interest rates yet. In terms of the news we did get, traders learned that Q4 GDP for the region stagnated, leaving the overall Eurozone economy just 0.1% larger than it was back in 2022. Even more alarmingly, the Bundesbank recently warned that Germany, the Eurozone’s largest and most important economy, will see 0.0% growth in Q1 “at best” and that a contraction is possible.

As always with markets though, it’s not the absolute economic data that drives prices; instead, traders should remain focused on how an economy evolves relative to expectations. With traders the world over feeling downbeat toward the Eurozone economy, at least relative to the US, any upside surprises for the continent could support EUR/USD in the coming week and beyond.

This Week’s Key Euro Data

In addition to the US data and events in the coming week – highlighted by the FOMC meeting minutes on Wednesday – these are the key reports for EUR/USD traders to watch:

Monday:

- Spanish Trade Balance

- Spanish Consumer Confidence

Tuesday:

- Eurozone Current Account

- Eurozone Construction Output

Wednesday:

- ECB Fernandez-Bollo Speech

- Eurozone Flash Consumer Confidence

- ECB Tuominen Speech

Thursday:

- ECB Fernandez-Bollo Speech

- French Business Confidence

- Eurozone Services and Manufacturing PMIs

- Italian Inflation

- ECB Tuominen Speech

- Eurozone Final CPI

- Eurogroup Meeting

Friday:

- German GDP Growth

- IFO Business Survey

- ECB Schnabel Speech

- ECB Jochnick Speech

- ECB Schnabel Speech

- Eurozone Consumer Inflation Expectations

While not economic data per se, there are also a series of bond auctions from Germany (Monday, Tuesday, Wednesday), France (Monday), and Italy (Friday). Among the above releases, Thursday’s flash PMI surveys may be the most significant. For the uninitiated, PMI surveys are one of the most timely measures of on-the-ground economic activity, and this month’s iterations will give traders insight into whether the strong momentum from January has carried over into this month. With traders aggressively pricing out interest rate cuts from all major central banks since the start of the year, it could take another round of strong PMI surveys to prevent a near-term selloff in the euro.

In the same vein, both ECB and Fed speakers will be on the wires, so the similarities and contrasts between their views on monetary policy and interest rates over the first half of the year will provide a clear focus for EUR/USD traders.

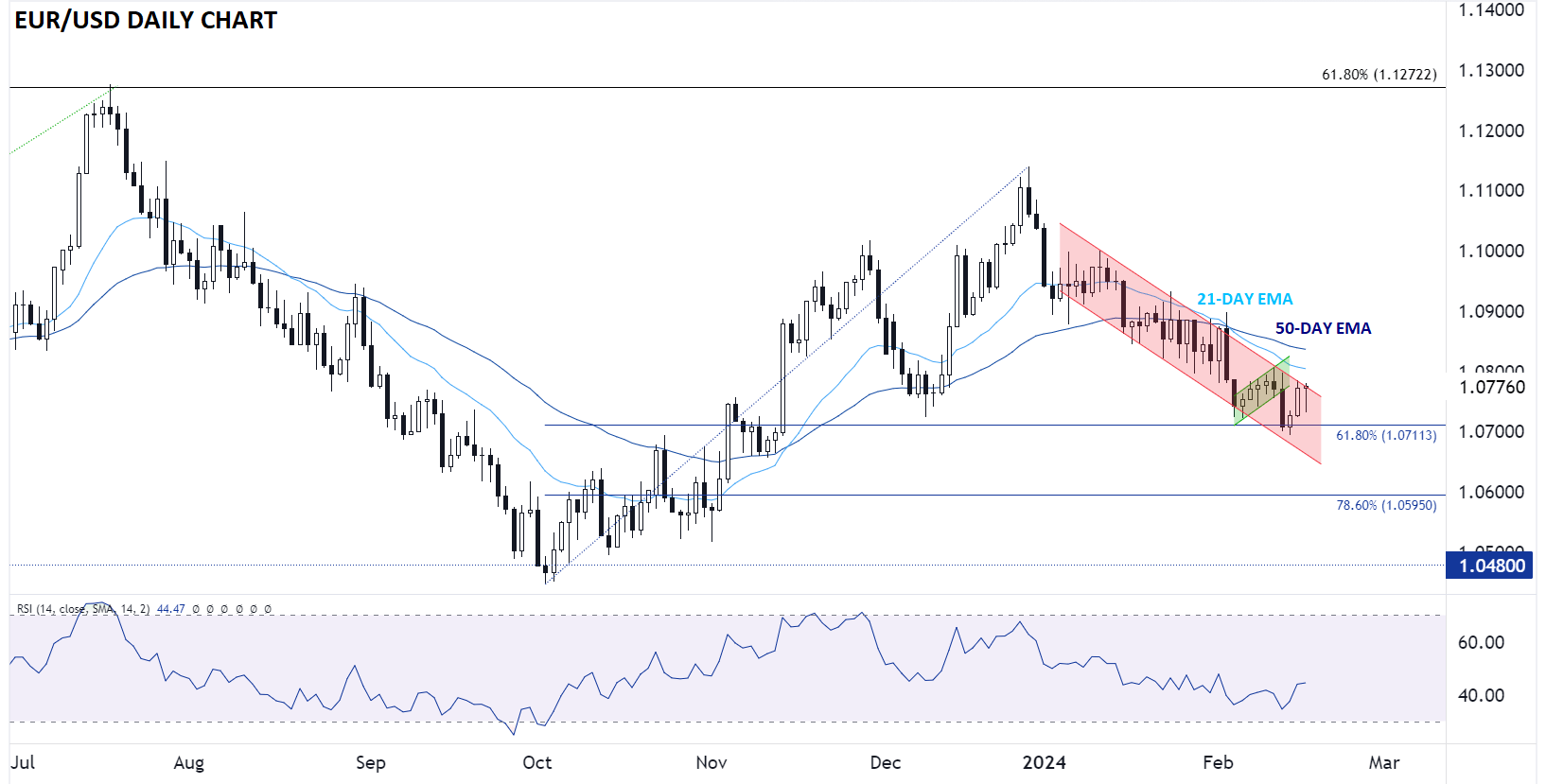

Euro Technical Analysis – EUR/USD Daily Chart

Source: TradingView, StoneX

As the chart above shows, EUR/USD remains just within its well defined 7-week bearish channel. From a technical perspective, the start of this week will be key: If EUR/USD bulls are able to push the pair above the top of this channel, a more substantial bounce may be in the cards for the first time this year, whereas a bearish reversal early on would signal that the channel remains intact for a retest of support in the 1.0700 area.

From my perspective, I would lean toward looking for more downside given the clear economic divergence and established bearish trend, but time will tell!

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX