Week’s Recap:

- US ISM Manufacturing PMI: Negative

- JOLTS Job Openings: Negative

- ADP Non-Farm Employment Change: Negative

- ISM Services PMI: Positive

- Non-Farm Payrolls: Pending

- FOMC Statements by Members Waller and Williams

Key Events for the Week Ahead:

- US Consumer Price Inflation (Wednesday)

- ECB Monetary Policy Decision (Thursday)

Following the negative results from the leading economic indicator, the US ISM Manufacturing PMI, along with negative employment indicators, the market sentiment is leaning towards the bear side ahead of the NFP reports, and ahead of technical key breakout levels.

The EURUSD and US Dollar Index facing critical levels between a trend reversal and confirmation, beyond the borders of December and July 2023 extremities, as policies are awaited to confirm the trends. Today’s non-farm payroll result, followed by the remarks from FOMC members Williams and Waller, are set to shape the magnitude expectation of the upcoming Fed rate cut, possibly giving more weight to the employment stats over next week’s consumer price inflation data.

From a monetary policy perspective, the EURUSD is expected to face a bearish wave with the high probability of a rate cut by the ECB next Thursday, which is expected to take place after the non-farm and US CPI indicator market impacts.

Technical Outlook:

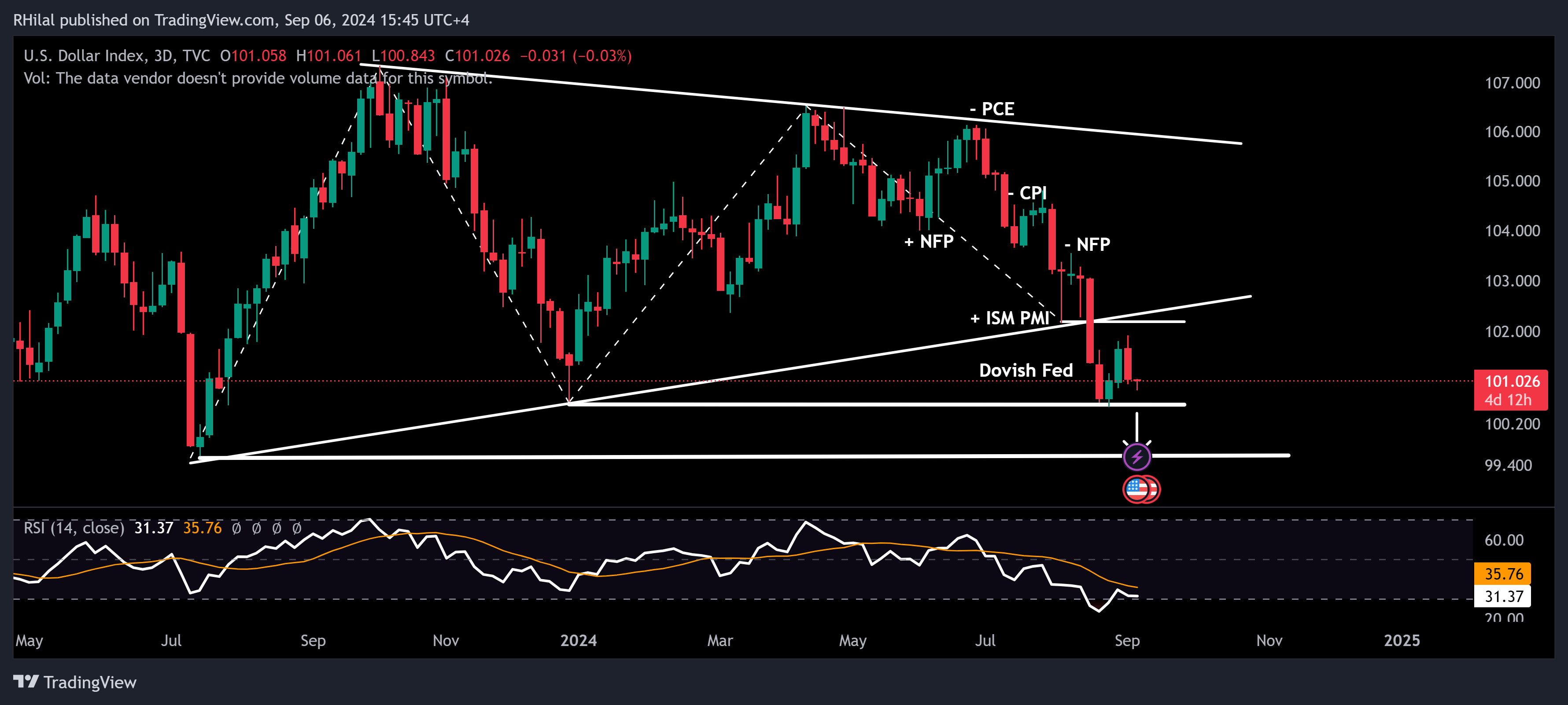

DXY Analysis: 3-Day Time Frame – Log Scale

Source: Tradingview

The DXY is trading near its December 2023 lows and appears poised to drop toward the July 2023 lows around the 99.60 level, particularly if NFP data disappoints. A continued decline could reinforce the downtrend that has been in place since the 2022 highs.

On the upside, the lower boundary of the trendline connecting consecutive higher lows between 2023 and 2024 is likely to offer resistance near the 102 level. A stronger-than-expected result could push the DXY higher, with potential resistance around the 104 level.

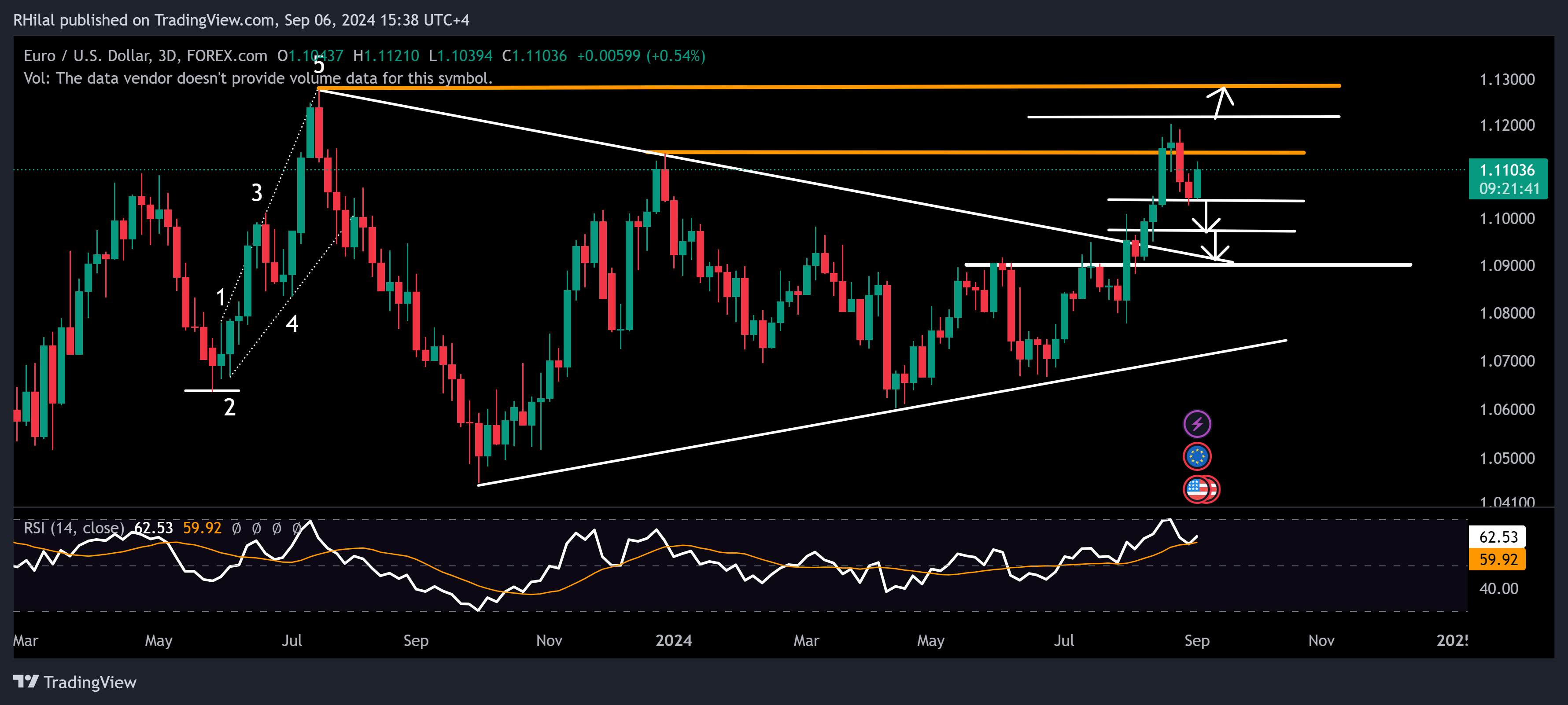

EURUSD Analysis: 3-Day Time Frame – Log Scale

Source: Tradingview

The EURUSD is currently rebounding from the 1.1030 support zone, supported by a relative strength indicator bounce from its moving average on the 3-day time frame. The overall trend appears set for a bullish breakout, with a close above the 1.120 and 1.130 resistance levels needed to confirm the uptrend that began from the 2022 lows.

On the downside, unexpected results from the US labor market or inflation data could dampen expectations for upcoming Fed rate cut magnitude. Combined with a potential ECB rate cut, the EURUSD could see declines toward 1.0980, 1.0920, and 1.0890, potentially holding just below the 1.1020 level and aligning with the trendline connecting consecutive lower highs between 2023 and 2024.

--- Written by Razan Hilal, CMT – on X: @Rh_waves