Euro Talking Points:

- After a punishing sell-off saw EUR/USD trade down for 17 of 19 days last week, a bit of support has finally appeared, and the USD has held resistance at 104.50 for a second test in DXY.

- EUR/JPY has been perhaps a bit cleaner on the long side with another fresh two-month-high after the open of trading this week. There is some dramatics in the Yen given the recent election, but price action continues to paint a bullish short-term picture.

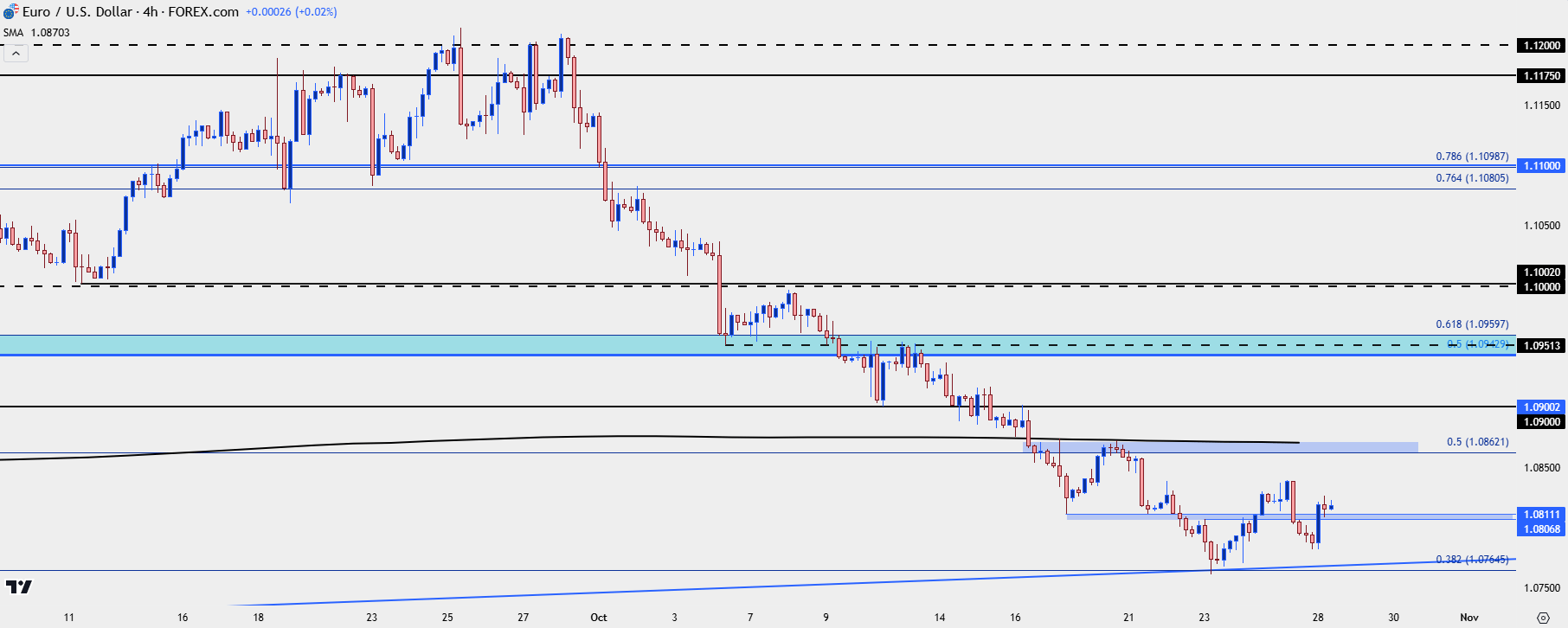

It’s not exactly a bullish trend in EUR/USD but given how aggressive sellers came in around the Q4 open, the past few days of price action represents a change-of-pace.

I had looked at a big spot of support for the pair in last Tuesday’s webinar, and that came into play on Wednesday. I wrote an article about it at the time and at that point, it looked as though that support could give way at any moment. But – it held and led to a bounce on Thursday that was faded out to a degree on Friday. But – so far sellers have been unable to test that prior low and prices have held above the 1.0765 support level. Given the higher-low, there’s scope for a deeper pullback move in the pair with focus on the 1.0862 Fibonacci level up to the 1.0872 level which is confluent with the 200-day moving average.

EUR/USD Four-Hour Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

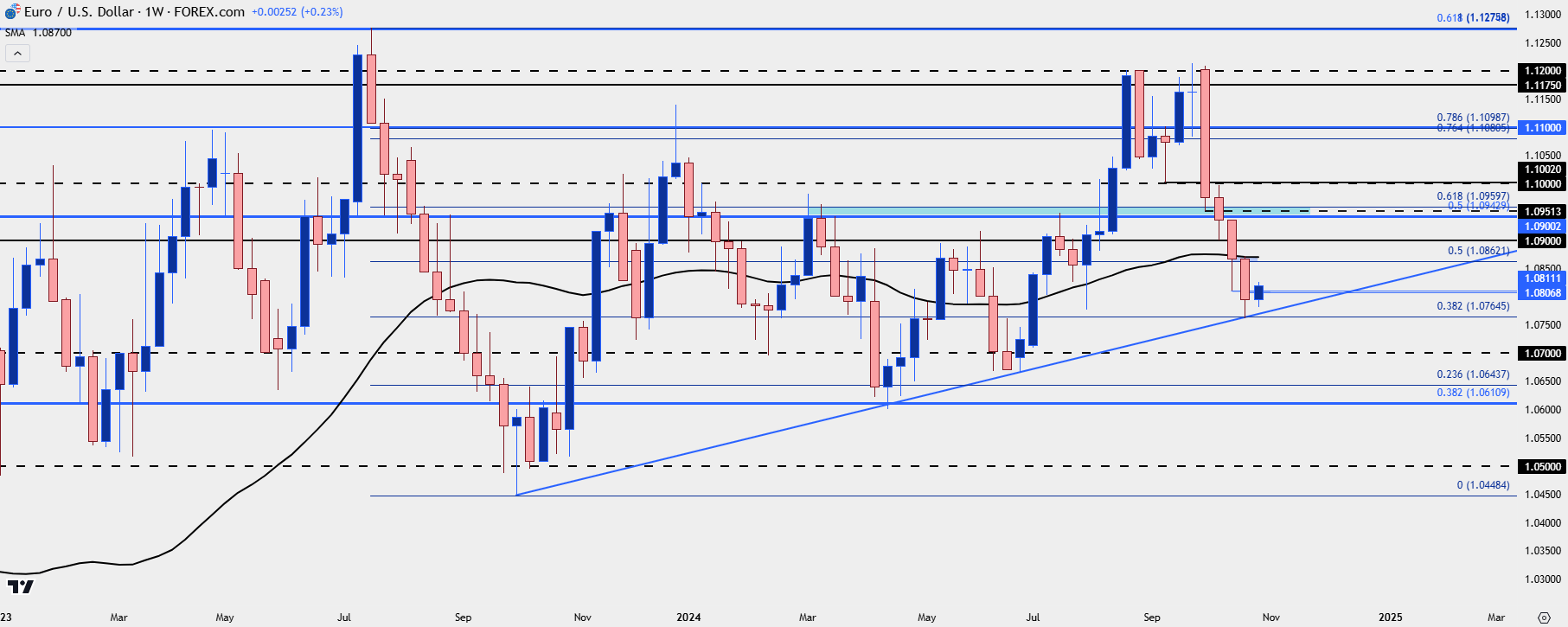

EUR/USD Bigger Picture

This still doesn’t classify as a reversal in EUR/USD in my mind unless or until the 200-day moving average can clear. If it can, prior supports at 1.0900 and 1.0943-1.0960 come into the picture before a 1.1000 test.

But, notably, EUR/USD has been range-bound for more than 22 months at this point and the month of October has merely been continuation of that after the month of September saw stalling at the 1.1200 level.

That 1.0943 level seems especially important as that’s the 50% mark of the Fibonacci retracement produced by the 2021-2022 major move. And that Fibonacci retracement has put in the work over the past year-and-change as the 61.8% retracement marked last year’s high, and the 38.2% retracement has marked this year’s low. The price of 1.0943 is the 50% mark from that same Fibonacci setup and it held resistance in both March and July of this year.

EUR/USD Weekly Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

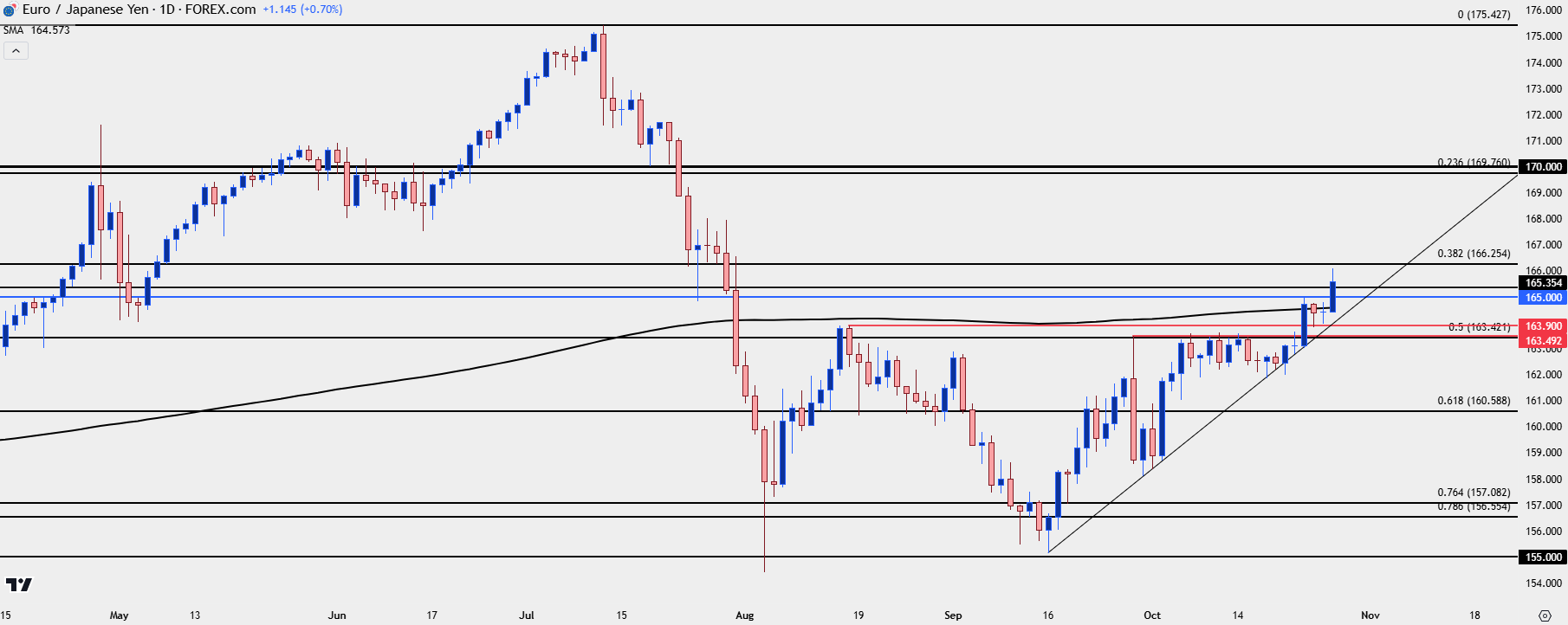

EUR/JPY

The recovery in EUR/JPY has been a bit more fruitful for Euro-bulls over the past month and this weekend showed yet another breakout in the pair.

Coming into last week, an ascending triangle had formed in a manner very similar to GBP/JPY. In EUR/JPY, resistance was showing at a Fibonacci level of 163.50 and that was in-play for a few weeks before last Wednesday’s breakout.

This weekend showed another extension in the move for the pair to push back-above the 165.00 psychological level while also clearing above the 200-day moving average.

EUR/JPY Daily Price Chart

Chart prepared by James Stanley, EUR/JPY on Tradingview

Chart prepared by James Stanley, EUR/JPY on Tradingview

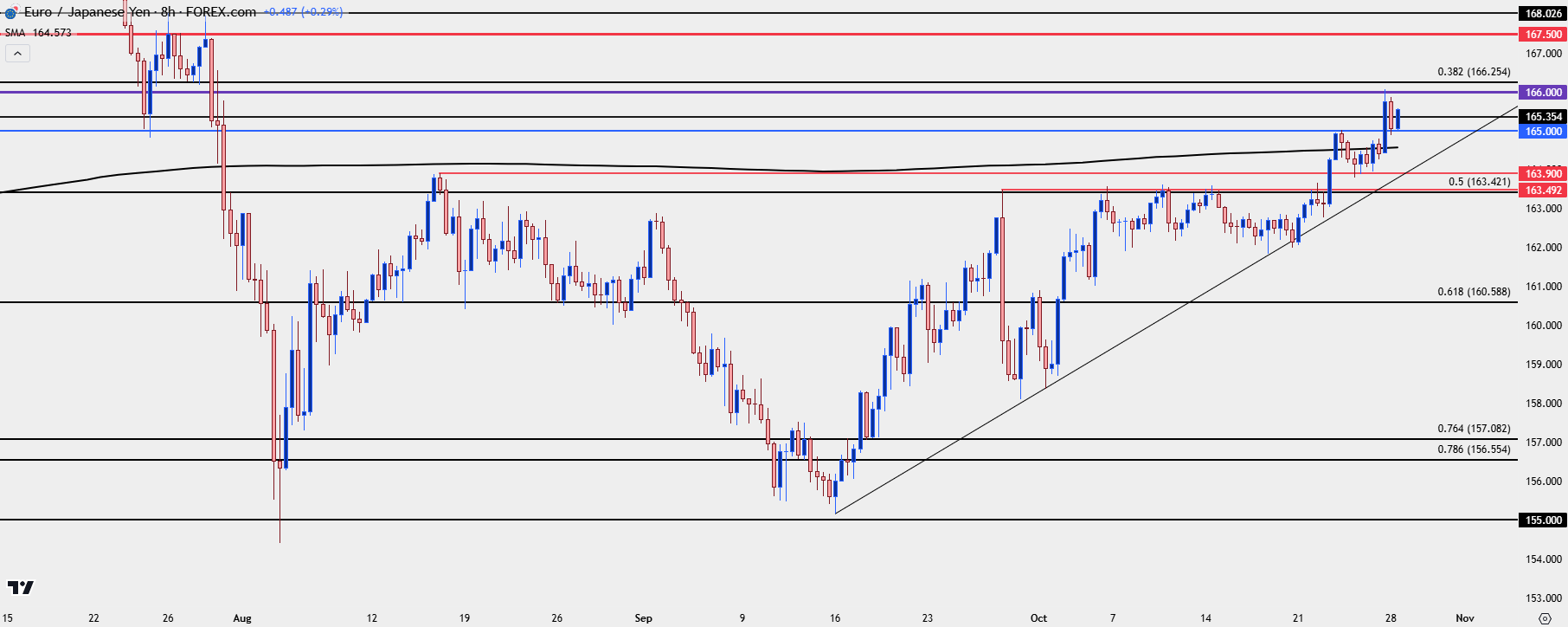

EUR/JPY Shorter-Term

There’s already been gyration in early trade this week following that EUR/JPY breakout. Price stalled at 166.00 and hurriedly pulled back for a support test at 165.00, which has held so far. Buyers have already forced a brisk move off that level and this denotes bullish continuation potential.

Chasing the short-term move could be a challenge, however, and this sets up the possibility of a higher-low off the 165.35 prior price swing. For next resistance levels beyond 166.00, I’m tracking a Fibonacci level at 166.25 and then a prior price swing around the 168.03 level. There’s also some interest around the psychological level of 167.50 as this produced some noise during the July sell-off.

EUR/JPY Eight-Hour Price Chart

Chart prepared by James Stanley, EUR/JPY on Tradingview

Chart prepared by James Stanley, EUR/JPY on Tradingview

--- written by James Stanley, Senior Strategist