Key Events

- ECB’s third rate cut opens the door for progressive easing

- US Core Retail Sales reached a new 2024 high

- Treasury Secretary Yellen highlighted potential US election impacts

Next Week

- ECB President Lagarde’s Speech (Wednesday)

- Flash PMIs from France, Germany, Europe, and the US (Thursday)

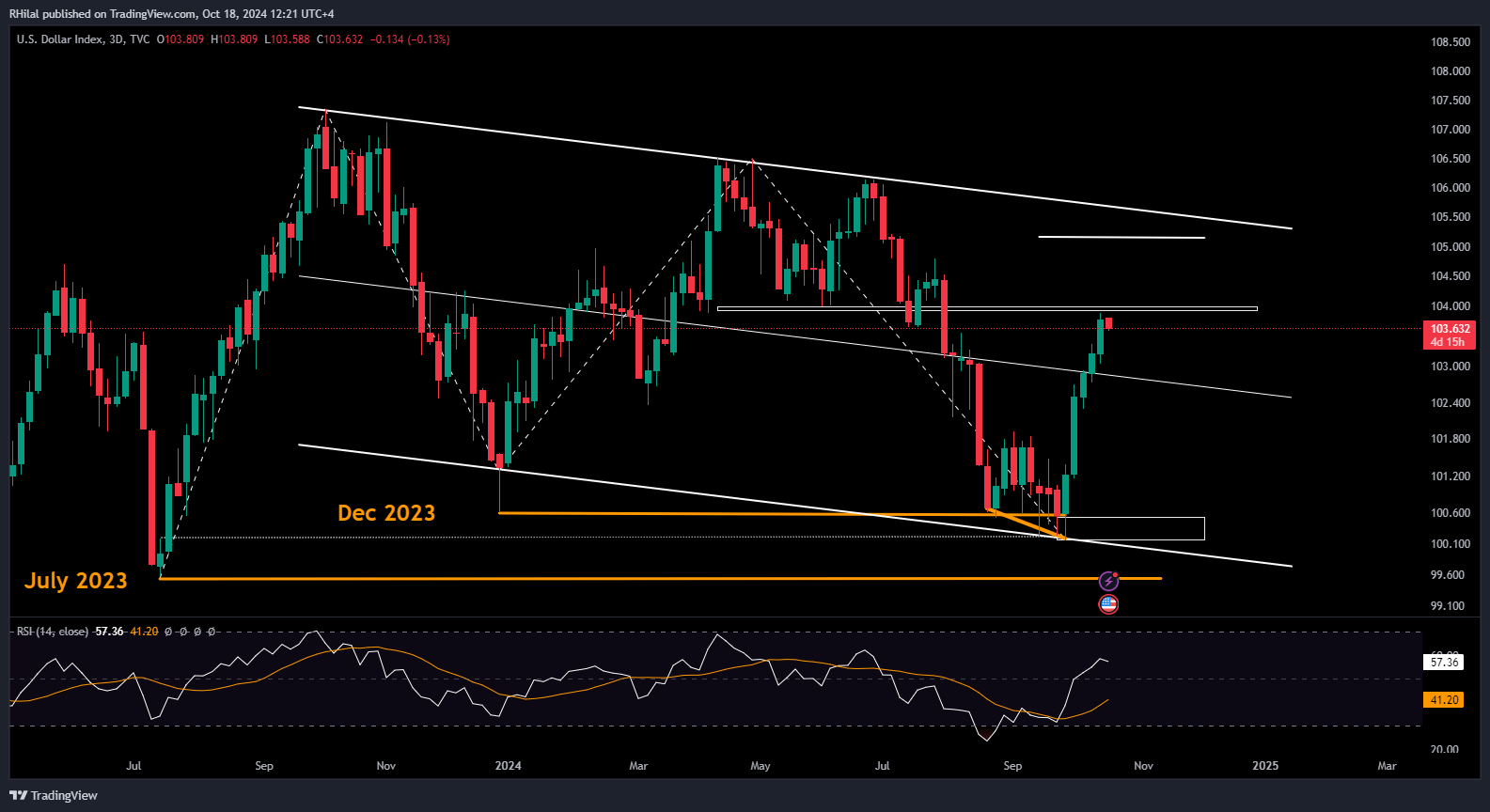

DXY Analysis: 3Day Time Frame – Log Scale

Source: Tradingview

The DXY’s rebound from the 100.15 low is currently aligned with the 0.618 Fibonacci retracement level of the downtrend between the high of June 2024 (106.12) and low of September 2024 (100.15). Positive non-farm payroll, CPI, and retail sales data boosted the dollar alongside rising global uncertainties.

Besides haven demand behind geopolitical tensions, the uncertainty regarding the US elections is playing a significant role. In her recent speech, Treasury Secretary Janet Yellen warned that a Trump election, along with his proposed tariff policies, could reignite inflation risks and harm the economy.

As a result, rising uncertainties could maintain a bullish ground on the dollar index leading up to the elections.

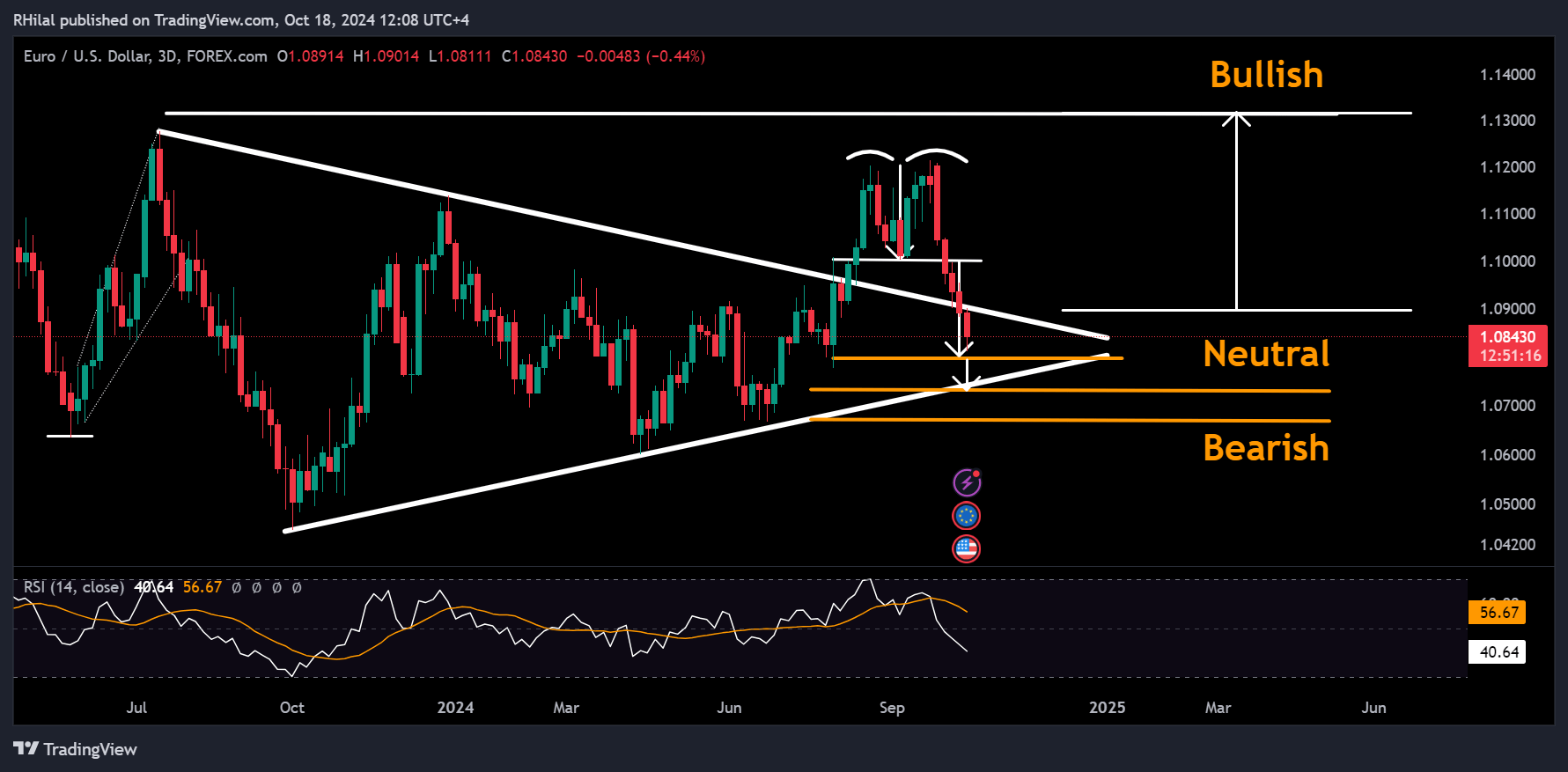

EURUSD Analysis: 3Day Time Frame – Log Scale

Source: Tradingview

With the strength of the dollar index on one side and the monetary easing policies of the ECB on the other, the EURUSD completed a double top pattern from the 1.1220 resistance. Further insights on the European economy are expected from Lagarde’s speech on Wednesday, with more volatility likely on Thursday from French, German, European, and US Flash PMIs.

Technically speaking, the EURUSD reached a notable support zone between the 1.08 and 1.0780 levels. A close below 1.0780 can extend the drop towards 1.0730 (the lower boundary of the consolidation) and 1.0680, a crucial level that separates a neutral from a bearish outlook.

From the upside, daily momentum indicators for both the DXY and EURUSD are in extreme zones. The daily RSI on the EURUSD touched down at the oversold 26 zone, hinting at a possible reversal towards the respective resistance levels 1.09 and 1.10.

If momentum builds, the pair could extend further towards resistance levels 1.1220 and 1.1320, potentially setting up a longer-term bullish scenario.

--- Written by Razan Hilal, CMT on X: @Rh_waves