Euro Area Inflation Data and Potential Impact on the DAX

Key Inflation Data to Watch (Q3 and October 2024):

- Euro Area Inflation Rate YoY Final (October):

- 2.0% YoY is expected, up from 1.7% in September (lowest since April 2021).

- Key drivers:

- Slower decline in energy prices (-4.6% vs -6.1%).

- Faster price increases for food, alcohol, and tobacco (2.9% vs 2.4%) and non-energy industrial goods (0.5% vs 0.4%).

- Services inflation remained steady at 3.9%.

- Core Inflation Rate YoY Final (October):

- 2.7% is expected, unchanged from September but slighty above forecasts of 2.6%.

- Indicates persistent inflation pressures beyond volatile components like energy and food.

- Consumer Price Index (CPI):

- Expectations lie around 127.03 points in October from 126.60 points in September, reaching an all-time high.

- Month-over-month inflation is expected to have increased 0.3%, the biggest rise in six months, which would confirm renewed upward price pressures.

How This Can Influence the DAX

1. Impact on Monetary Policy Sentiment

- ECB Rate Expectations: Inflation now at the European Central Bank’s 2% target could reduce additional monetary loosening in the short term. This may ease concerns about rising borrowing costs in the longer term. And could potentially boost rate-sensitive sectors on the DAX, such as real estate and consumer discretionary stocks.

- Core Inflation Concerns: Persistent core inflation (2.7%) may still signal near term rate cuts.

2. Sector-Specific Impact

- Energy Sector: With energy prices falling at a slower rate, stocks in energy-intensive industries (e.g., chemicals and manufacturing) could face modest cost relief, which might support names like BASF or HeidelbergCement.

- Consumer Staples and Retail: Rising food and consumer goods prices could provide tailwinds for companies like Henkel and Beiersdorf, as higher prices often translate to better margins if demand holds steady.

- Technology and Growth Stocks: Persistent inflationary pressures might dampen growth stock valuations, particularly if the ECB remains cautious about future rate adjustments.

3. Broader Market Sentiment

- DAX Movement: Inflation stabilization at 2% could bolster overall investor confidence, as it signals a potential turning point in inflationary pressures. This could lead to:

- Increased risk appetite for cyclical sectors (e.g., autos like Volkswagen or Daimler).

- Greater optimism for export-heavy companies, as stable inflation might help boost consumer demand in key markets.

- Currency Effects: If inflation data supports a weaker euro due to increased expectations for ECB loosening, export-heavy DAX companies could benefit from improved price competitiveness internationally.

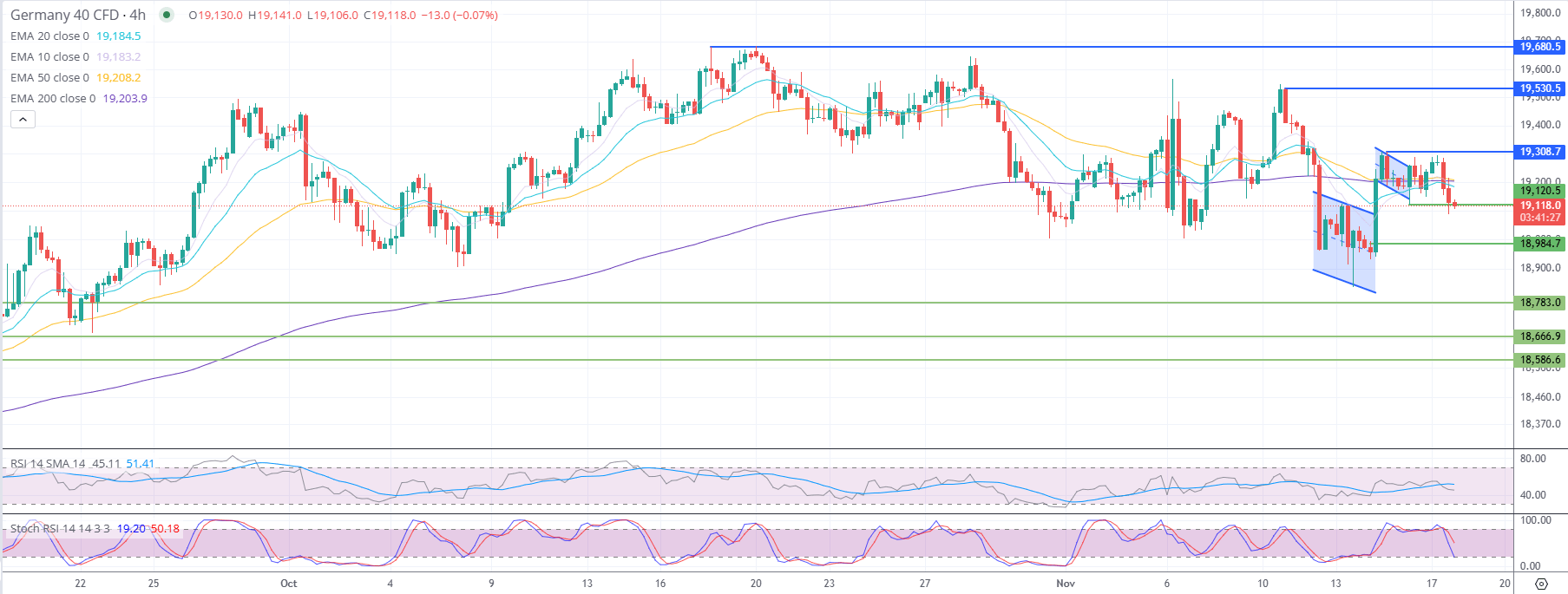

DAX Technical Analysis

1. Current Price Action and Trend:

- The DAX is trading at 19,118.0, showing bearish momentum after failing to break above the key resistance at 19,308.7. The price has fallen below the short-term moving averages as well as the support level at 19,120, suggesting increasing bearish sentiment.

2. Support and Resistance Levels:

- Resistance:

- The immediate resistance remains at 19,308.7, which has been a key barrier for upward momentum. A breakout above this level would signal renewed bullishness.

- The next resistance is at 19,530.5, followed by 19,680.5, which represents a major high and would confirm a stronger bullish trend if breached.

- Support:

- Immediate support now lies at 18,984.7, and a break below this level would signal further bearish movement.

- Additional support levels include 18,783.0, 18,666.9, and 18,586.6, providing multiple downside targets in the event of extended bearish pressure.

3. Moving Averages (EMA 10, 20, 50, and 200):

- The DAX is trading below all key moving averages:

- EMA 10 at 19,183.2, EMA 20 at 19,184.5, and EMA 50 at 19,208.2 are acting as immediate resistance levels.

- The EMA 200 at 19,203.9 suggests bearish momentum if the price remains below this level.

4. RSI and Stochastic RSI:

- The RSI is at 45.11, reflecting a bearish outlook, though it has not yet reached oversold conditions, indicating room for further declines.

- The Stochastic RSI is at 19.20, nearing oversold territory, which could signal a short-term bounce if support levels hold.

Scenario 1: Bearish Continuation:

- If the DAX breaks below 18,984.7, it could extend its decline to 18,783.0 and lower, with potential targets at 18,666.9 and 18,586.6.

- Sustained trading below all key moving averages supports this bearish scenario.

Scenario 2: Short-term Bounce:

- Given the oversold conditions on the Stochastic RSI, a short-term bounce is possible from 18,984.7 or nearby levels.

- If the DAX manages to reclaim 19,184.5 (EMA 20), it could challenge 19,308.7 once again, signaling a potential return to range-bound trading.

Conclusion

The DAX is likely to respond positively to the inflation data, particularly as it signals a cooling trend that aligns with ECB targets. However, persistent core inflation could temper gains in some sectors.

Technically the DAX is leaning bearish after failing to sustain above 19,308.7 and breaking below key short-term moving averages. A break below 18,984.7 would confirm further downside, while a bounce could occur given the oversold Stochastic RSI.

Latest market news

Today 08:25 PM

Today 07:48 PM

Today 05:30 PM

Today 04:41 PM