What is the Services PMI?

S&P Global compiles data from questionnaires given to a panel of service firms in Germany, France, Italy, Spain, and Ireland to create the HCOB Eurozone Services PMI.

This compiled index is derived from a query that inquiries about variations in the amount of business activity compared to last month.

Transportation, technology and communication, banking, insurance, real estate, and business services are among the industries covered. Retail stores are not questioned, however.

The index ranges from 0 to 100. A reading above 50 indicates an overall increase from the previous month, whereas a reading below 50 indicates an overall drop.

Eurozone Services PMI

The HCOB Eurozone Services PMI increased sharply from 51.9 in July 2024 to 53.3 in August 2024, well beyond the market estimates of 51.9. This represents the fastest rate of growth in the services sector in the bloc since April!

However, this was mostly caused by the short-term boost from the Olympics in France…which resulted in the strongest on-paper expansion since May 2022. Is this sustainable?

The euro area generally also saw a strong increase in most countries, excluding the two biggest economies Germany and France, however.

Employment and new orders grew somewhat. Input costs kept rising in terms of prices, while inflation slowed to its lowest point since April 2021.

Still, selling prices increased at the fastest rate in the previous three months mainly due to increased input costs.

These factors could all add up to decreasing optimism about the production prospects for the future in the Eurozone and a potential verification with this release.

Expectations for this release lie at the 53.3 level, where a previous reading of 51.9 was reported. This shows an increase in the sentiment, however this might have been attributed to the France Olympics so caution is advised.

What is the Eurozone Composite PMI?

Now that we know what the services PMI is, it is now a good idea to know what the Composite PMI means.

The HCOB Eurozone Composite Output Index is a weighted average of the Manufacturing Output Index and the Services Business Activity Index. Again, it is compiled by S&P Global from questionnaire responses sent to survey panels of manufacturers in Germany, France, Italy, Spain, the Netherlands, Austria, Ireland, and Greece. I also include service providers in Germany, France, Italy, Spain, and Ireland, totaling approximately 5,000 private sector companies.

The index tracks variables such as sales, new orders, employment, inventory, and pricing, and ranges from 0 to 100, with a number above 50 indicating an overall gain over the previous month and a reading below 50 suggesting a general fall.

For this release a slight gain to 51.2 is expected from a previous reading of 50.2, showing a moderate increase in the Eurozone.

Eurozone Composite overview

According to a flash estimate, the HCOB Eurozone Composite PMI increased to 51.2 in August 2024 from 50.2 the previous month, exceeding market forecasts of 50.1 and marking the sixth consecutive improvement in the Euro Area's private sector activity. Growth was driven by a four-month high increase in the services sector (53.3 vs 51.9 in July), which compensated two years of contraction in the manufacturing sector (45.6 vs 45.8).

As a result, aggregate levels of new orders continued to vary during the period, with new business among service providers rising softly but that of factories decreasing rapidly, causing new business to fall for the third consecutive month at the aggregate level.

In addition, composite employment fell marginally, bringing a halt to seven months of uninterrupted growth. On the price front, input prices rose considerably, while inflation moderated. Nonetheless, enterprises passed costs to clients at a faster rate, and output charge inflation increased.

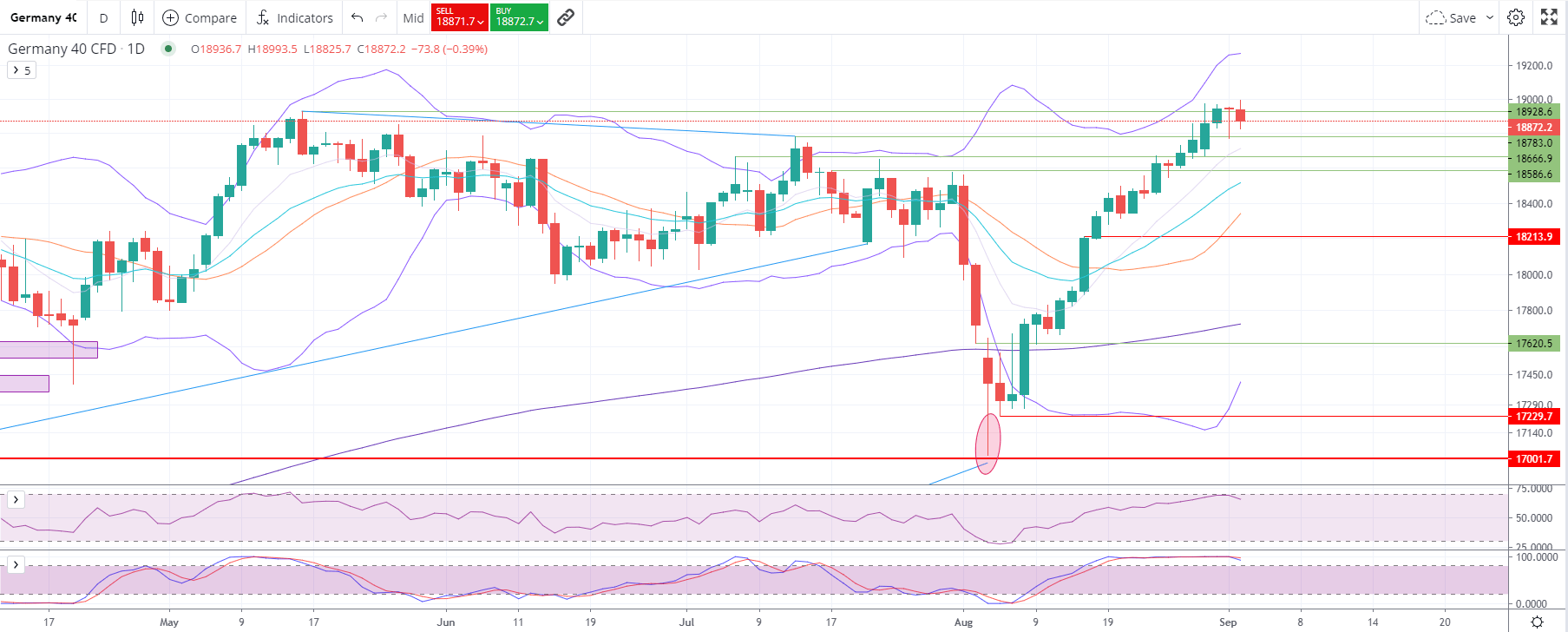

DAX-Technical Analysis 1D

Bollinger Bands: The price is nearing the upper Bollinger Band, suggesting the possibility of an overbought condition.

Moving Averages: The shorter-term moving average is above the longer-term moving average, indicating a bullish trend.

Resistance Levels:

18993.5 ATH

18928.6 May ATH

Support Levels:

18213.9

17620.5

17229.7

17001.7

RSI: The RSI is around 70, which indicates that the asset might be overbought.

Stochastic RSI: The lines have been above the 70 lines, pointing to bullish momentum and ongoing buying pressure in the underlying.

Analysis: The DAX has shown a predominantly bullish trend characterized by: The price trading near the upper Bollinger Band, short term EMAs above the long term EMAs. And the Stochastic RSI being over the 70 lines for an extended period of time.

Moving averages in a positive alignment, indicating upward momentum.

Last weeks all time high was tested at 18,973. The price is currently taking a breather ahead of tomorrow’s data.