Asian Indices:

- Australia's ASX 200 index fell by -19.4 points (-0.27%) and currently trades at 7,122.20

- Japan's Nikkei 225 index has risen by 11.44 points (0.04%) and currently trades at 28,001.43

- Hong Kong's Hang Seng index has fallen by -256.41 points (-1.4%) and currently trades at 18,086.71

- China's A50 Index has fallen by -47.27 points (-0.38%) and currently trades at 12,443.34

UK and Europe:

- UK's FTSE 100 futures are currently down -33 points (-0.45%), the cash market is currently estimated to open at 7,336.44

- Euro STOXX 50 futures are currently down -38 points (-0.97%), the cash market is currently estimated to open at 3,877.09

- Germany's DAX futures are currently down -155 points (-1.08%), the cash market is currently estimated to open at 14,223.51

US Futures:

- DJI futures are currently down -20 points (-0.06%)

- S&P 500 futures are currently down -22 points (-0.18%)

- Nasdaq 100 futures are currently down -4.5 points (-0.11%)

Trump to run (again) in 2024 election

In true Trump style, his announcement was delivered in full ‘campaign mode’ to the roar of his supporters at his Mar-a-Lago resort. Citing high levels of inflation, his record for a US president not having a war and the amazing job he did of saving lives around the pandemic, he’s likely just warming up for what could be another turbulent 2-years (at least) for US politics.

At this stage the bigger question is whether he will split the Republican party and inadvertently hand the Democrats an easy win. Of course, a lot can happen between now and then – but if inflation is not under control, it will put the Dems in a very weak position by the elections.

However, it’s a long arduous road to the Whitehouse and as of yet Trump wields no presidential powers, so it could take some time for markets to take notice – which is likely why they showed no meaningful reaction today, from an announcement we all fully expected.

NATO to meet today regarding alleged Russian missile in Poland

Reports flew in of a Russian missile hitting Polish soil, killing two people. Given Poland is NATO member, and ‘and attack on one is an attack on all’, fears that the war in Ukraine will escalate beyond its borders and bring in NATO members quickly escalated. However, the US and Western allies are not yet able to confirm the report and are still investigating – and there has been some speculation that the rocket may be shrapnel from a rocket, and not a planned attack.

In the grand scheme of things, volatility could have been greater given the potential fallout from the alleged Russian missile. So, from that alone it appears markets have taken it within their stride and are assuming that a resolution can be found without an escalation of war.

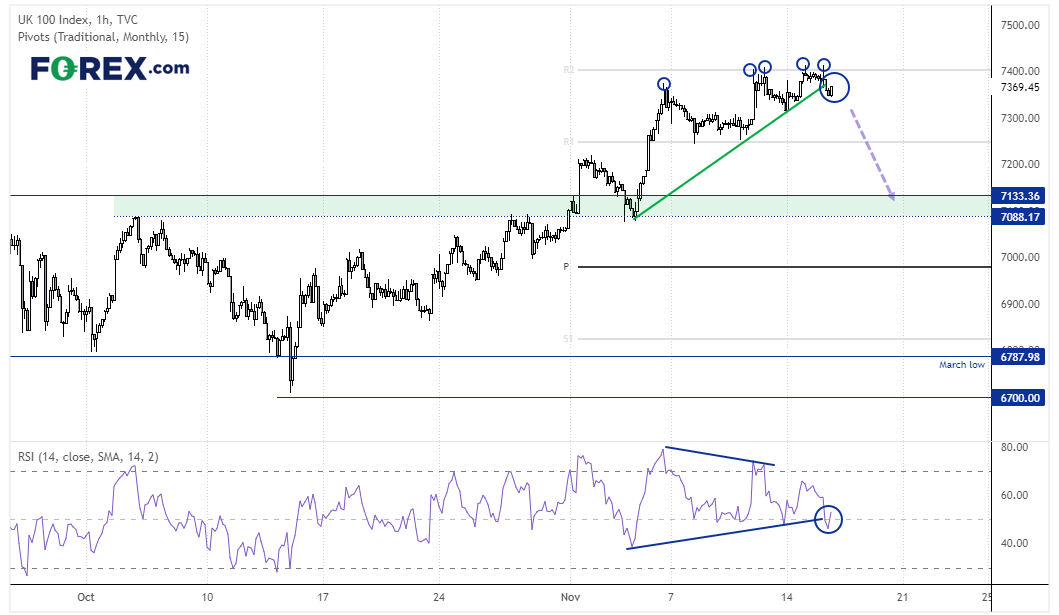

FTSE 100 daily chart:

The FTSE 100 has found resistance at the monthly R2 pivot point, with the past 4 daily candles test (yet failing to close above) it. A bearish divergence has formed on the 1-hour RSI to show loss of momentum, and both prices and the RSI broke their respective support lines ahead of yesterday’s close. Given futures markets are pointing lower, I suspect the market has seen its interim high and we could be headed for a move back to the 7088 – 7133 support zone.

FTSE 350 – Market Internals:

FTSE 350: 4094.09 (0.66%) 15 November 2022

- 229 (65.43%) stocks advanced and 112 (32.00%) declined

- 0 stocks rose to a new 52-week high, 5 fell to new lows

- 12.57% of stocks closed above their 200-day average

- 50.57% of stocks closed above their 50-day average

- 5.43% of stocks closed above their 20-day average

Outperformers:

- + 4.25% - Carnival PLC (CCL.L)

- + 3.77% - Fidelity China Special Situations PLC (FCSS.L)

- + 3.38% - Centrica PLC (CNA.L)

Underperformers:

- -16.79% - Ocado Group PLC (OCDO.L)

- -7.94% - Vodafone Group PLC (VOD.L)

- -7.17% - Synthomer PLC (SYNTS.L)

Economic events up next (Times in GMT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.