The final result of the US Presidential election has yet to be announced although Joe Biden has extended his lead and Trump’s legal challenge to stop counting in Michigan and Georgia has been thrown out. The markets are still leaning towards Biden win together with a split Congress.

In Europe, covid cases continue to surge despite national lockdowns in France & Germany and data provided fresh evidence that the recovery from the pandemic in the Eurozone’s largest economy is slowing. German data once again showed weaker than expected growth. German industrial production increased 1.6% MoM in September, softer than the 2.7% growth expected. The data comes after German Factory orders increased less than expected and after the IFO said that

Brexit remains a drag on sentiment after the EU Internal Markets Commissioner Thierry Breton said that there was a 50 / 50 chance that the EU and the UK would be able to achieve a trade deal. He highlighted that the UK had more to lose in the case that a deal wasn’t achieved. With the UK now back in lockdown a Brexit trade deal is even more key that before. The double whammy hit of lockdown paralysis and no trade deal Brexit could send many businesses over the edge. GBP/USD trades mildly lower but still comfortably over $1.31 on US Dollar weakness

Non farm payrolls to show slowing recovery

Looking ahead US non-farm payrolls will be release, although they could well be overshadowed by any developments surrounding the race to the White House. The latest US labour market report is expected to support the narrative of a slowing recovery.

The NFP is expected to show 600k new jobs were added to the US economy in October. Meanwhile the unemployment rate is expected to slip from 7.9% to 7.7%. Lead indicators have been mixed. The ADP report showed that a much weaker than expected 365k new private sector jobs, well off the 650k forecast. On the other hand, initial jobless claims have remained below 800k and the most encouraging lead indicator has been the employment sub-component of the ISM non-manufacturing PMI which jumped significantly higher to 53.2, from 49.6.

A stronger than forecast reading could lift sentiment, boosting US stock markets higher, whilst dragging on the safe haven US Dollar.

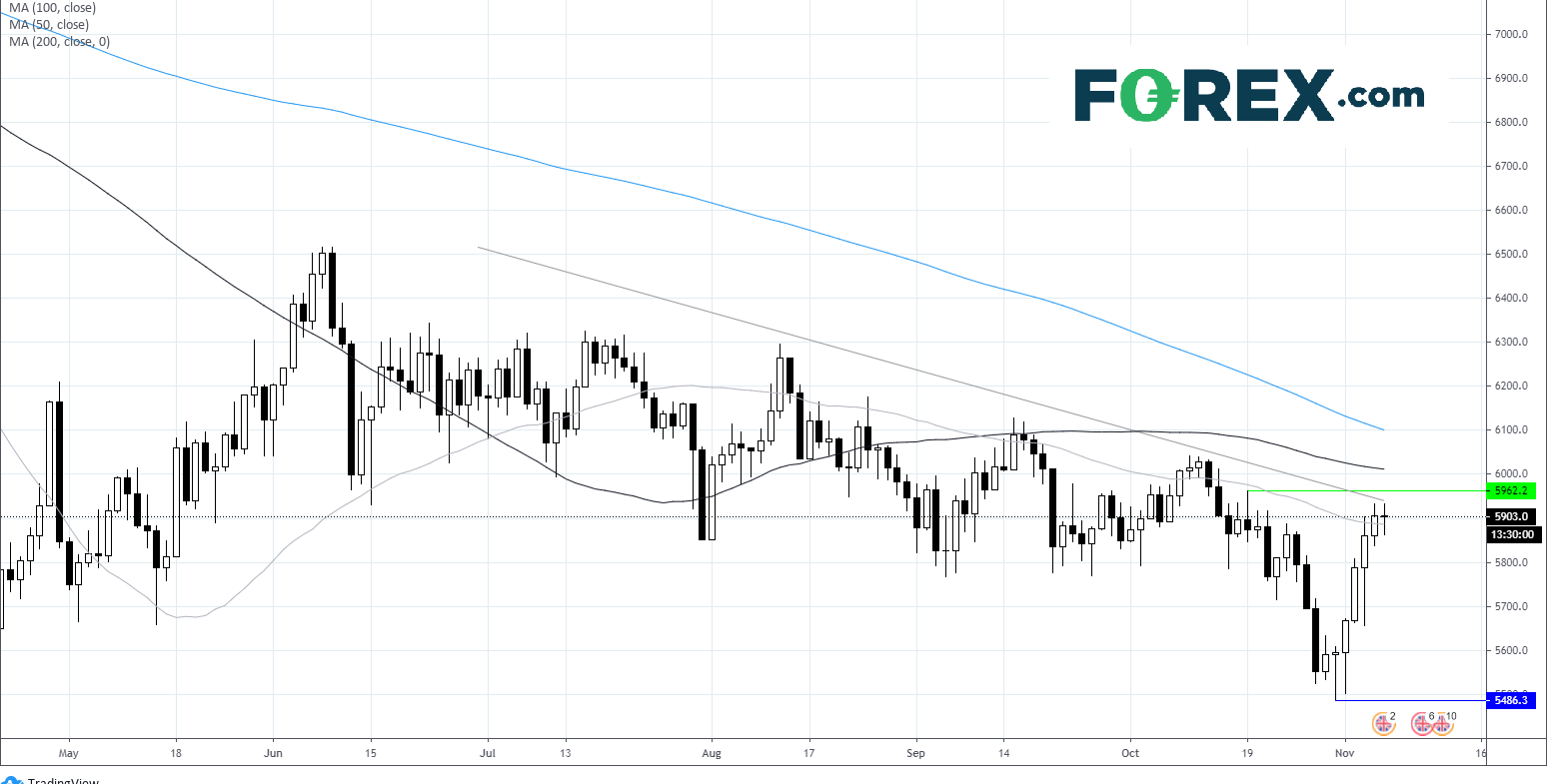

FTSE Chart