Now that Germany and Spain have revealed their CPIs, it is time for Europe to do the same.

Price pressures in two big Eurozone economies have eased, raising hopes for lower interest rates starting next month.

In August, German and Spanish inflation decreased faster than projected, raising the prospect of further European Central Bank interest rate cuts!

The largest economy in the Eurozone, Germany posted a harmonised annual inflation rate surprisingly lower than expectations, and as a matter of fact, fell to a three-year low of 2% from 2.6% in July.

The result, the lowest level not seen since March 2021, was also less than the 2.3 percent projection of economists worldwide.

The harmonised inflation measure for Spain, also came in below last month’s reading and dropped to 2.4% from 2.9% the previous month. While expectations from economists were for the reading to be around the 2.5% level.

These numbers for Germany and Spain could now suggest that the eurozone inflation data, which will be published Today, may already come close to the ECB's 2% target! This could in fact give us a “downside surprise” in the Eurozone figure, and makes an ECB interest rate cut next month “very very likely”.

The ECB was already expected by the Markets to cut its benchmark deposit rate by a quarter of a percentage point to 3.5 per cent at its next meeting on September 12. Making this more likely than ever.

The national inflation rate for Germany also decreased more than anticipated, to 1.9% from 2.3% in the prior month. Core inflation, which takes into account increases in the cost of food and energy, decreased from 2.9% in July to 2.8% August.

Fading inflationary pressure combined with fading growth momentum give an almost perfect macro canvas for another rate cut.

Energy continued to drag on German inflation, with prices in this subsector contracting 5.1 per cent in August. However, services inflation, a key measure of domestic price pressures and a concern for policymakers, was 3.9 per cent in August, unchanged from levels seen in the previous three months.

In Spain, core inflation eased from 2.8 per cent to 2.7 per cent in August, the lowest reading since January 2022.

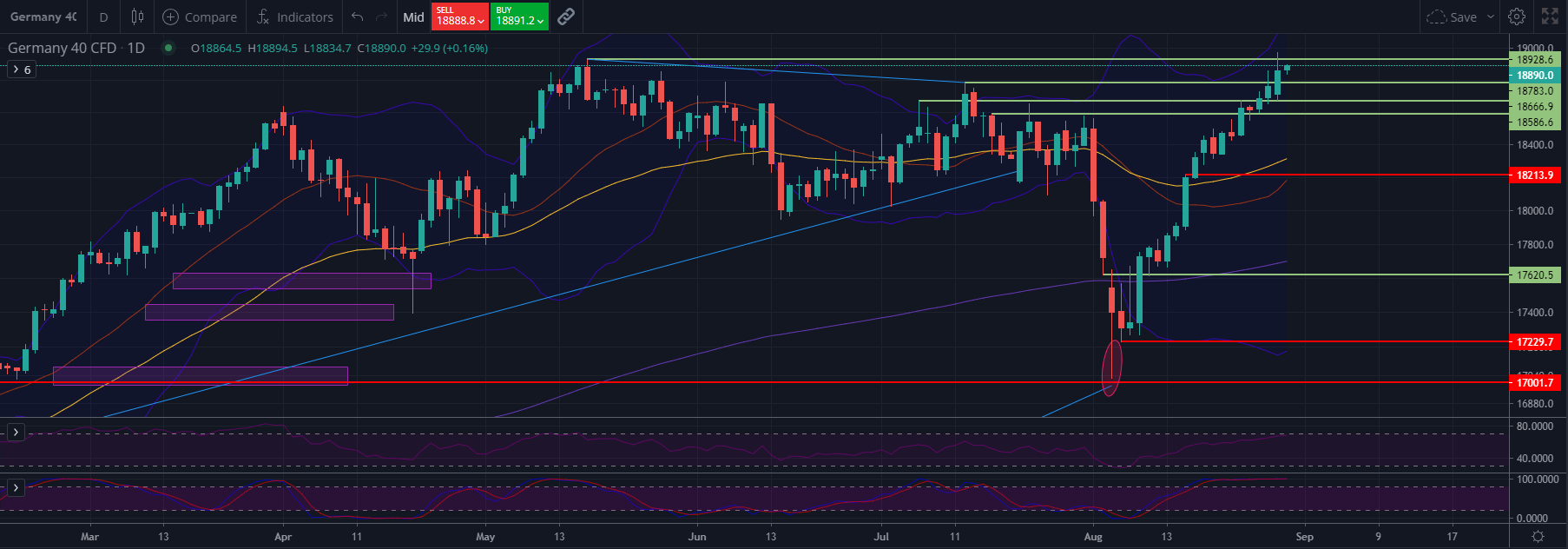

DAX: Technical analysis

Important levels

Indicators