Euro Weakness Continues Amid Global and Regional Challenges

After a brief recovery, the euro dropped over 1% against the U.S. dollar at the start of the week. Several global and regional developments contributed to this decline:

Key Drivers of Euro Weakness

- Political Instability in France:

- France faces a potential no-confidence vote against Prime Minister Michel Barnier’s government.

- Uncertainty about future fiscal consolidation and unresolved structural challenges have pressured the euro near a two-year low.

- Bond spreads in the Eurozone have widened, further amplifying market concerns.

- Instability in South Korea:

- President Yoon Suk Yeol’s declaration and reversal of martial law caused political turmoil, pushing the KOSPI index down 1.3%.

- The South Korean won, already the weakest currency in the region, stabilized after suspected intervention but remains down 9% against the dollar this year.

- Rising Rate Cut Expectations in the Eurozone:

- Money markets are pricing in robust ECB rate cuts in 2025, increasing the interest rate differential between the U.S. and the Eurozone.

- Volatility in currency options markets has surged, with 3- and 6-month implied fluctuations reaching levels not seen since April 2023.

Market Impacts and Broader Trends

- ISM Manufacturing Index: The ISM index for U.S. industry rose to its highest level since June 2024, with new orders signaling growth for the first time in eight months. Employment metrics also climbed to a five-month high, confirmed by the JOLTS report.

- Global Tensions:

- China banned the export of key minerals, escalating trade tensions with the U.S.

- The Australian dollar weakened after soft economic data, increasing rate cut expectations.

- Oil prices rose, fueled by concerns over Middle East tensions.

Positive Market Performance in 2024

The stock market in 2024 has so far recorded a 19% gain, with hopes for a year-end rally. However, given the strong early performance, investors may begin to reduce risks in the coming days.

Other Key Updates

- Musk Pay Package: A record compensation package for Elon Musk was rejected by Delaware judges.

- China Escalates Trade Tensions: Key mineral exports to the U.S. have been banned.

- Microsoft Faces Legal Trouble: The company is facing a £1 billion lawsuit in the UK for allegedly overcharging cloud customers.

- Crypto Developments:

- The U.S. government transferred $2 billion worth of Bitcoin to Coinbase.

- Crypto whales accumulated $1 billion in Ethereum in just four days.

- France proposed a tax on unrealized gains for digital and "non-productive" assets.

Today's Agenda (GMT)

- 13:15: USD ADP Nonfarm Employment Change (Nov)

- 13:30: EUR ECB President Lagarde Speaks

- 14:45: USD S&P Global Services PMI (Nov)

- 15:00: USD ISM Non-Manufacturing PMI & Prices (Nov)

- 15:30: USD Crude Oil Inventories

- 17:10: EUR German Buba President Nagel Speaks

- 18:45: USD Fed Chair Powell Speaks

- 19:00: USD Beige Book Release

Earnings Today

- National Bank of Canada (Premarket)

- Hormel Foods (Premarket)

- Dollar Tree (Premarket)

- Foot Locker (Premarket)

Today’s DAX leaders

Daimler Truck Holding +2.51%

Commerzbank +1.49%

Rheinmetall AG +1.39%

Zalando SE +1.17%

Today’s DAX laggards

RWE AG +0.88%

Fresenius SE +0.78%

Bayer +0.62%

Symrise AG +0.10%

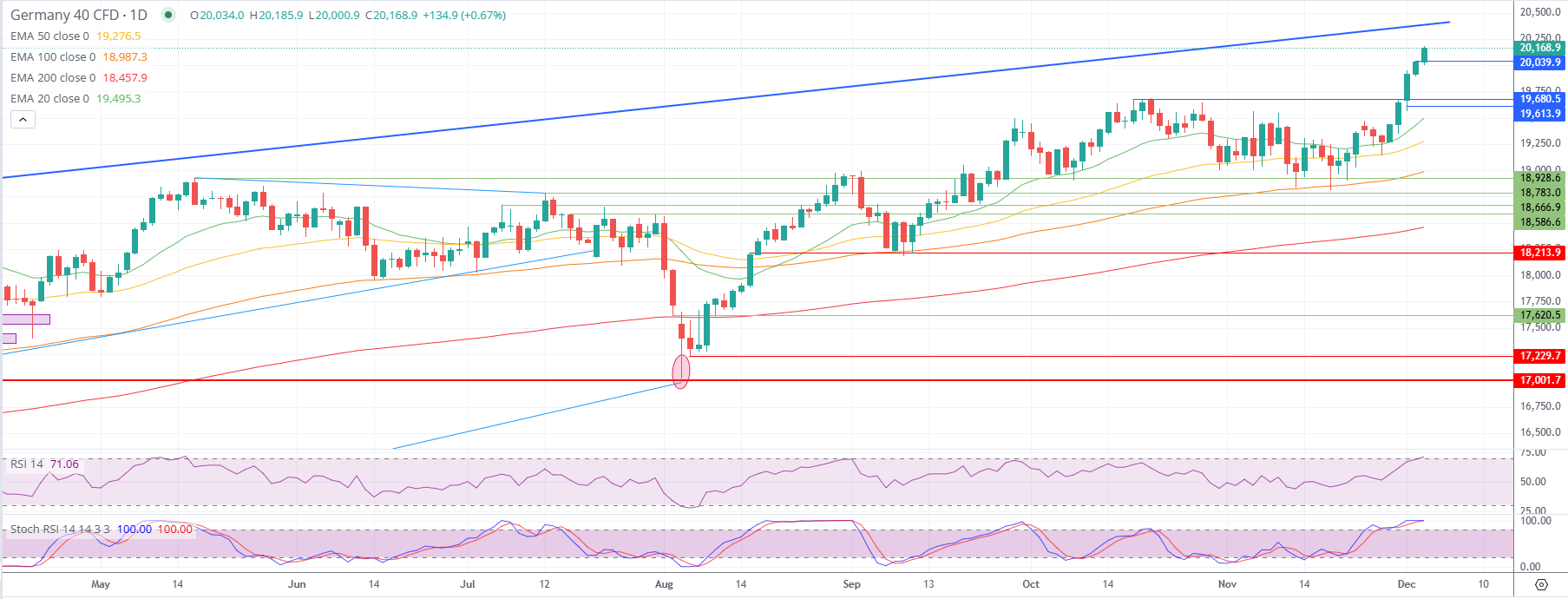

DAX Technical Analysis Daily Chart

Daily Chart Overview:

- The DAX remains in a strong bullish trend, trading well above the 50-day and 200-day EMAs, confirming upward momentum.

- The 14-day RSI at 69 suggests that the index could rise further, potentially reaching 20,150 before entering overbought territory.

Key Levels to Watch:

- Upside Targets:

- A break above the all-time high of 20,140 could pave the way toward:

- 20,150: Immediate resistance zone.

- 20,400: Intermediate target due to trendline.

- 21,150: Long-term upside target if bullish momentum persists.

- Downside Risks:

- A drop below 19,750 could signal the start of a bearish retracement:

- 19,500: Key support level for bears to target.

Factors Influencing DAX Movements:

- Services PMIs: Economic performance indicators that could impact market sentiment.

- US Labor Market Data: A weaker labor market could fuel dovish Fed expectations, supporting equities, including the DAX.

- Central Bank Commentary: ECB or Fed commentary may drive interest rate expectations, influencing market direction.

- US Tariff News: Updates on tariffs could directly affect Germany's export-heavy economy and the DAX.

Outlook:

- Bullish Scenario: If the DAX holds above 19,750 and breaches 20,150, the index could continue its upward trajectory toward the upwards sloping trendline around 20,400 and beyond.

- Bearish Scenario: A sustained break below 19,750 may signal a correction, targeting 19,500.

Conclusion: The euro remains under pressure due to political and economic challenges, while global markets face volatility fueled by political instability, rising rate cut expectations, and escalating trade tensions. The DAX gains from the pressured EUR and rises to all time highs. Today’s focus will shift to ECB speeches, U.S. economic data, and earnings from key companies.