Euro Talking Points:

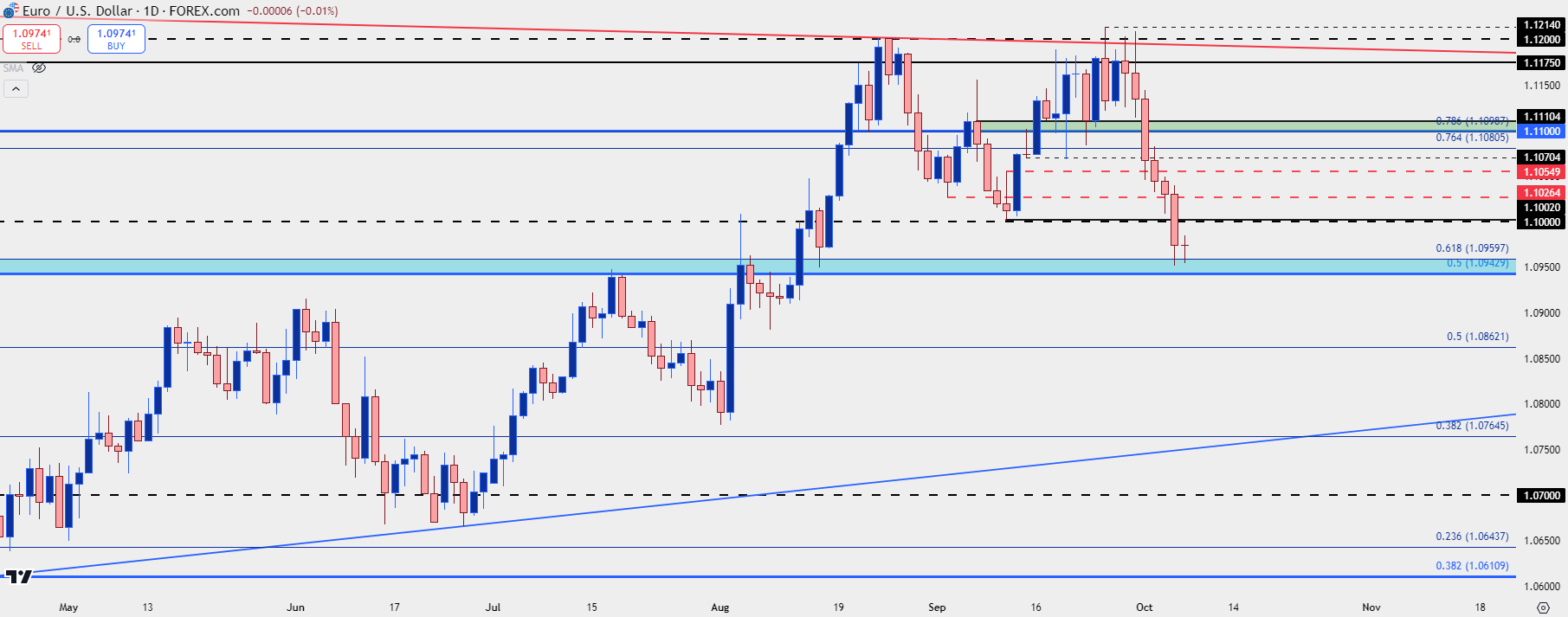

- After spending the first two months of Q3 in an uptrend and September grinding at resistance, EUR/USD bears woke up to start Q4 trade.

- The pair extended the move on the back of Friday’s NFP report and found support at the Fibonacci level of 1.0960. That support has held the lows so far this week as bulls try to push a bounce.

- The big question now is when/if/where sellers re-enter. The 1.1000 level is a logical area to look for lower-highs but there’s additional context for resistance over that, looked at below.

- I’ll be looking into these setups in the weekly webinar on Tuesday. Click here for registration information.

There was a month of stall and grind in EUR/USD, with the pair re-testing the 1.1200 level even last Monday on the final day of Q3 trade.

But that’s around the time that a shift began to show, with USD bulls showing up and helping to push EUR/USD-lower. This was a few days after the Core PCE report that showed a degree of entrenchment with inflation so while many headlines pointed to reduced rate cut expectations and the prospect of higher-than-expected inflation, that driver really showed up on the Friday before last.

Price action, however, started to show a strong move after the Q4 open in the Greenback and this impacted EUR/USD with the pair turning lower and lower, re-approaching the psychological 1.1000 level ahead of the Friday NFP report. That’s a big price in the pair, as this was the level that was defended in September ahead of the ECB meeting that helped to stoke a rate cut rally in the pair. The low that was in-play ahead of the NFP report was 1.1026 and this will be looked at a little later in this article.

NFP came out very strong, helping to push the USD rally even more and along the way EUR/USD fell through the 1.1000 level, eventually finding support at the 1.0943-1.0960 support zone.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

USD Counter Themes

With the Euro playing a massive 57.6% of the DXY’s composition, it’s logical to look at each as a mirror image of each other.

But, perhaps more interesting is when there’s a degree of divergence as seen via deduction. I had looked at this leading into last week, as EUR/USD had stalled even as other pairs like GBP/USD and AUD/USD pushed strong up-trends to yearly highs. That stalling in EUR/USD was matched with stalling in USD as the DXY pushed into a falling wedge formation that broke out in a big way last week. And as that USD strength came on, EUR/USD put in a strong reversal, all the way until a key support zone came into play to hold the lows.

But this is the week where we’ll see what sellers in EUR/USD have, and where any lower-highs might print. The 1.1000 level is massive but it’s also very close to current price and recent support, so a hold of lower-high resistance there could be seen as an aggressive step from sellers.

A bit higher, that 1.1026 level that had held the lows ahead of NFP comes into play. And above that, another prior swing low around 1.1055 comes into the picture as a prior level of resistance-turned-support. A bounce could theoretically run up to the 1.1100 zone that I’m spanning up to 1.1110 while still retaining a bearish posture.

The push point for that, of course, is the US Dollar and just how aggressive bulls remain there. The big data driver for this week is the CPI report on Thursday morning and, notably, it’s headline CPI that’s helped the Fed get to rate cuts, even despite stall or entrenchment showing in Core PCE so far this year.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

--- written by James Stanley, Senior Strategist