Euro Talking Points:

- Not to get lost in the election shuffle but EUR/USD has continued the bounce from support that was looked at a couple weeks ago.

- Given the backdrop in USD, EUR/USD appears to be an offset valve for tomorrow’s election results. EUR/JPY, on the other hand, could be of interest for those looking for a purer play of Euro-strength and or Yen-weakness.

- I’ll be looking at several markets ahead of election results in tomorrow’s webinar, and you’re welcome to join: Click here for registration information.

There’s been some change-of-pace in the past two weeks. Just a couple weeks ago EUR/USD was in a continued sell-off as the pair was red for 17 of 19 days.

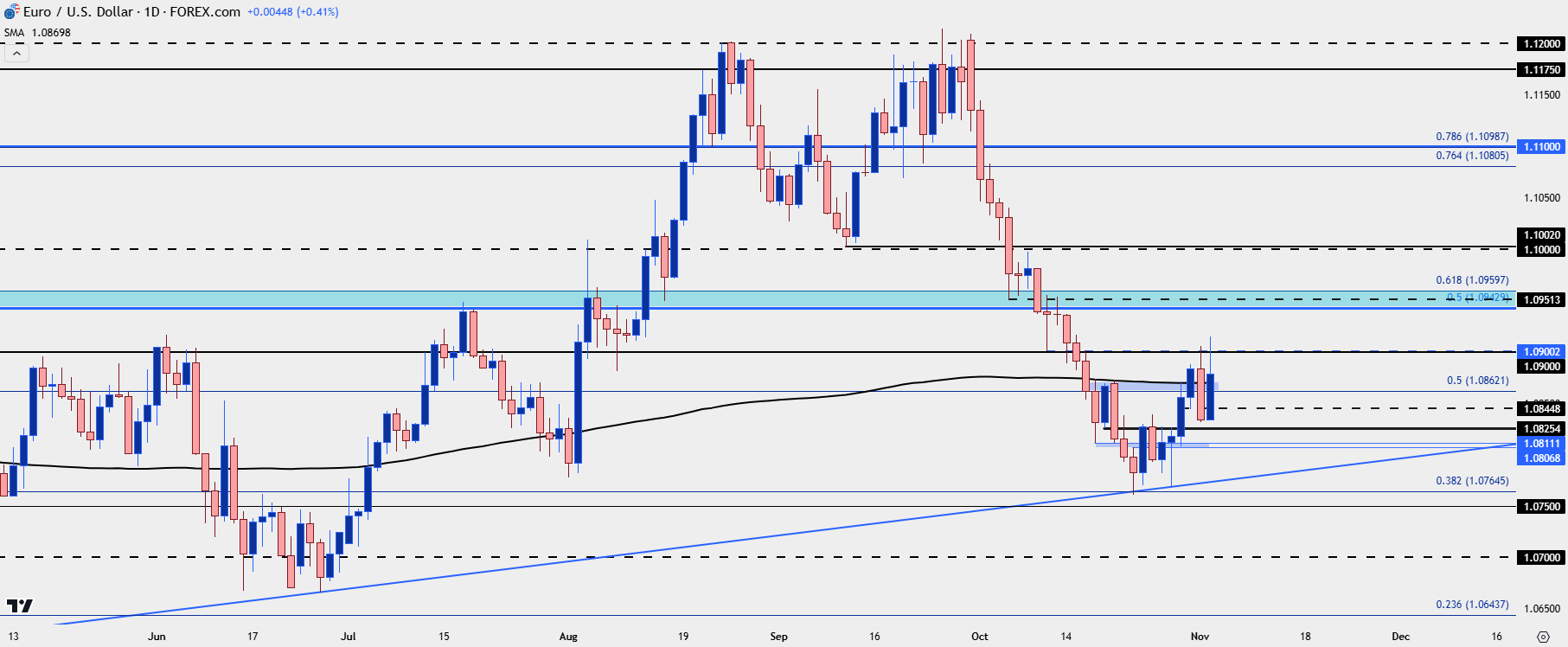

I looked at a support level in the webinar that week at 1.0765 and that came into play a day later, which led to an initial bounce. That bounce was quickly faded, however, and last week, sellers made another run at that support but were unable to test the low. Support ended up showing at a trendline projection and that led to am ore spirited bounce and this time, price was able to stretch up for a re-test of the 200-day moving average.

The NFP report on Friday brought bears back into the mix after an abysmal headline number which, normally, would be thought to equate to USD-weakness. Instead, it seems as though election dynamics are at-play and with such a meager headline print, that could be seen as supportive for Trump which, in-turn, could be construed as USD-positive. I looked deeper into that earlier this morning and I’ll dig further behind that in tomorrow’s webinar.

EUR/USD finished last Friday with a bearish engulfing formation but given the fast shifting around election odds over the weekend, USD-weakness has taken-hold ahead of tomorrow’s election; and once again EUR/USD is re-testing the 200-day moving average and the 1.0900 level that had stalled the advance last week.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

EUR/USD Dynamics

Anyone that’s followed my work for any length of time will know that I try to steer away from politics and headlines and towards price action, as that can at least present some opportunity for strategy.

In this case, it seems difficult to diverge away from the political impact of tomorrow’s election. Given the stout run of USD-strength that’s shown in October as odds for a Trump victory have increased, it really seems the two are intertwined, to a degree. And elections present their own risks so tying a trade idea directly to an election result seems to invite another, less manageable risk into the equation.

What I can do, however, is track price from the four-hour chart to find levels that may be a bit more usable around the event. And for those looking to steer further away from the election dynamics, I’ll look at EUR/JPY a little lower in this article.

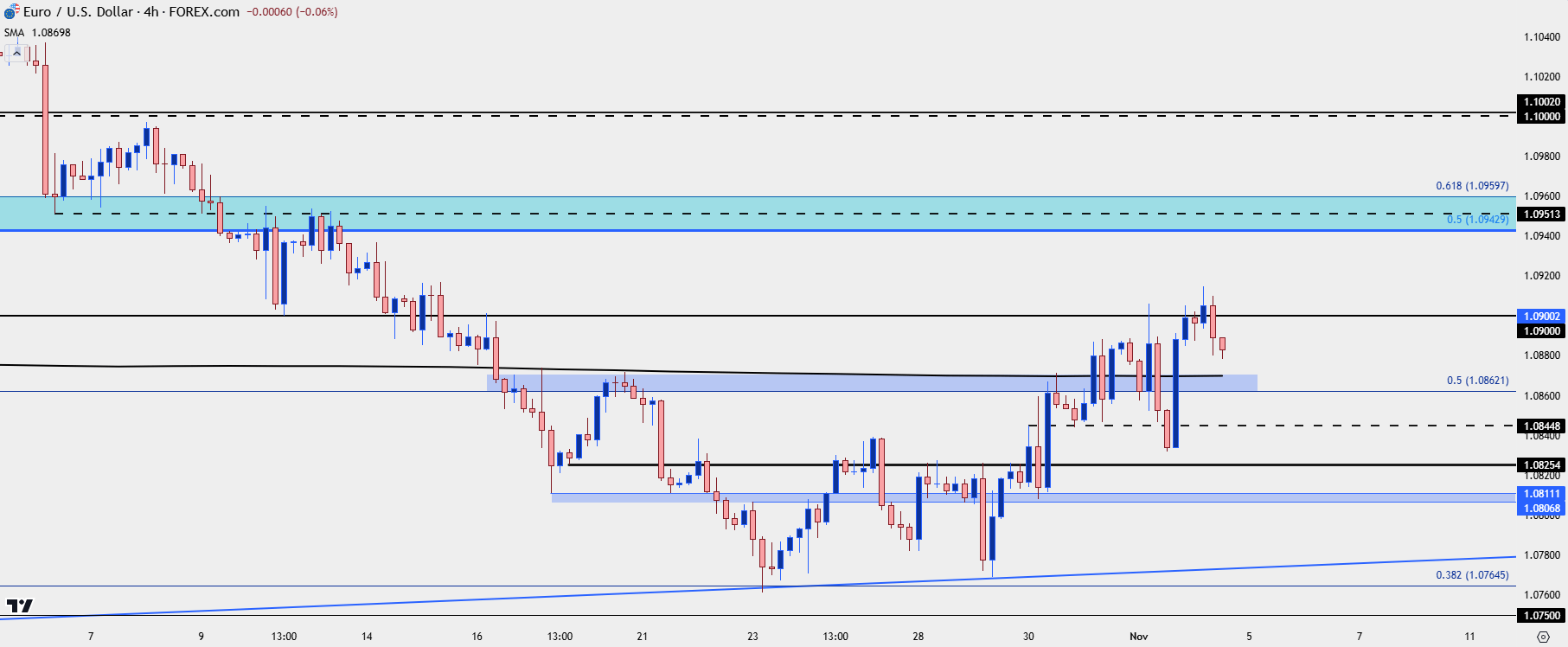

In EUR/USD four-hour, there’s been continued higher-highs and higher-lows. The same zone that I looked at in last week’s webinar, from 1.0805-1.0811 remains of interest as that’s been defended with a higher-low, and a push below that will illustrate an element of buyers losing control of the short-term move.

There’s potential for higher-low support in the same 1.0862-1.0872 area, confluent with the 200-day moving average.

Sitting overhead is a major zone with some long-term importance at 1.0943-1.0960. Bulls showing stall at that zone could open the door for longer-term bearish swing scenarios such as I had looked at in the last two webinars.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

EUR/JPY

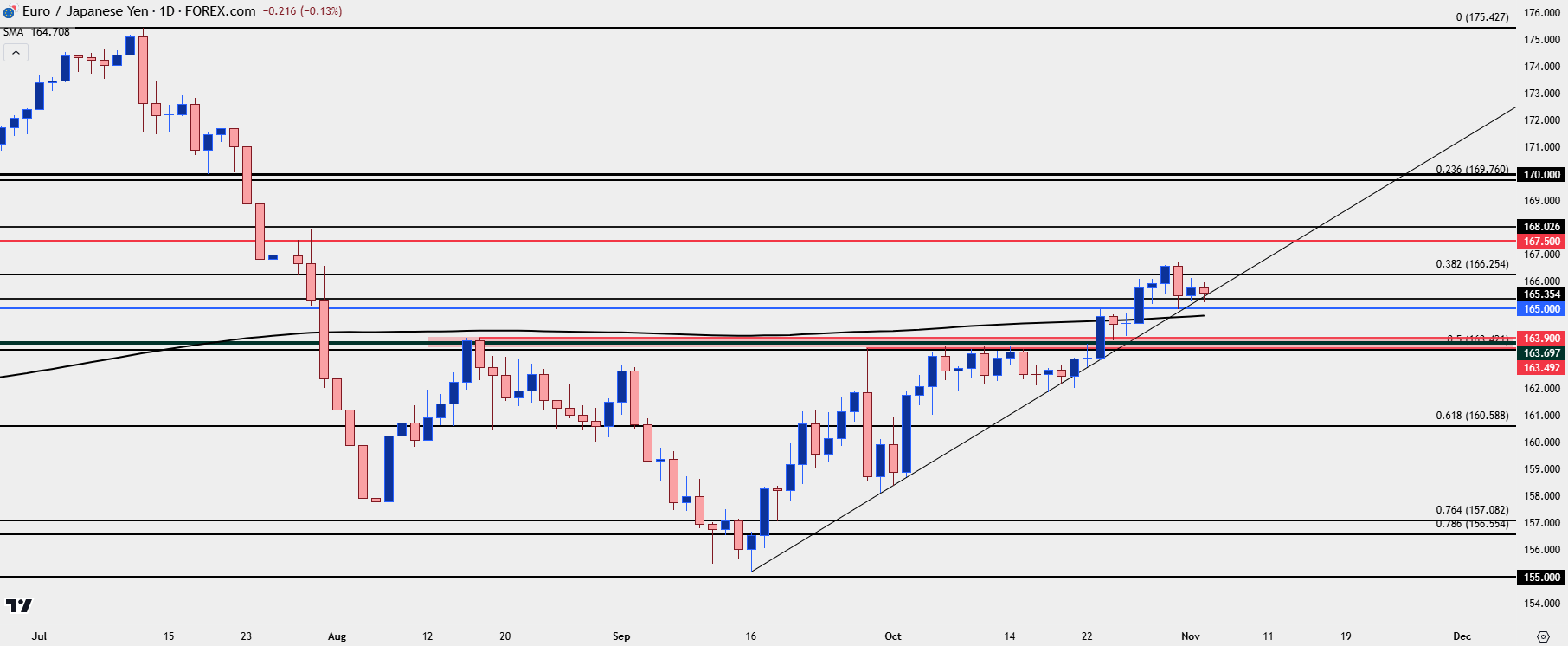

While the Euro has shown strength since the oversold snap back against the USD, EUR/JPY has shown a cleaner technical backdrop.

I looked at this in the weekend forecast two weeks ago and, at the time, EUR/JPY had already broken out from an ascending triangle formation but wasn’t able to take-out the 165.00 level yet.

The pullback from that psychological level had so far held support at a key spot of 163.90, helping to set higher-low support, at which point the breakout extended again in early trade last week. I was targeting resistance at 166.25 at the time and that was traded through last Wednesday.

Since then, however, the pair has been pulling back and so far, we have support holding at prior resistance of 165.00. There’s also support as taken from the bullish trendline that had previously made up the ascending triangle formation.

The 200-day moving average is also of interest here, particularly if we see a test below the big figure, and that currently plots around 164.75.

For next resistance, I’m tracking the 167.50 psychological level.

EUR/JPY Daily Price Chart

Chart prepared by James Stanley, EUR/JPY on Tradingview

Chart prepared by James Stanley, EUR/JPY on Tradingview

--- written by James Stanley, Senior Strategist