Euro Technical Outlook: EUR/USD Short-term Trade Levels

- Euro poised for fourth-daily loss- breaks to fresh yearly lows post US CPI

- EUR/USD approaching trend support- risk for exhaustion / price inflection ahead

- Resistance 1.0680-1.07 (key), 1.0730, 1.0777/82- Support 1.0535 (key), 1.0466, 1.0340-1.0406

Euro is poised to mark a fourth consecutive-daily loss with EUR/USD breaking to fresh yearly lows today in New York. In-line inflation data out of the US early in the session fueled another bout of selling and the focus now shifts to a possible reaction into downtrend support, just lower. Battle lines drawn on the Euro short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this EUR/USD technical setup and more. Join live Monday’s at 8:30am EST.Euro Price Chart – EUR/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Technical Outlook: In my last Euro Short-term Technical Outlook we noted that, “Euro recovery is now testing the first major resistance hurdle and a major pivot zone- looking for reaction here into the monthly cross. From a trading standpoint, a good zone to reduce long-exposure / raise protective stops- losses would need to be limited to the weekly open (~1.08) IF price is heading for a breakout with a close above 1.0879 needed to fuel the next move.”

Euro broke higher on Election day with price registering an intraday high at confluent resistance near 1.0934/47 before reversing sharply. The USD Trump Bump marked a massive outside-day reversal candle with EUR/USD now down more than 3.4% from the monthly high. The focus is on possible slope support here as price attempts to break the objective yearly lows / 2023 low-week close at 1.0587-1.0602- watch today’s close.

Euro Price Chart – EUR/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Notes: A closer look at Euro price action shows EUR/USD trading within the confines of a descending pitchfork formation extending off the September high with the lower parallel converging on the 88.6% retracement of the 2023 advance at 1.0535- look for a larger reaction there IF reached.

Initial resistance stands near the June low-day close (LDC) at 1.0680-1.07 backed by the November high-day reversal close / weekly high at 1.0730. Broader bearish invalidation now lowered to the August low / October LDC at 1.0777/82.

A break / close below the lower parallel would threaten another accelerated decline towards subsequent support objectives at the 2023 LDC at 1.0466 and massive pivot zone at 1.0340-1.0406- a region defined by the 2017 low, the 2017 LDC, and the 50% retracement of the broader 2022 advance (an area of interest for possible downside exhaustion / price inflection IF reached).

Bottom line: The Euro sell-off is attempting to break the objective yearly range-lows with downtrend support seen just lower. From a trading standpoint, look to reduce portions of short-exposure / lower protective stops on a stretch towards the lower parallel- rallies should be limited to the 1.07-handle IF price is heading for a break lower with a close below 1.0535 needed to fuel the next leg of the decline.

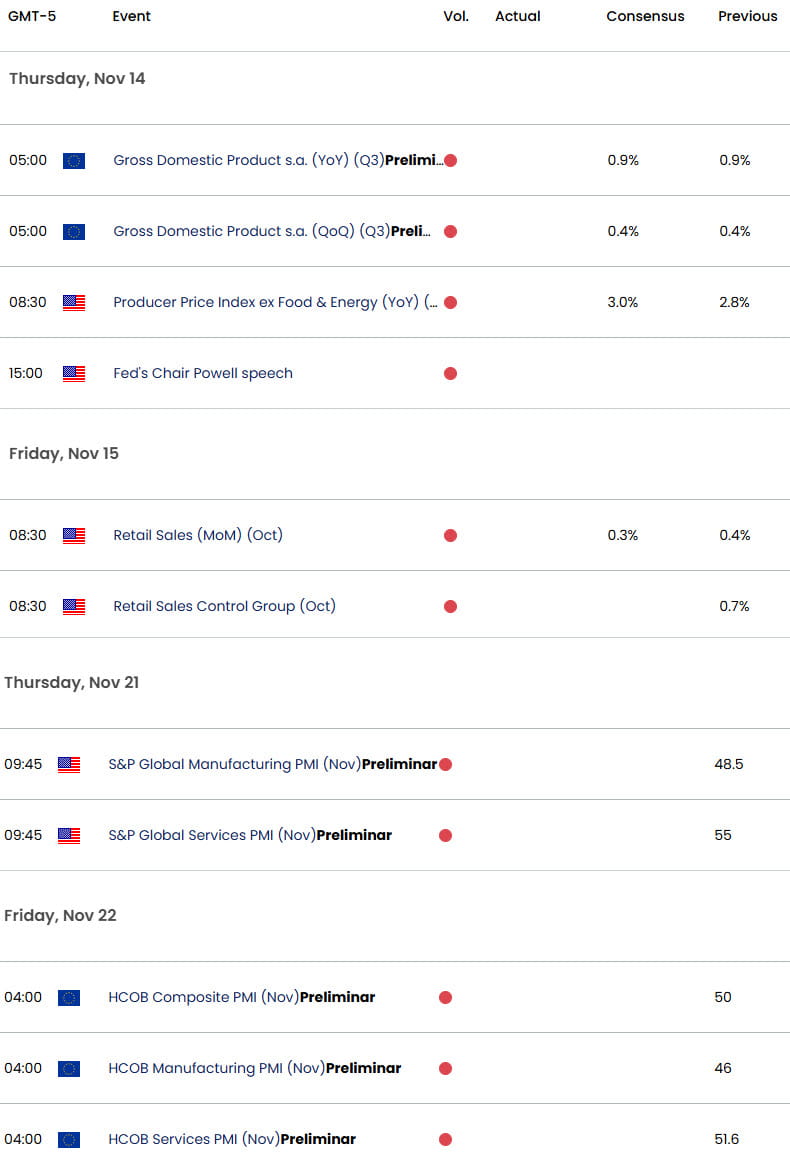

Keep in mind we have more Fed commentary, PPI, and retail sales on tap this week. Watch the Friday close here for guidance. Review my latest Euro Weekly Technical Forecast for a closer look at the longer-term EUR/USD trade levels.

Key EUR/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- US Dollar Short-term Outlook: USD Trump Bump Extends into Resistance

- Australian Dollar Short-term Outlook: AUD/USD Bears Go for the Break

- Canadian Dollar Short-term Outlook: USD/CAD Trump Rally Faces Fed

- Gold Short-term Outlook: XAU/USD Plunges on Trump Victory- Fed on Tap

- Swiss Franc Short-term Outlook: USD/CHF Rally Vulnerable into Fed

- Japanese Yen Short-term Outlook: USD/JPY Stalls into US Election, Fed

- British Pound Short-term Outlook: GBP/USD Bears Charge Support

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex