Traders are not committing to any particular direction across financial markets, and you can’t really blame them. Thanks to an exceptionally close US presidential race, many traders are pursuing option strategies rather than taking outright long or short positions. For example, Bloomberg has reported that some hedge funds are opting for call options on currencies such as the EUR and AUD, in the event Kamala Harris wins and the USD plunges. Yet, the polls are so close that even options trading is not straight forward, or worth the risk for some. This is exemplified by the EUR/USD’s one-week implied volatility surging to its highest levels since March last year. The uncertainty has also led to a loss of risk appetite with stocks struggling in the last couple of weeks, while Bitcoin ETFs suffered a record daily outflow of nearly $580 million on Monday. The EUR/USD outlook is therefore far from certain and given the surge in implied volatility, we could see a big move in this pair as one side will be proven wrong and forced to abandon their bets.

All about US election

The EUR/USD has been supported in the last few days for several macro reasons such as the ECB pushback against a 50-basis point rate cut in December, a rather weak US jobs report, and, more to the point, the recent poll suggesting Harris might be performing better than anticipated in swing state of Iowa.

Until the start of this week, markets were pricing in a win for Trump, and while that could still be the case, Harris has closed the gap to essentially make it a coin flip between the two candidates. Of course, the polls could be misleading, and we may see an easy win for one or the other, but as things stand it looks like it could be a photo finish. This makes it extremely difficult to make a strong case for the direction of the dollar or stocks this week.

Trump’s core policies on taxes, tariffs, and immigration are considered inflationary. This is why we have seen a big rise in treasury yields and the US dollar until the start of this week.

This week, however, Harris has seen improving odds on election prediction sites, even though the Polymarket continues to show Trump as the likely victor. The fact that she has taken a lead in Iowa, which was traditionally a red-leaning state, has helped her case.

For this reason, the market has priced out sightly the threats extra tariffs and we have seen the currencies of all big exporters to the US outperform. The greenback could give back more gains, should Harris wins.

Conversely, a Trump victory could spell trouble for the yuan, euro, Canadian dollar and Mexican peso, among other currencies. The threat of universal tariffs could hit other risk assets too.

EUR/USD levels based on election outcome

Voting has started in the US presidential election. We could see results from the swing states start coming in around 02:00 to 03:00 GMT on Wednesday morning. A Trump win should weigh on the EUR/USD outlook, potentially dropping to at least 1.0700 while a clean sweep for the Republicans could see the pair trade close to 1.0500. A victory for Harris on the other hand could send the pair north of 1.1000.

ISM services PMI merely a distraction

Today’s key US data on the economic calendar is the ISM services PMI for October at 15:00 GMT. This is expected to weaken slightly from the prior reading of 54.9. Equally important would be the employment subcomponent given the fact the Fed’ focus has shifted to employment from inflation. This is the last important data before the Fed’s policy decision on Thursday. But questions remain as to whether we will have known the result of the presidential election by then. If so, the Fed could potentially provide a clearer indication of future rates, else we may not hear too much other than data dependency from the Fed when it comes to the December and subsequent meetings.

Technical EUR/USD outlook

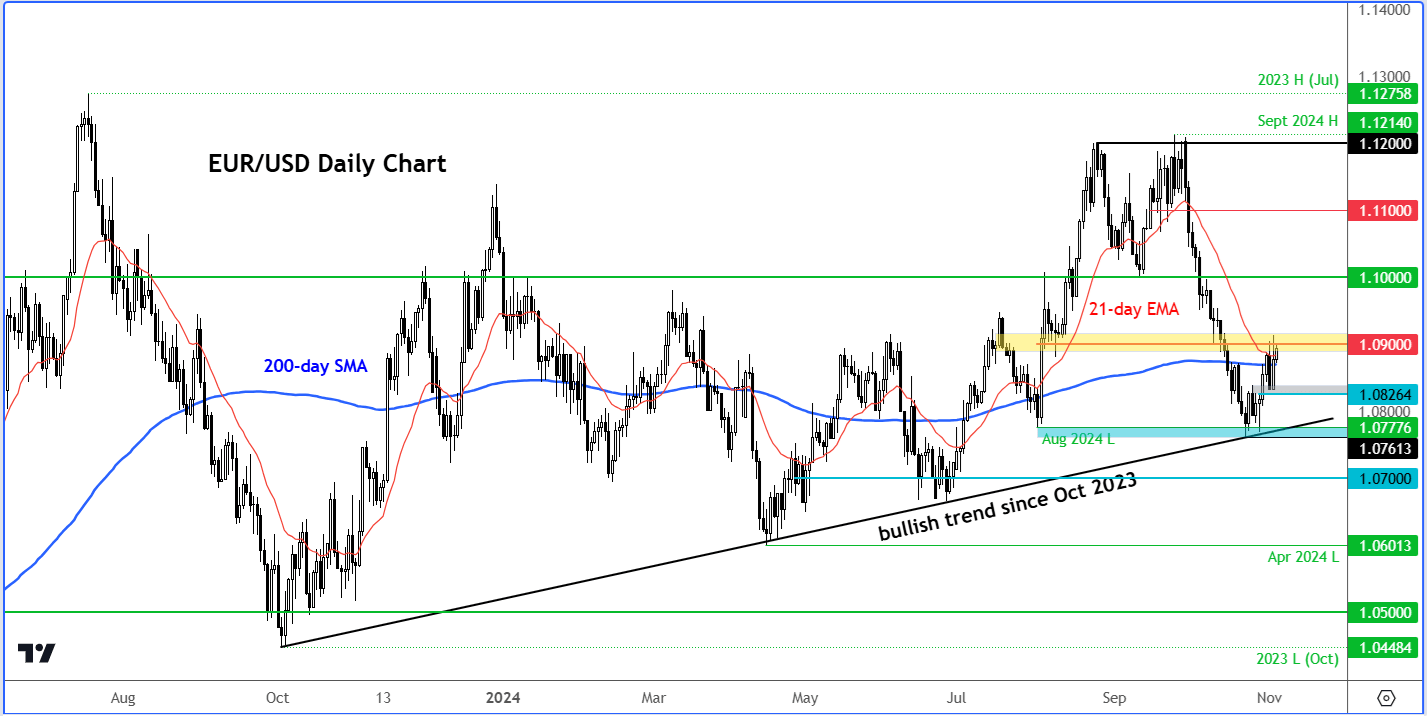

Source: TradingView.com

The EUR/USD has bounced back after holding its own above the bullish trend line that has been in place since last October. At the time of writing it was testing key resistance around 1.0900, where it had previously found support. The next potential resistance above this level is around 1.0950 followed by the 1.100 handle. In terms of support, 1.0825-1.0840 is now the first area of defence for the bulls, followed by the bullish trend line and last week’s support area around 1.0770 to 1.0800. A clean break below this zone could pave the way for follow-up technical selling towards 1.0700 area next.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R