This week is a crucial one for the markets, with significant data releases, central bank meetings, and major company earnings reports set to impact indices, metals, and currencies. As we start the week, the EUR/USD has fallen with the dollar rising across the board. Still, the EUR/USD forecast is not entirely bearish yet even if you take into account the loss of momentum in Eurozone data in recent months. Due to declining US bond yields and increasing expectations of rate cuts by the Federal Reserve, we could see a more meaningful downtrend in the dollar this week. This, in turn, could help alleviate some pressure on the EUR/USD arising from a weakening Eurozone economy.

Tope 3 Influential Events for EUR/USD This Week

Influencing the euro’s direction is likely to be inflation data from Germany and the Eurozone, due in the first half of the week. For US dollar, the focus will be on the FOMC rate announcement and the July jobs report in the latter half of the week.

Eurozone CPI and German Inflation Data

Inflation data from Germany (Tuesday) and the Eurozone (Wednesday), scheduled for the first half of the week, could influence the euro’s direction in the event of a surprise from expectations. Investors will closely watch these figures to gauge the economic health of the Eurozone and anticipate any potential policy changes by the European Central Bank. In particular, it will be the German CPI data that will likely have the biggest influence on the euro’s direction given the size of the German economy. Unless this or the Eurozone CPI collapses (the latter is only expected to moderate to 2.8% y/y from 2.9% previously), then the downside should be limited for the single currency.

That’s because much of the downside risks stemming from declining confidence indicators and weak economic data from eurozone has already been factored in. While economic recovery is faltering, inflation has generally aligned with ECB projections, although persistent inflation in services and ongoing wage pressure have heightened the upward risks to these forecasts. Let’s see if the inflation trends have changed when this week’s CPI forecasts are released.

FOMC Meeting: Anticipating a Dovish Stance

At the conclusion of this week’s FOMC meeting on Wednesday, the possibility of the Fed adopting a more dovish tone is what we expect to witness. Recent comments from Fed officials and weak US economic data, including a rising unemployment rate now at 4.1%, suggests that the current monetary policy might be too restrictive. Given the global trend towards policy loosening, the Fed may seek to avoid unnecessary economic strain, especially considering the central bank’s past track record with inflation and interest rate management.

Market expectations indicate a September rate cut, with around 68 basis points worth of cuts priced in by year-end. If the Fed confirms a dovish stance, predictions could escalate to potentially three cuts before the end of the year, which could undermine the dollar and support the EUR/USD pair.

US Jobs Report: Impact on the Dollar

The upcoming US jobs report on Friday is another key event. Economists predict approximately 177,000 net non-farm job gains for July. However, the rising unemployment rate and the slowing pace of job gains could reinforce expectations of a September rate cut. This scenario may further weaken the dollar, providing upward momentum for the EUR/USD.

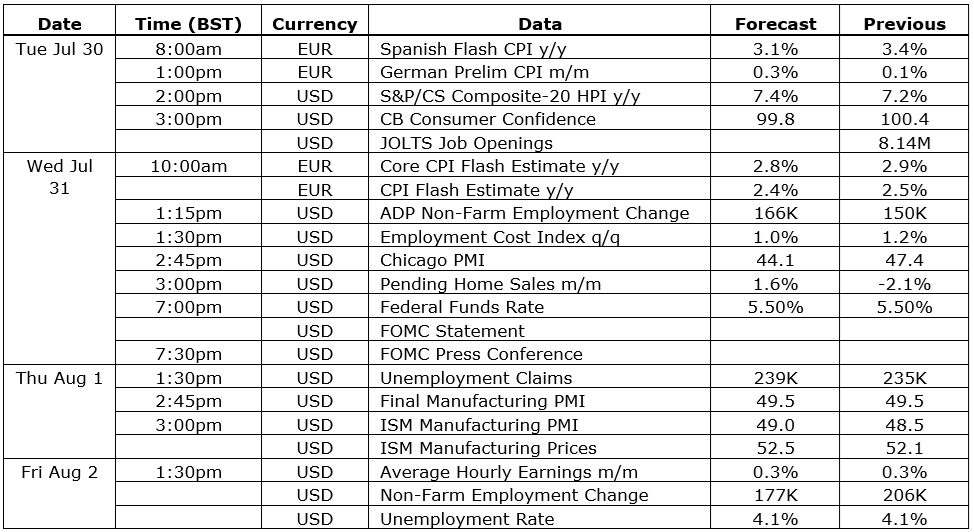

EUR/USD Economic Calendar for this week

Here’s a full list of upcoming data releases on the economic calendar relevant only for the EUR/USD pair:

EUR/USD forecast: Technical Analysis and Trade Ideas

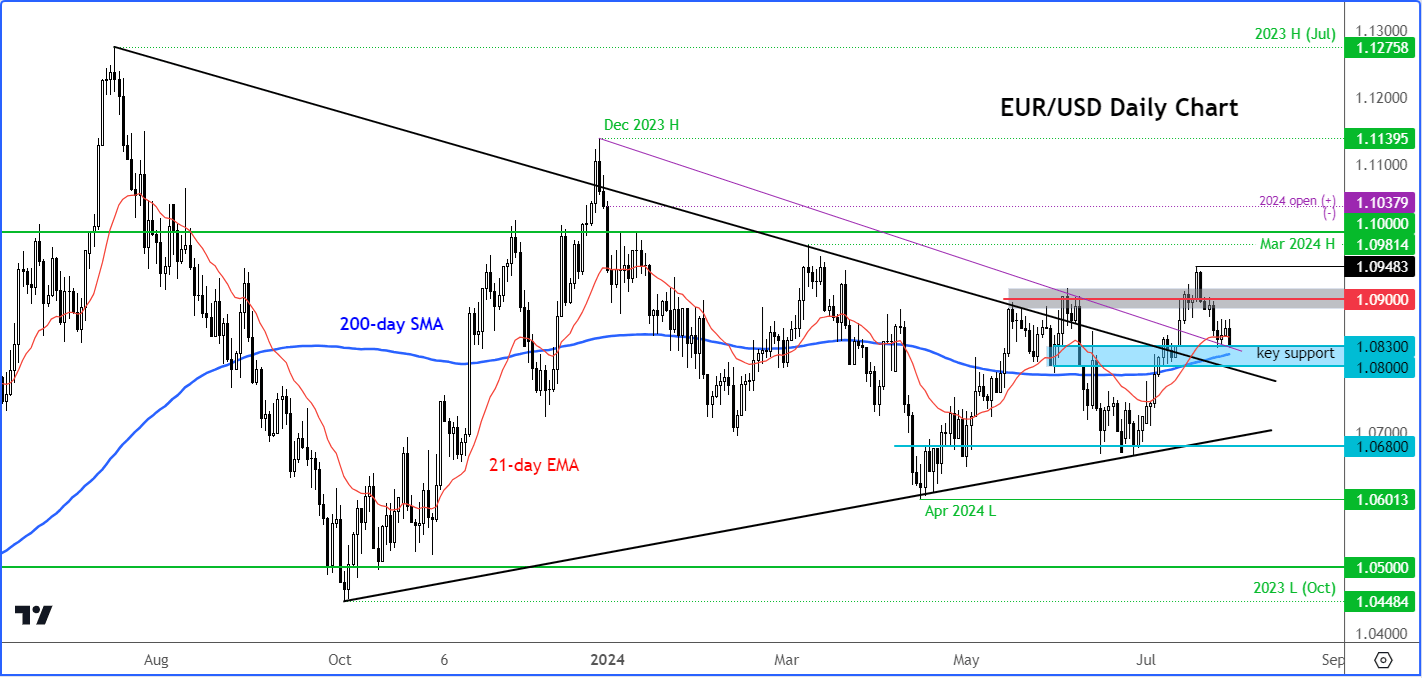

Source: TradingView.com

From a technical perspective, the technical EUR/USD forecast and trend is slightly bullish, influenced by the recent decline in US yields and rising expectations of rate cuts by the Fed thanks to softer economic data from the US. A potentially dovish Fed, combined with softening US job data, could push the EUR/USD higher, breaking through resistance levels and establishing new highs.

However, we have seen a loss of that momentum in the last couple of weeks, so bullish traders must await a fresh bull signal before potentially looking for new trade ideas.

One key support area where we could see the return of bullish price action is seen between 1.0800 to 1.0830 range. This is where the EUR/USD was trading around at the time of writing. Here, the top sides of two broken trend lines that stretch back to December and July 2023, respectively, come into play. In addition, we have the 200-day moving average residing bang in the middle of this range.

Therefore, if the EUR/USD fails to find its feet in the above-mentioned 1.0800-1.0830 zone, then that could potentially pave the way for a deeper correction towards the low 1.07s.

Else, if we see the return of bullish price action, as we expected, then the EUR/USD may climb towards 1.0900 resistance level initially ahead of 1.0950 next.

In summary…

Our EUR/USD forecast this week is modestly bullish as we await a fresh bull signal. This could be driven by anticipated US economic data weakness and the Fed’s meeting. The Eurozone and German inflation data will play a critical role in determining the euro's strength, while the FOMC meeting, and US jobs report will significantly influence the dollar. Traders should stay alert to these events to capitalise on potential market movements in the EUR/USD pair.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R