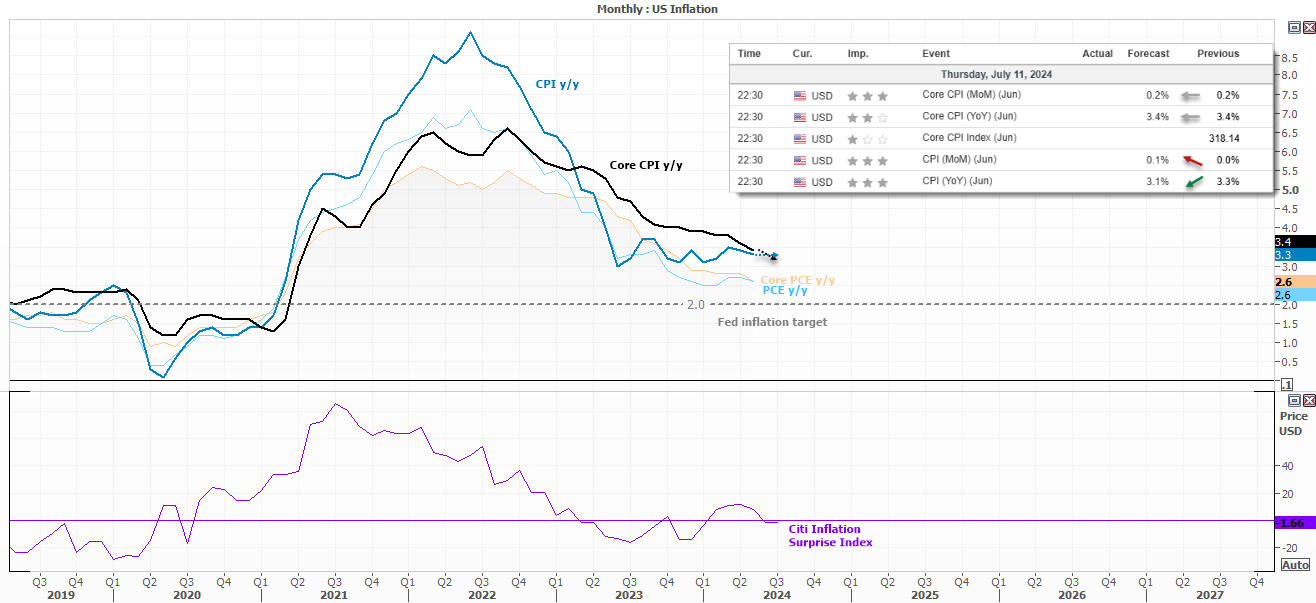

With US economic data souring and the Citi Inflation Surprise Index (CISI) remaining stagnant, I’m inclined to suspect a downside surprise for core inflation, if there is to be one at all. Yet the consensus is for core CPI to remain flat at 3.4% y/y and 0.2% m/m. Headline inflation is expected to cool to 3.1% y/y from 3.3% but rise by 0.1% compared with 0% previously.

Ultimately, the closer core CPI can get to 3%, the stronger the case becomes for those backing multiple Fed cuts next year. Fed Fund futures currently imply a 70% chance of a September cut and a 45.8% chance of a second cut in December. The cumulative probability of four 25 basis point (BP) cuts by April sits at 88.7%.

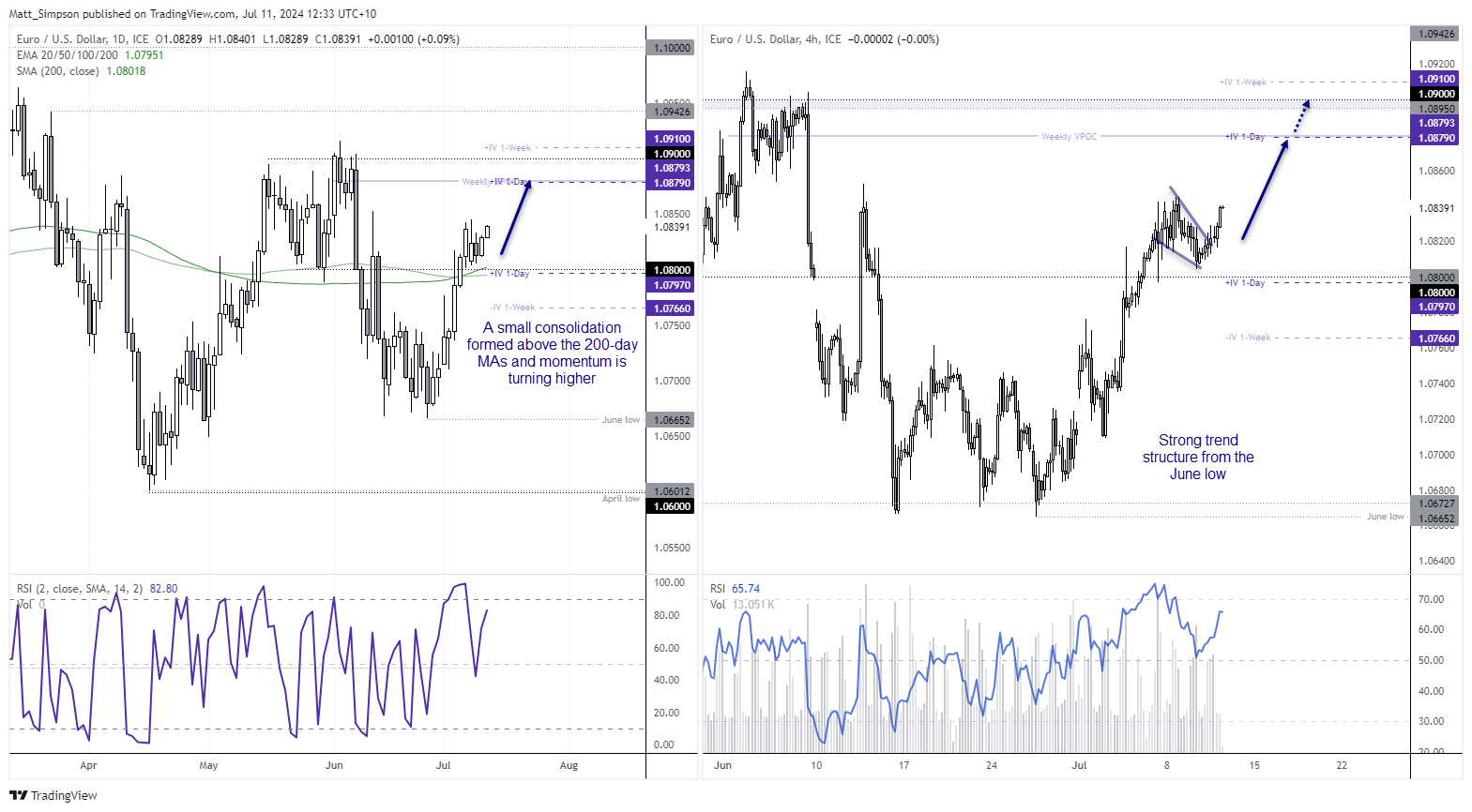

It seems there is already excitement in the air for a soft CPI report, with EUR/USD rising in today’s Asian session. Traders are likely taking a punt on a softer set of figures following slightly dovish comments from Jerome Powell on Wednesday.

Economic events (times in GMT+1)

- 07:00 – UK GDP, construction/manufacturing output, index of services, industrial production, trade balance

- 07:00 – Germany CPI

- 09:00 – China outstanding loan growth, new loans, M2 money supply, total social financing

- 13:30 – US CPI, jobless claims, real earnings

- 16:30 – FOMC member Bostic speaks

EUR/USD technical analysis:

The euro has seen a decent rally from the June low; prices are moving higher from a sideways consolidation above the 200-day averages. This means that the 108 handle is likely an important support level on the daily chart, and dips towards it could look tempting for bullish swing traders.

The one-hour chart shows a strong trend structure, one that shows potential to break to new highs above 1.09. Assuming that the current trends continue to deteriorate and the ECB sits on their hands at next week’s meeting, the path of least resistance could indeed be higher for EUR/USD.

1.0880 Is an area of interest because it's where a weekly VPOC (volume point of control) sits near the upper one-day implied volatility band.

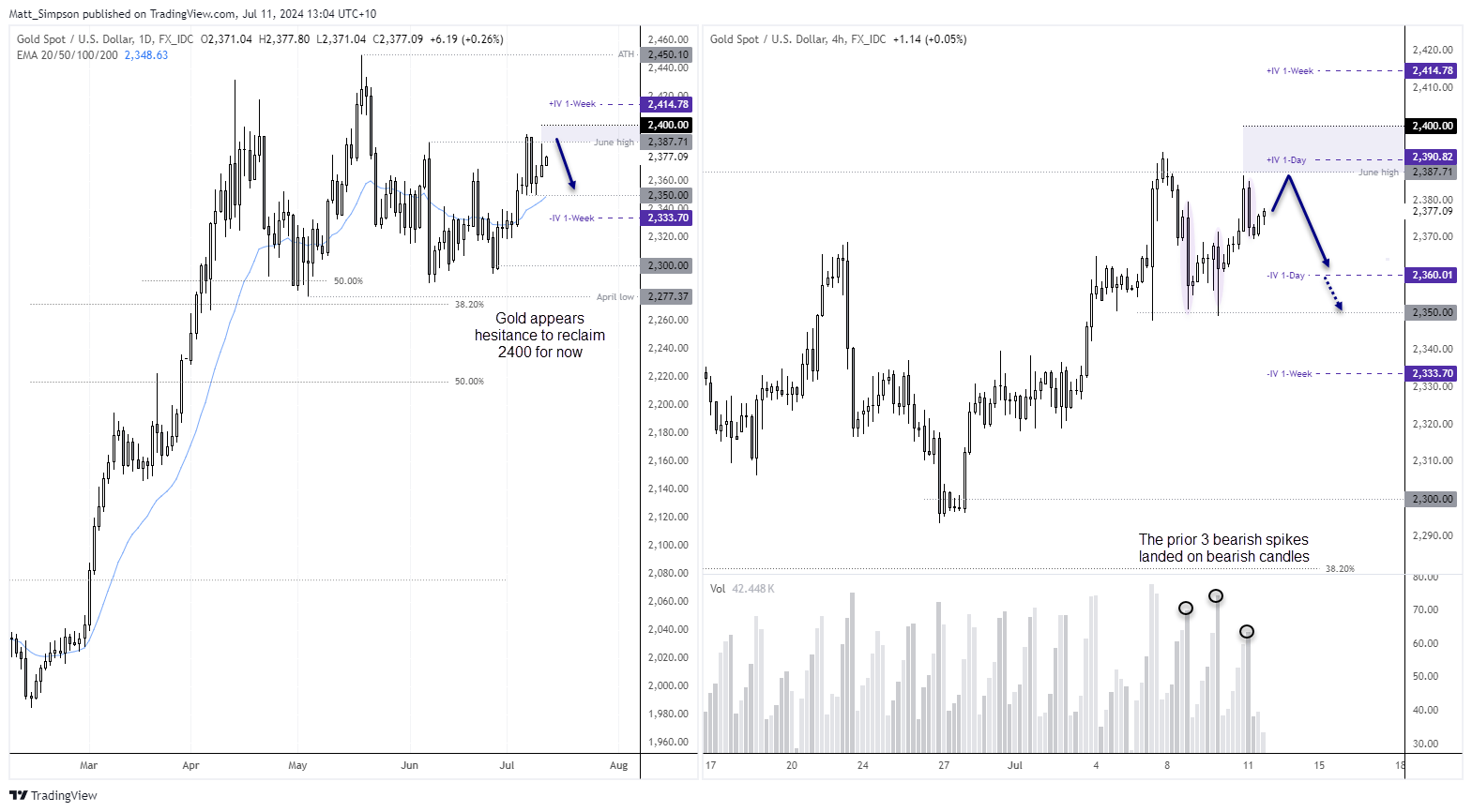

Gold technical analysis:

If US CPI surprises to the upside, gold is my preferred choice for a potential short over EUR/USD for the near-term. Gold formed a prominent bearish candle on Monday which failed to breach Friday’s high. Whilst gold has risen for two consecutive days, it has failed to recapture Monday’s losses, and over half of Wednesday’s range was the upper wick, which shows hesitancy around the June high. Furthermore, the 4-hour chart shows that the three previous high-volume spikes landed on bearish candles, which suggests some form of distribution below the June high.

Like EUR/USD, we’re seeing momentum turn higher, but gold lacks the bullish enthusiasm of the euro. Therefore, I am on guard for a false move higher before prices roll over once more, which brings 2360 and 2350 into focus as bearish targets.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge