- US dollar pairs decouple from US rate correlations

- USD/CAD, USD/CHF, EUR/USD show weak reactions to inflation data

- Bessent Senate confirmation, US retail sales headline Thursday calendar

Summary

USD/CAD, USD/CHF, and EUR/USD are breaking away from their once-strong correlation with US interest rates and yield spreads, with the relationship significantly weakening in recent weeks.

This shift is evident in their subdued reaction to December's soft US inflation report, despite sharp moves in Treasury yields, suggesting that rates are no longer the dominant driver they once were.

Technicals may have also played a role with failed breakouts witnessed across all three pairs. USD/CAD and USD/CHF both attempted bearish breaks of uptrend support that fizzled, while EUR/USD reversed after breaking wedge resistance.

Does this mean dollar’s dominance is set to continue, or just a temporary setback for those positioning for a reversal?

US rates losing stranglehold over FX universe

The stranglehold US interest rates and yield spreads had over G10 currencies has been dissipating or outright breaking down recently, including in pairs like USD/CHF and EUR/USD which are often heavily influenced by the rates universe.

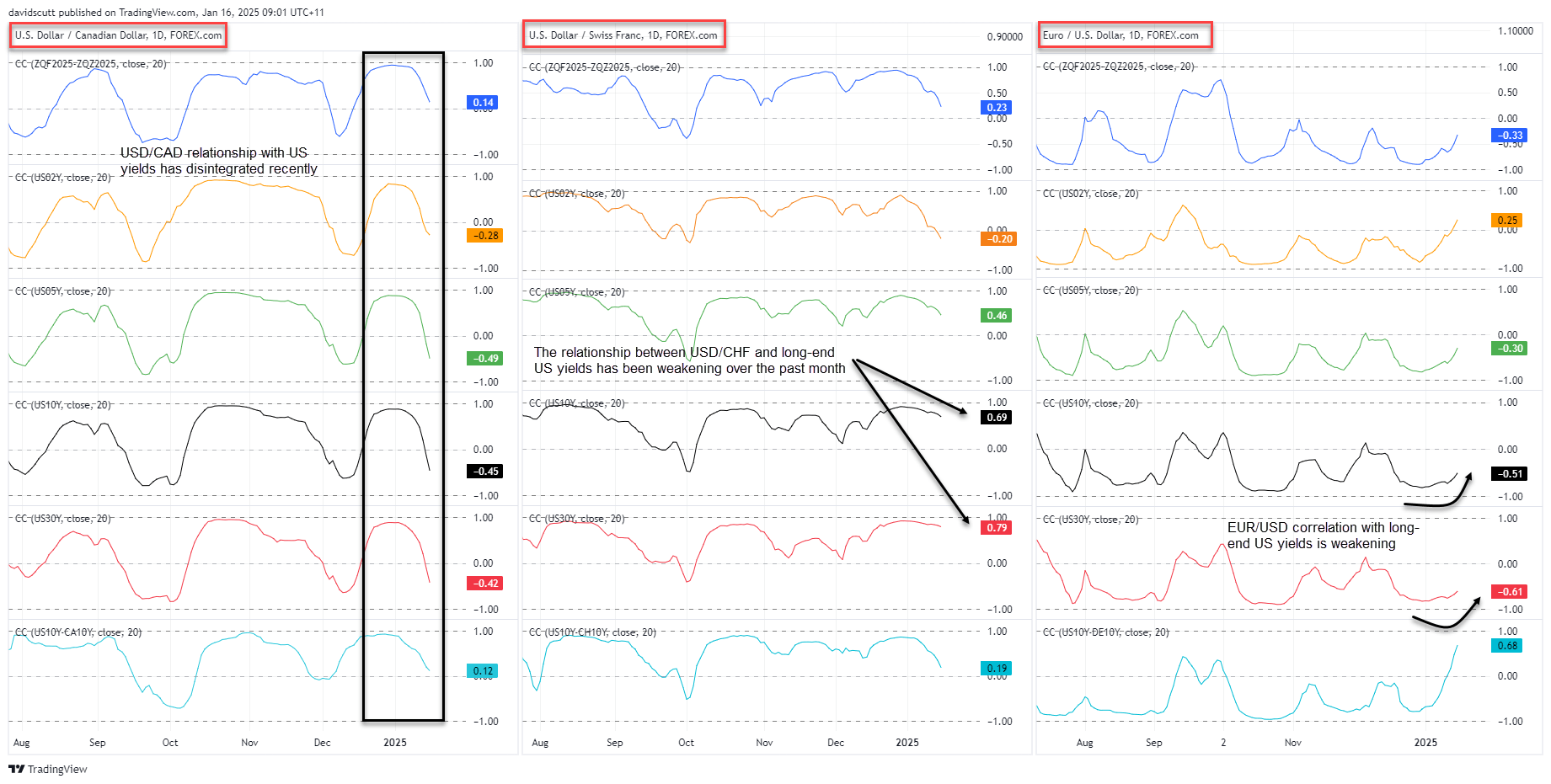

The chart below illustrates this shift, showing rolling 20-day correlation coefficient scores for USD/CAD, USD/CHF, and EUR/USD against 2025 Fed rate cut expectations (blue), US two, five, 10, and 30-year yields (yellow, green, black, and red respectively), along with 10-year yield spreads (light blue).

Source: TradingView

The previously strong relationship between rates and USD/CAD has disintegrated. While some correlation persists between USD/CHF and EUR/USD with longer-dated US yields, it has noticeably weakened over the past month.

This breakdown may explain the muted price action in these pairs following the US inflation report, despite significant moves in US Treasury yields. Rates are no longer the dominant force they once were, possibly reflecting uncertainty around what executive orders incoming President Donald Trump might issue upon his return to the Oval Office.

Technicals may have also played a role in the subdued price action, with failed breakouts observed across each of these pairs during Wednesday’s session.

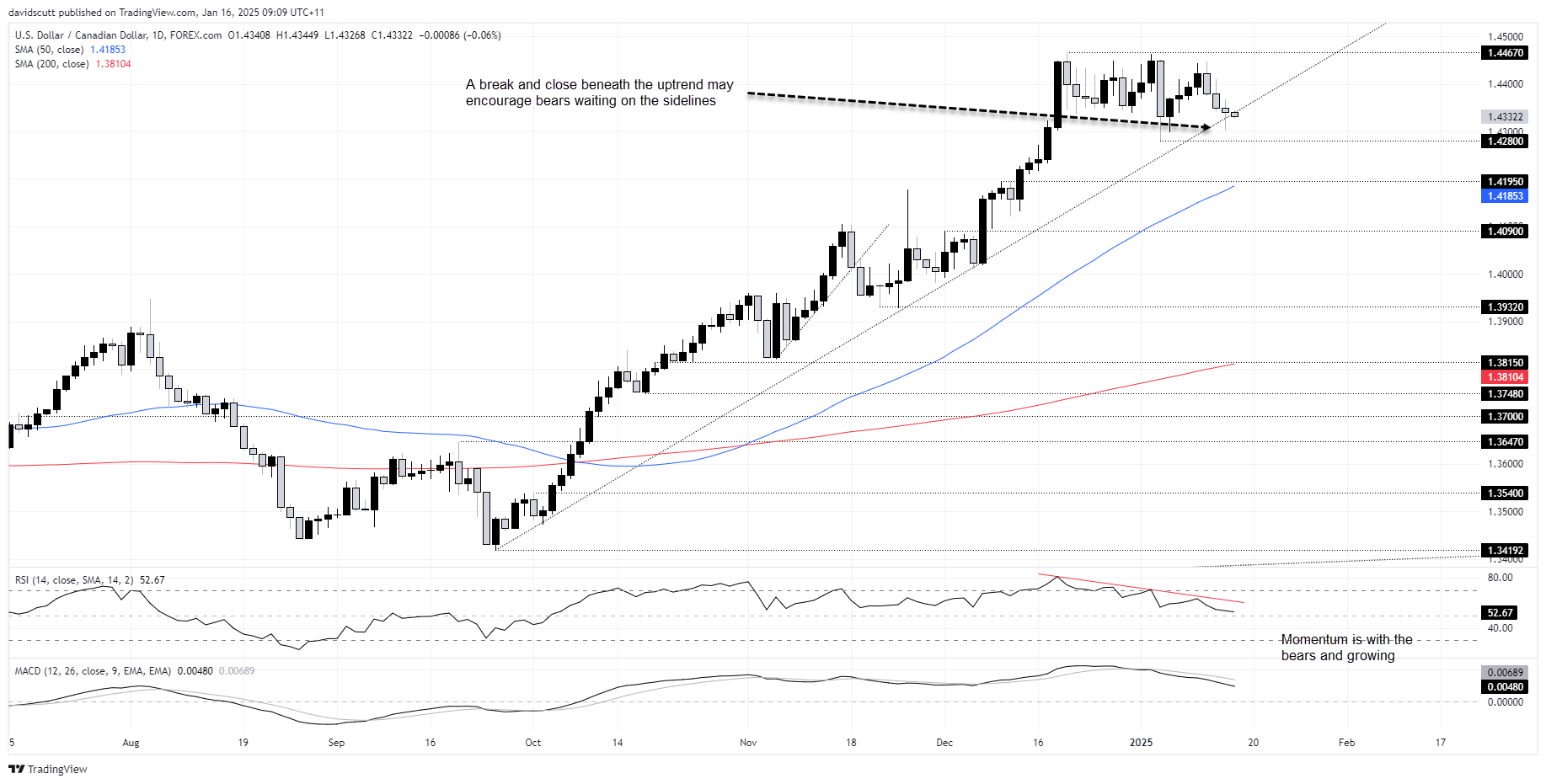

USD/CAD bears still eying downside break

Source: TradingView

USD/CAD traded through uptrend support dating back to late September after the inflation report but failed to hold beneath, with the price retracing higher into the close. However, bears appear to be taking another look in early Asian trade, suggesting another breakout attempt may be on the horizon.

RSI (14) and MACD are trending lower, reinforcing a bearish bias near-term. Beneath the uptrend, 1.4280, 1.4195, the 50-day moving average, and 1.4090 are levels of interest.

Should the price bounce convincingly from the uptrend and take out 1.4467, the bearish bias would be invalidated.

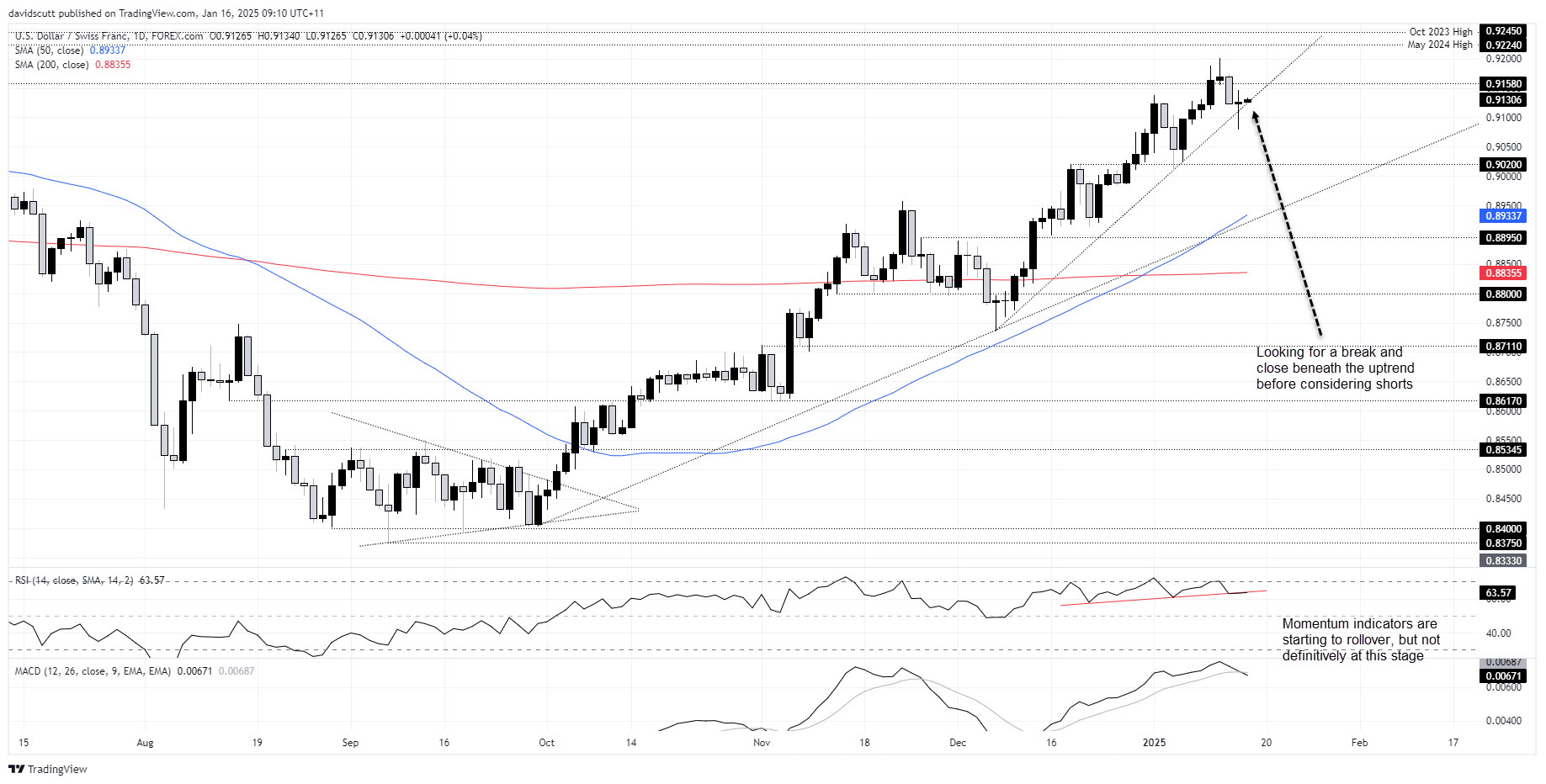

<USD/CHF bears thwarted, for now

Source: TradingView

USD/CHF followed a similar trajectory to USD/CAD, with an attempted bearish break of uptrend support ultimately failing after the inflation report. Momentum indicators, including RSI (14) and MACD, are rolling over, while two price reversal signals earlier in the week support a slightly bearish short-term bias.

A break and close beneath the uptrend would solidify expectations of a sustained reversal. Levels to monitor include .9020, the September 2024 uptrend, the 50-day moving average, and .8895.

If trend support holds and recent highs are taken out, the bearish bias would no longer hold.

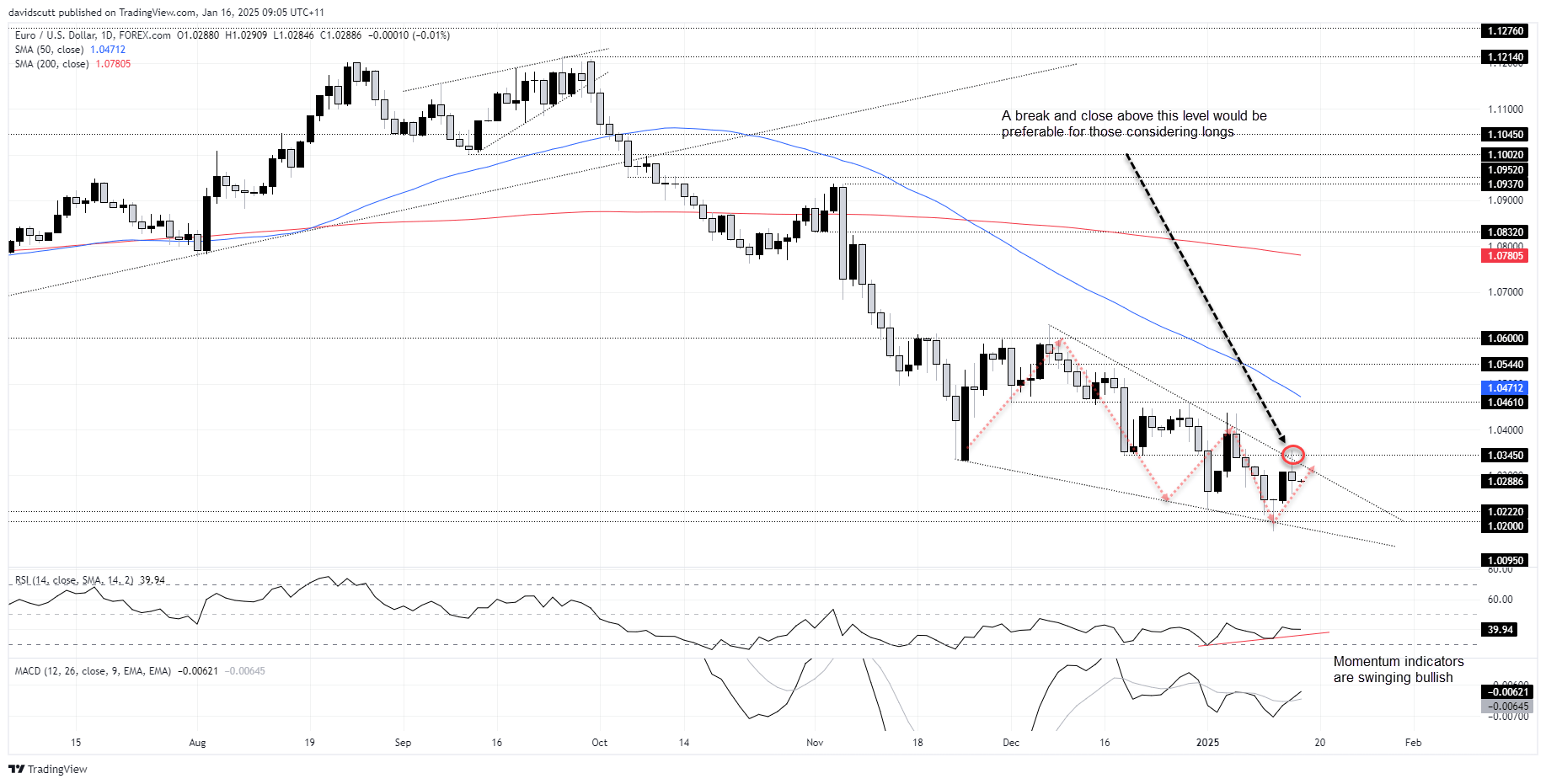

EUR/USD remains trapped in falling wedge

Source: TradingView

EUR/USD also failed to sustain a breakout, encountering sellers above 1.0345 post-inflation report before reversing lower. Despite this, a bullish bias remains intact for now, with momentum indicators hinting that bearish momentum could be fading.

A break and close above the uptrend and 1.0345 would favour a move higher, potentially targeting 1.0461, the 50-day moving average, 1.0544, and 1.0600. However, if the price breaches recent lows, it would signal that bearish bias is warranted.

-- Written by David Scutt

Follow David on Twitter @scutty