Weekly Technical Trade Levels on USD Majors, Commodities & Stocks

- Technical setups we are tracking into the weekly open / monthly close- US PCE, NFPs on tap

- Next Weekly Strategy Webinar: Monday, November 4 at 8:30am EST

- Review the latest Video Updates or Stream Live on my YouTube playlist.

In this webinar we take an in-depth look at the technical trade levels for the US Dollar (DXY), Euro (EUR/USD), British Pound (GBP/USD), Australian Dollar (AUD/USD), Canadian Dollar (USD/CAD), Japanese Yen (USD/JPY), Gold (XAU/USD), Crude Oil (WTI), Silver (XAG/USD), S&P 500 (SPX500), Nasdaq (NDX) and the Dow Jones (DJI). These are the levels that matter on the technical charts heading into the weekly open.

Japanese Yen Price Chart – USD/JPY Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/JPY on TradingView

USD/JPY opens the week just below confluent resistance at the May low-day close (LDC) and the 61.8% retracement of the yearly range at 153.02/40. Note that the 75% parallel gas caught the intraday highs for the past two-attempts and a breach / close above this slope would be needed to validate a breakout of the July downtrend / mark uptrend resumption. Looking for a reaction here into the monthly cross with the long-bias vulnerable while below.

Initial support rests with the 2022 high at 151.95 and is backed closely by the 200-day moving average, currently near ~151.40s. A break / close below the median-line would be needed to suggest a more significant high was registered today with such a scenario exposing 148.73-149.60- look for a larger reaction there IF reached.

Note that yields on the US 10-year and 2-year are also testing resistance into the weekly open- look possible price inflection here watch the weekly close for guidance. A topside breach / close above today’s high exposes the June LDC at 157.89 backed by the 78.6% retracement at 157.16.

Oil Price Chart – WTI Weekly

Chart Prepared by Michael Boutros, Technical Strategist; WTI on TradingView

Oil prices plunged more than 6.5% since the weekly open with WTI turning from resistance for a second week at the objective yearly open at 71.33. The decline puts critical support back in focus at 65.62-66.31- a major pivot region defined by the 2020 high and the 20023 close-low. Look for a larger reaction there IF reached with a close below needed to keep the focus on possible test of the 2020 high-week close (HWC) / 100% extension at 59.16-60.31. Ultimately, a close back above the yearly open would be needed to suggest a more significant low in place.

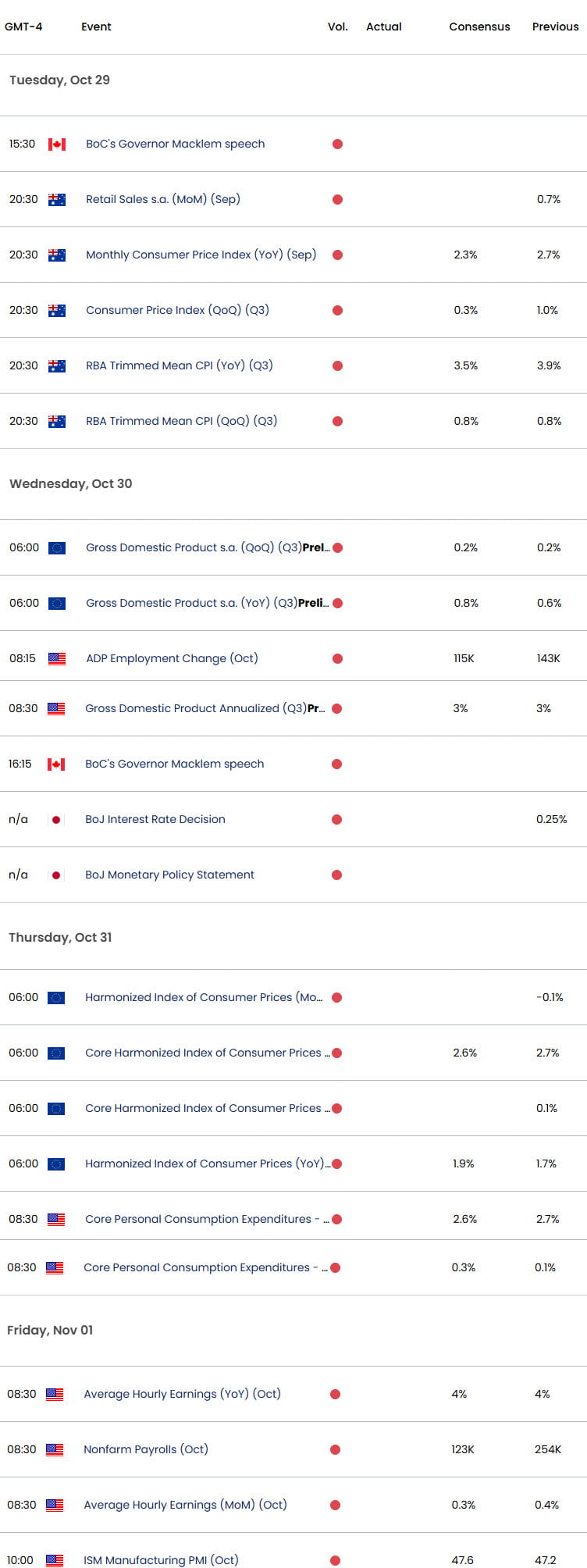

Economic Calendar – Key USD Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

--- Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex