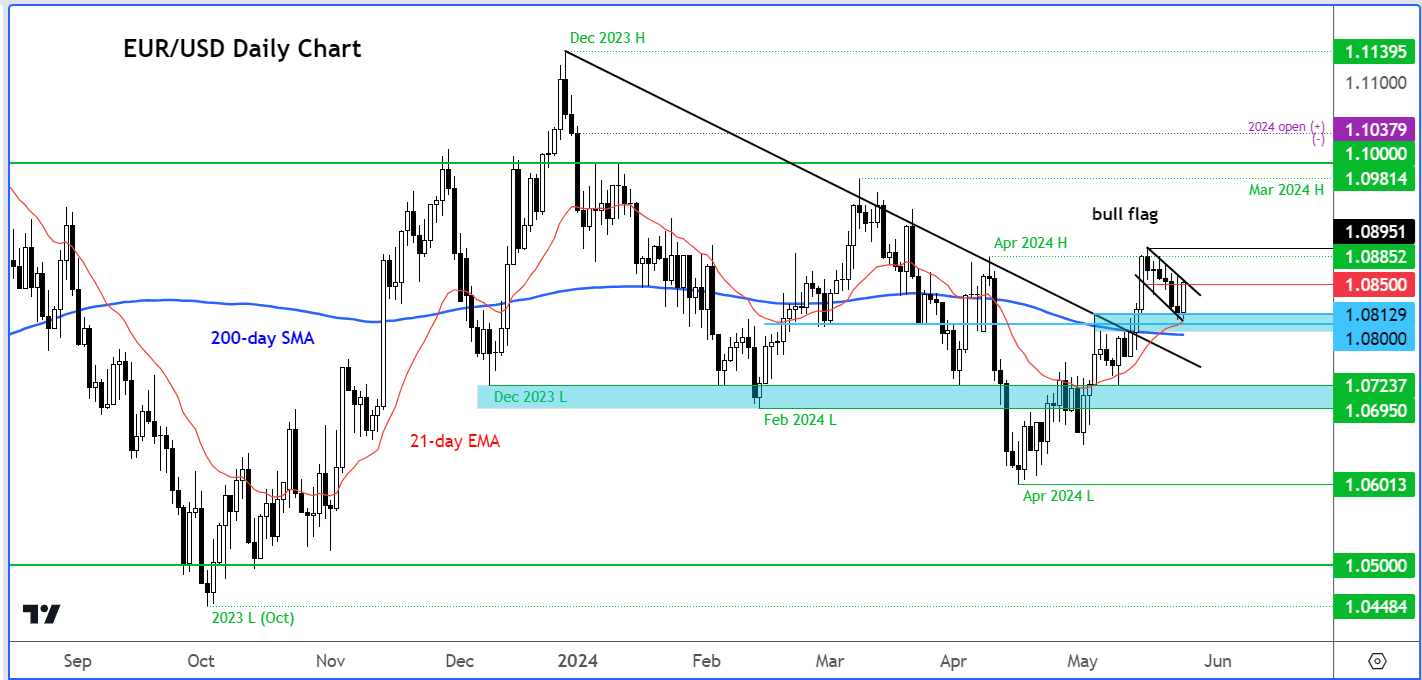

The EUR/USD managed to bounce back on Friday, following its losses in the day before. The single currency has been declining inside what could be either a short-term bear channel or a potential bull flag. It looks like we could find out which one it is in the week ahead, as we have some key inflation data coming from the both the US and Eurozone to look forward to. The data could shed light on the timing of the first rate cut by the ECB and Fed, both of which have been pushed back again on the back of a much stronger-than-expected Eurozone wage growth and a solid US business activity report, which also showed a sharp rise on in services inflation. On Friday, though, the University of Michigan’s revised inflation expectations survey showed a drop in 1-year inflation to 3.3% from 3.5% reported initially. This helped to weigh on the dollar ahead of the long weekend, with Monday markets in the UK and US closed for public holidays. The upcoming inflation data from both economic regions could significantly impact the EUR/USD analysis in the week ahead.

EUR/USD analysis: Eurozone and US inflation among week’s key data highlights

Inflation is in focus in the week ahead. The German CPI report will come out on Wednesday, a couple of days ahead of the Eurozone numbers on Friday, when we will also have that Core PCE Price index from the US.

Economic data in the Eurozone has improved lately, which has helped to provide support for the single currency. Last week we had better-than-expected PMI data and an unexpected rise in Eurozone wage growth in the first quarter. Wage growth was primarily driven by a significant increase in Germany, which could help accelerate the recovery. Negotiated Wages in Q1 rose to 4.7% year-over-year vs. a drop to 4.0% from 4.5% in Q4 expected. This is providing a major dilemma for the ECB ahead of its June rate decision. If German CPI also overshoots expectations in the week ahead, then the rate cut could be delayed by at least another meeting.

As mentioned, the Fed’s favourite inflation measure will come out on Friday, putting all the major FX pairs into focus, including the EUR/USD. The core PCE figures will be published a week before the May jobs report. Until then, the dollar may remain in a holding pattern following its gains through much of last week and the drop the week before. Stagflation concerns are rising in the US, with price pressures remaining higher and incoming data mostly surprising negatively of late, which does not bode well for the economy. The PCE data could impact the timing of the first rate cut, currently expected well after the summer.

EUR/USD analysis: technical levels and factors to watch

Source: TradingView.com

The EUR/USD rebounded on Friday after experiencing losses the previous day. The euro has been falling within a pattern that could either be a short-term bearish channel or a potential bullish flag. The upcoming week may clarify this, as key inflation data from both the US and Eurozone are anticipated, as mentioned. The underlying trend is arguably bullish following the break of the bearish trend line that had been in place since December. However, the subsequent loss of bullish momentum has reduced the appeal of the EUR/USD from a short-term bullish perspective. Still, the bulls will be content for as long as key support around 1.0800 area holds. Short-term resistance comes in at 1.0850, which was being tested at the time of writing late in the day on Friday.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R