On the agenda today

12:30 EUR - ECB Publishes Account of Monetary Policy Meeting

13:30 USD - Core CPI (MoM) (Sep)

13:30 USD - Core CPI (YoY) (Sep)

13:30 USD - Core CPI Index (Sep)

13:30 USD - CPI (YoY) (Sep)

13:30 USD - CPI (MoM) (Sep)

13:30 USD - CPI Index, n.s.a. (Sep)

13:30 USD - CPI Index, s.a (Sep)

13:30 USD - CPI, n.s.a (MoM) (Sep)

13:30 USD - Initial Jobless Claims

18:00 USD - 30-Year Bond Auction

18:00 EUR - German Buba President Nagel Speaks

China recap

Officials from China expressed complete confidence in reaching this year's 5% GDP growth objective. However, investors who had anticipated further support were disappointed that no more robust fiscal measures to go along with the wave of monetary easing from two weeks ago had been disclosed.

The China A50 index experienced a 17% fall as a result. However, the index looks to have stabilized today as we are currently up 1.5%.

Corporate news

$1 billion is invested in Pfizer by an activist investor. In an attempt to turn the company back, Starboard Value has accumulated a share in the pharmaceutical behemoth, which has suffered since hitting new heights during the pandemic. It has apparently made contact with former finance head Frank D'Amelio and former Pfizer CEO Ian Read in an attempt to turn around Big Pharma. Starboard believes that the company's previous emphasis on cutting expenses and investing in innovative medications has been replaced by the current CEO. The price of Pfizer's stock is around half of what it was at its peak in 2021.

Judge decides Google must allow Android users to download apps from stores other than its own. Following the triumph of Fortnite maker Epic Games in its antitrust action against Google, a federal judge in California issued an injunction yesterday requiring the search giant to facilitate the creation of independent app stores for Android devices by third-party developers. Google will not be able to pay other businesses to not compete with its store or to release apps on its store first; instead, it will have to enable competitors to install their own Google Play store apps on the devices. The judicial loss coincides with the DOJ's investigation into Google's antitrust practices and a second lawsuit by Epic.

The day's main event! US CPI

On Thursday, the September CPI inflation report will probably be most significant. Inflation was estimated by economists to be 2.3% last month, down from 2.5% in August. The 3.2% core CPI projection remains unchanged. The markets may be able to determine whether and how much more rate cuts are anticipated in November depending on whether we end up above or below those projections.

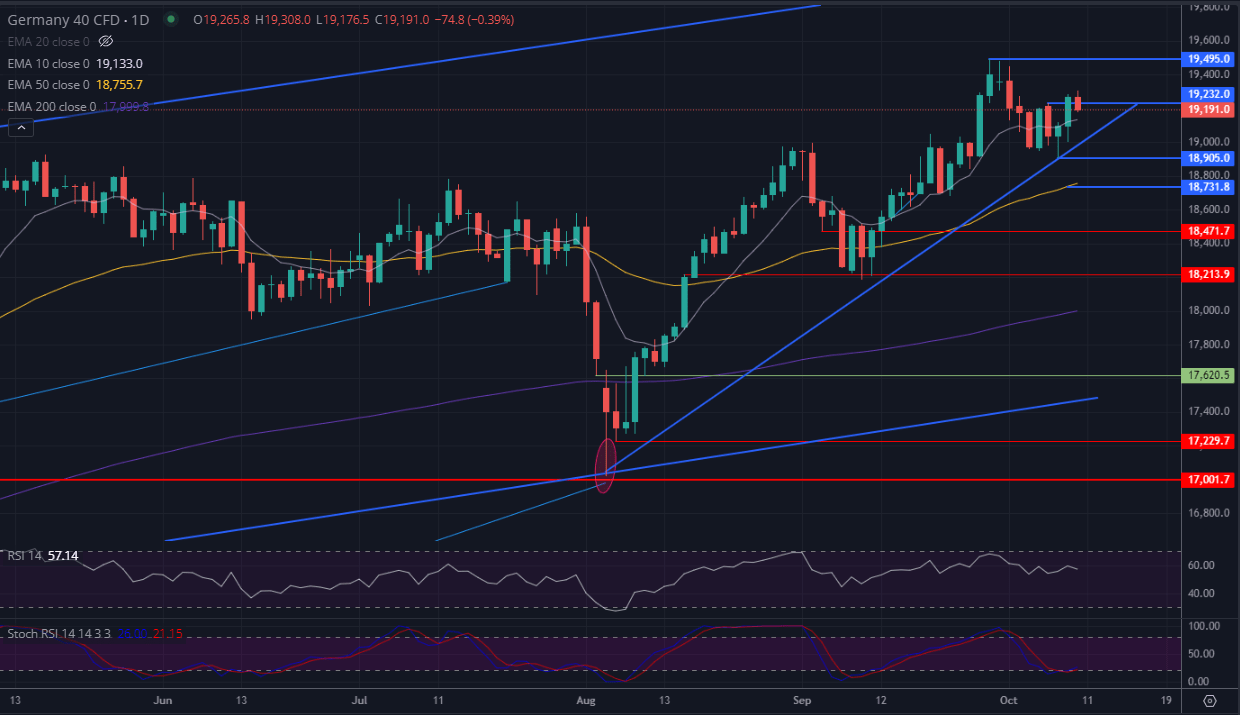

DAX technical analysis

After better-than-expected exports from Germany yesterday the DAX index advanced to the first resistance line around the 19,232 level and broke through to 19,300 where the momentum was lost. Today’s German retail sales also mostly surprised to the upside; however, the DAX is currently cooling off from yesterday’s rise, potentially due to some events outlined below the chart.

We also have the 12:30 PM - ‘’ECB Account of Monetary Policy Meeting’’ for last months rate cut, which could give us some signs on what policyholders though of at the last interest rate cut decision which can help us see how the opinion of the policymakers has changed since then.

Tomorrow, we have the long-awaited German CPI report coming out so the market might position itself today in anticipation of the expected readings to be printed. This comes as the ECB had cut the rates just recently and so the CPI has become more important overall, as it could shed light on the gravity of the next interest rate decision of the ECB which happens next week.