Global Markets Struggle Amid Diverging Trends in Stocks, Commodities, and Productivity

Asian stock indices closed in the red last week, pressured by disappointing economic data and diverging trends in global markets. While the tech-heavy Nasdaq 100 continued its ascent, driven by optimism in AI and technology sectors, the Dow Jones Industrial Average suffered seven consecutive days of losses, weighing heavily on Asian sentiment.

Bitcoin hit a record high above $106,000, marking a significant milestone for the cryptocurrency. However, this surge failed to provide broader market support.

Chinese stocks remained under pressure despite slightly better-than-expected industrial output growth.

Key economic metrics, such as retail sales, fell short of forecasts, and new home prices recorded their 17th consecutive monthly decline after last month's sharpest drop in over nine years.

This week we have pivotal rate decisions from the Federal Reserve (Fed), Bank of Japan (BoJ), and Bank of England (BoE).

Europe's Productivity Gap with the U.S. Widens

Economic challenges in Europe were also in focus. From the start of the 21st century through Q3 of this year, labor productivity in the European Union grew by just 27%, compared to a robust 61% in the United States. The discrepancy is even more pronounced in the IT sector, where U.S. productivity surged 40% over the past two decades, while the EU stagnated.

The International Monetary Fund (IMF) attributes this disparity to Europe’s fragmented internal market, where cross-border trade between EU member states is only about half as robust as interstate commerce in the U.S. Additionally, European companies rely less on equity markets for financing, a disadvantage for tech-focused investments that often require substantial capital without tangible collateral. Closing this gap will require Europe to foster deeper market integration and prioritize equity-based financing to support innovation and technology.

Coffee Futures Soar Amid Supply Concerns

Coffee futures hit an all-time high last week as supply concerns continued to drive the rally in an increasingly backwardated market. Brazil, the world’s largest coffee producer, has been grappling with drought conditions caused by El Niño, which disrupted crop yields. While weather conditions have recently turned favorable, recovery in production remains slow. Vietnam, another major producer, has also faced challenges that raise questions about global output stability.

Agricultural commodities, like coffee, often see price rallies driven by reduced supply, a dynamic that contrasts with energy commodities such as natural gas and oil, where demand plays a more prominent role in price movement. The global coffee market is expected to face a production shortfall of 8.5 million bags in the 2025-26 season, marking an unprecedented fifth consecutive year of deficits. This structural supply imbalance is likely to sustain high prices in the foreseeable future.

Key Global Events and Market Divergences

As markets prepare for this week’s rate decisions from the Fed, BoJ, and BoE, the diverging trends between stocks, commodities, and economic fundamentals highlight the complexities investors currently face. The Nasdaq 100’s strength underscores optimism in U.S. technology sectors, while the Dow's decline reflects broader concerns about traditional industries. Similarly, coffee’s rally points to supply-driven price movements, while energy markets remain tethered to demand-side dynamics.

On the agenda today:

Monday, December 16:

Empire State Manufacturing Survey for December is reported at 5:30 AM PST with a significant drop expected to 10 from a previous high of 31.2.

S&P Flash U.S. Manufacturing PMI for December is reported at 6:45 AM PST, expected to be slightly down at 49.6 from 49.7.

S&P Flash U.S. Services PMI for December is also reported at 6:45 AM PST, with a forecast of 55.3, down from 56.1.

DAX overview

DAX leaders

Siemens Energy AG +3.05%

Rheinmetall AG +1.72%

Deutsche Bank +1.32%

Commerzbank +1.11%

DAX laggards

Vonovia -2.96%

Sartorius AG -2.46%

RWE AG -1.74%

Porsche -1.68%

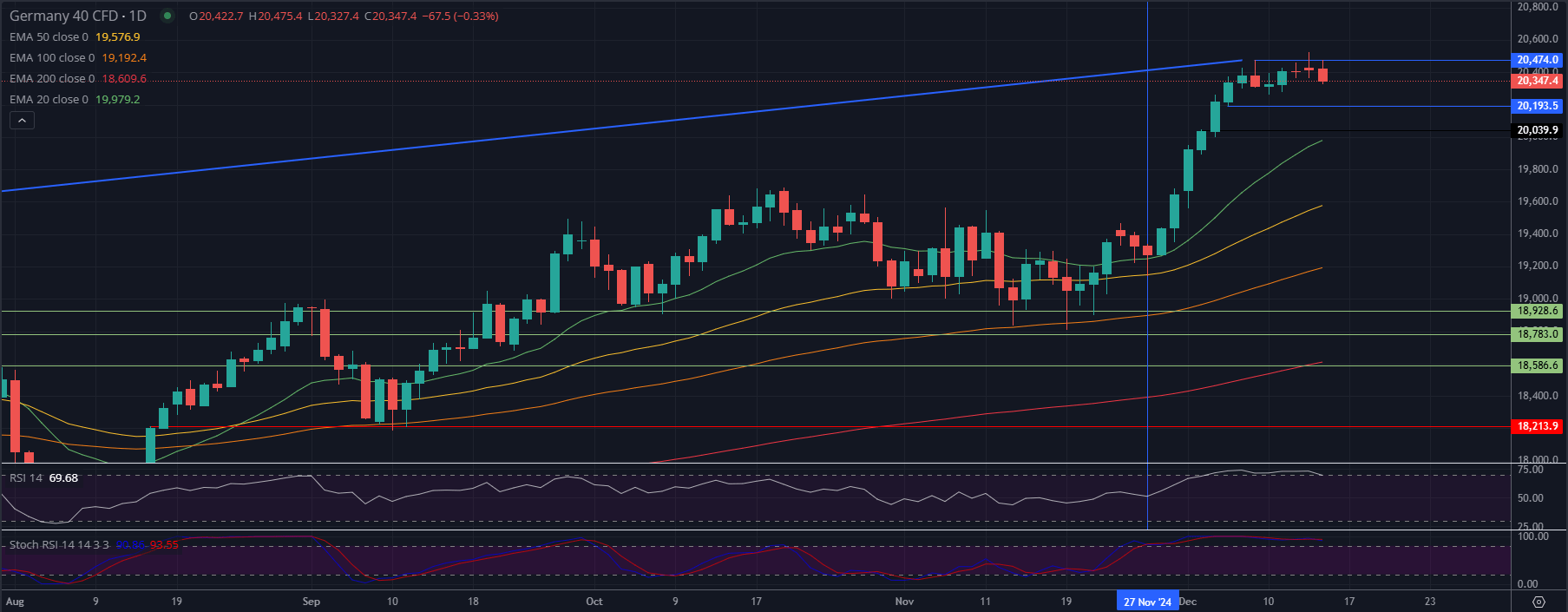

DAX (Germany 40) technical analysis

The DAX continues to trade in an uptrend, evidenced by higher highs and higher lows. The general bullish structure is intact, with momentum favoring buyers.

Key Technical Levels

- Support Levels:

- 20,193: The most immediate support level, as previously tested.

- 19,964: Medium-term support aligned with the 100 EMA.

- 19,681: Long-term dynamic support near the 200 EMA.

- Resistance Levels:

- 20,526: Current short-term resistance level.

- 21,000: A key psychological resistance level that traders will target if momentum continues.

Technical Indicators

- Exponential Moving Averages (EMA):

- The price is above the 20 EMA (short-term), 50 EMA (medium-term), and 200 EMA (long-term), confirming bullish momentum across all timeframes.

- The moving averages are aligned in a bullish sequence (20 > 50 > 100 > 200), indicating strong upward momentum.

- Relative Strength Index (RSI):

- Current Level (~70): The RSI is in overbought territory, signaling caution for potential short-term consolidation or a minor pullback.

- Stochastic RSI:

- The Stochastic RSI shows a downward cross from overbought levels, indicating a possible short-term correction.

Chart Patterns

- Breakout Confirmation: The DAX has broken above a horizontal resistance near 20,193 and is now testing the 20,526 region.

- Trend Continuation: If the DAX sustains above 20,193, this level will act as a new support, potentially paving the way for further gains toward 21,000.

Outlook and Strategy

- Bullish Scenario: A sustained close above 20,526 could trigger further upside momentum toward the 21,000 psychological level.

- Bearish Scenario: Failure to hold above 20,193 may lead to a correction, targeting the 19,964 (100 EMA) and 19,681 (200 EMA) levels.

Conclusion

The DAX remains in a strong bullish trend supported by rising EMAs and upward price action. However, overbought indicators (RSI and Stochastic RSI) suggest a short-term pullback or consolidation is possible before further gains. Traders should watch for a decisive break of the 20,526 resistance or a retest of the 20,193 support for directional cues.