Market Overview

Asian Markets

- Mixed Performance: Asian markets were mostly lower:

- South Korea: Political instability weighed heavily, with the KOSPI and the Korean won seeing sharp declines before partial recovery due to suspected intervention.

- China: Technology stocks rallied ahead of a key policy meeting, pushing Chinese markets higher.

- Focus on US Payrolls: Global markets are closely watching for a "Goldilocks" payrolls report (neither too weak nor too strong) to gauge its impact on Fed policy.

European Markets

- France:

- Prime Minister Michel Barnier’s ousting in a no-confidence vote has left France in a political stalemate, with no new elections possible before July 2025.

- The CAC 40 has lagged the broader European market by 8% since June, with much of the uncertainty already priced in.

- Germany:

- The construction sector remains weak, with residential building hit hardest due to fewer tenders and rising costs.

- Bau-Stimmungsindikator sits at 38 points, well below the growth threshold of 50, reflecting ongoing challenges.

Crypto Spotlight: Bitcoin Breaks $100,000

- Milestone Achieved: Bitcoin crossed the $100,000 mark, a significant psychological milestone.

- Year-to-Date Performance: Up 130% YTD, with a 50% gain since the U.S. election in November.

- Market Cap: Bitcoin’s valuation now stands at nearly $2 trillion, surpassing the combined market cap of all DAX companies.

- Trump’s Pro-Crypto Policies: The surge is fueled by Donald Trump’s election and his nomination of Paul Atkins, a crypto advocate, to lead the SEC.

- Skepticism Remains: Despite the rally, critics highlight Bitcoin's speculative nature, lacking ties to tangible value creation.

US Market Highlights

- Earnings Reactions:

- JetBlue (JBLU +8.25%): Strong November sales drove gains.

- Dollar Tree (DLTR +1.86%): Sales growth exceeded expectations.

- Salesforce (CRM +10.99%): Shares hit record highs, buoyed by AI product momentum.

- Foot Locker (FL -8.90%): Weak holiday shoe sales led to a sharp decline.

- Campbell’s (CPB -6.24%): Struggled as consumers opted for cheaper alternatives.

DAX Overview

- Leaders:

- Bayer: +2.21%

- Vonovia: +1.98%

- Henkel AG: +1.60%

- Porsche: +1.56%

- Laggards:

- Heidelberg Materials: -1.01%

- Rheinmetall AG: -0.97%

- Infineon: -0.72%

- Siemens Energy AG: -0.62%

Upcoming Data (GMT)

- 13:30: USD Average Hourly Earnings (MoM) (Nov)

- 13:30: USD Nonfarm Payrolls (Nov)

- 13:30: USD Unemployment Rate (Nov)

- 14:15: USD FOMC Member Bowman Speaks

- 18:00: USD FOMC Member Daly Speaks

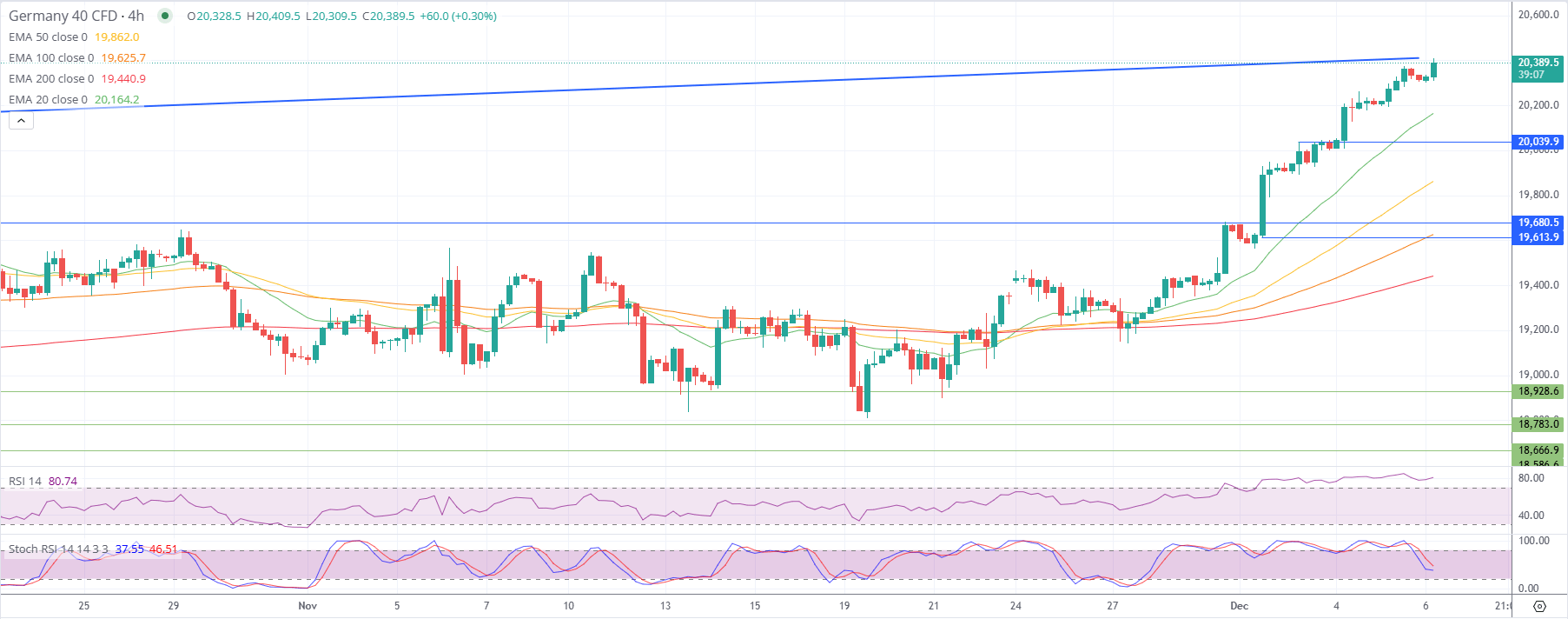

Germany 40 CFD (DAX) 4-hour

1. Current Price Action and Trend:

- The DAX is trading at 20,389.5, showing a strong uptrend after breaking above the key resistance level of 20,039.

- The price is nearing the upper boundary of an ascending trendline channel, suggesting strong bullish momentum but also possible resistance at these elevated levels.

2. Support and Resistance Levels:

- Resistance:

- Immediate resistance is at the ascending trendline around 20,410–20,450. A breakout above this level could lead to further upside.

- Beyond that, the next psychological resistance is at 20,600, a key level for the bulls.

- Support:

- The nearest support lies at 20,039, which has turned into a strong pivot point after the breakout.

- Further support is at 19,680.5, which was the previous resistance level and is now acting as a secondary support zone.

- Additional support levels include 19,613.9 and 19,440.9 (EMA 200), which provide further downside protection.

3. Moving Averages:

- The DAX is trading above all major moving averages, confirming a strong bullish trend:

- EMA 20 at 20,164.2 provides immediate dynamic support.

- The EMA 50 at 19,862.0 and EMA 100 at 19,625.7 reinforce medium-term support levels.

- The EMA 200 at 19,440.9 provides long-term support.

4. RSI and Stochastic RSI:

- The RSI is at 80.74, indicating overbought conditions. This suggests caution as the price may face resistance or consolidation in the short term.

- The Stochastic RSI is at 37.65, suggesting that while the overall trend is bullish, some short-term exhaustion is evident.

5. Key Observations:

- The DAX has successfully broken key resistance levels, but the overbought RSI indicates that momentum could slow, potentially leading to consolidation or a minor pullback.

- The ascending trendline suggests that the index is approaching a critical test zone near 20,410.

Thesis:

Scenario 1: Bullish Continuation:

- If the DAX breaks above 20,410, it could target 20,600 or higher.

- Sustained momentum above the ascending trendline would confirm the continuation of the bullish trend.

Scenario 2: Short-term Pullback:

- Overbought RSI conditions suggest a potential pullback to 20,039 or 19,680.5.

- A breakdown below 19,680.5 would indicate a deeper correction, with targets at 19,613.9 or 19,440.9 (EMA 200).

Conclusion:

The DAX is in a strong uptrend, with key resistance at 20,410 and support at 20,039. While the trend remains bullish, overbought RSI conditions suggest a potential short-term pullback. A breakout above 20,410 would confirm further upside, while a failure to sustain above this level could lead to consolidation or retracement. Traders should monitor the ascending trendline for the next directional move.

- Asia: Markets remain cautious amid political instability in South Korea and economic optimism in China.

- Crypto: Bitcoin's record-breaking rally underscores renewed enthusiasm, driven by U.S. political developments.

- Europe: The CAC 40 reflects political uncertainty in France, while Germany’s construction sector faces persistent challenges.

- US: All eyes are on the NFP report for clues on Fed policy, with broader markets reacting to mixed earnings results and crypto momentum.

Latest market news

Today 09:44 AM

Today 09:34 AM

Yesterday 07:55 PM

Yesterday 05:50 PM