Tuesday, October 16, 2024

DAX Technical Analysis and Economic Events

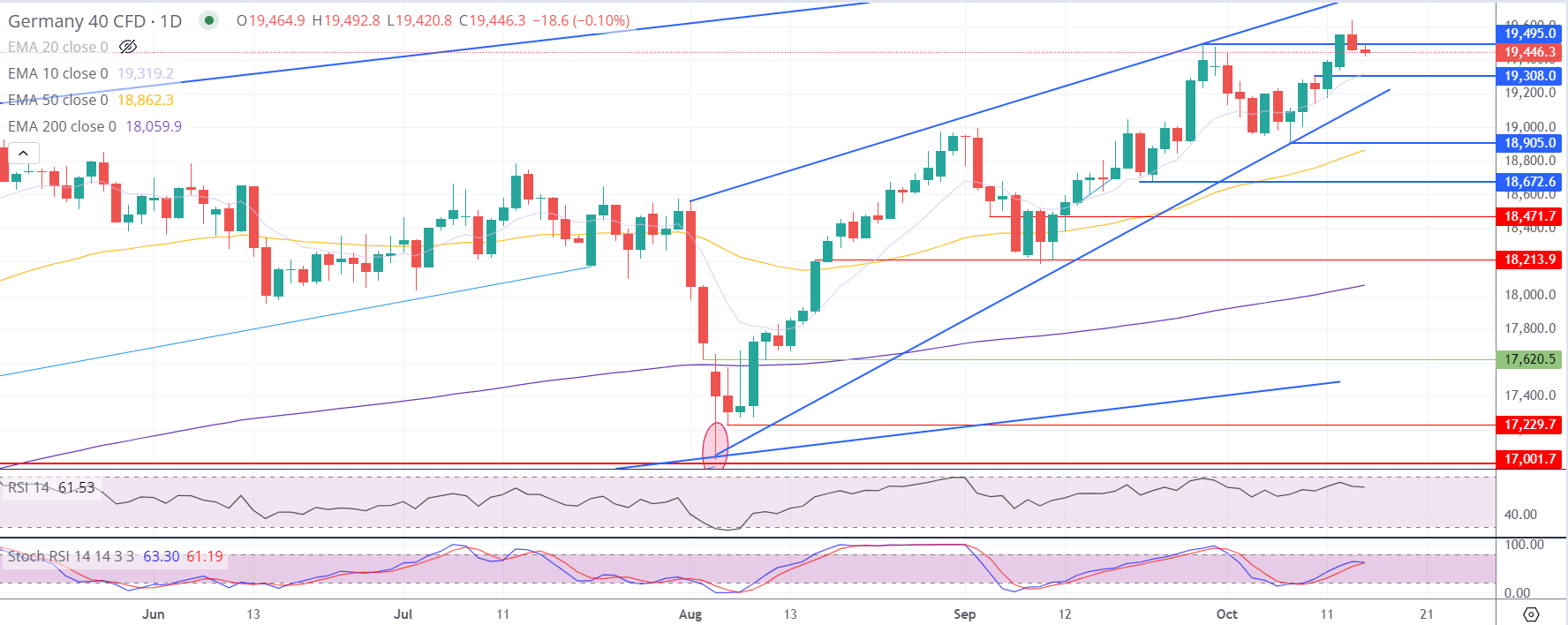

In European markets, the DAX has been experiencing a bullish continuation of its broader upward trend over the last five trading days. After successfully defending the EMA 20 on October 8, the index has been marking daily higher highs and lows, confirming a bullish market. This trend has been further supported by technical buy signals from the EMAs: 20, 50 and 200 alongside positive momentum from Slow Stochastics.

Despite this upward movement, there were some negative effects from the ZEW economic sentiment data for October, with the Current Conditions Index showing a worse-than-expected figure of -86.9, compared to the expected -84.5. However, the Economic Sentiment for Germany and the EU outperformed expectations, with Germany posting a 13.1 reading (vs. expected 10.2) and the EU posting 20.1 (vs. expected 16.9).

Technically, the DAX is approaching a key resistance level at 19,641 points. A breakout beyond this level could trigger a further rally toward the psychological barrier of 19,800 points. However, the bullish scenario would be invalidated if the index falls below 19,369 points.

The only significant economic data release today is the US Export Price Index (MoM) for September, which may provide further direction for market sentiment.

Corporate News: ASML

In corporate news, ASML has faced heavy selling pressure, with the company issuing a weak revenue forecast for 2025, causing a broad sell-off in global chip stocks. ASML’s U.S.-listed shares plummeted 16%, dragging other major technology names like NVIDIA, which fell by 4.7%.

UK Inflation Data

The UK’s Consumer Price Index (CPI) for September came in at 1.7% year-on-year, significantly below expectations of 1.9%, marking the lowest reading since April 2021. Core inflation also slowed, coming in at 3.2% YoY, compared to expectations of 3.4%. The decline in inflation below the Bank of England's target of 2% has fueled expectations that the central bank may consider cutting interest rates next month. The GBP faced some pressure in response to the lower-than-expected inflation figures.

Earnings Pre-Market

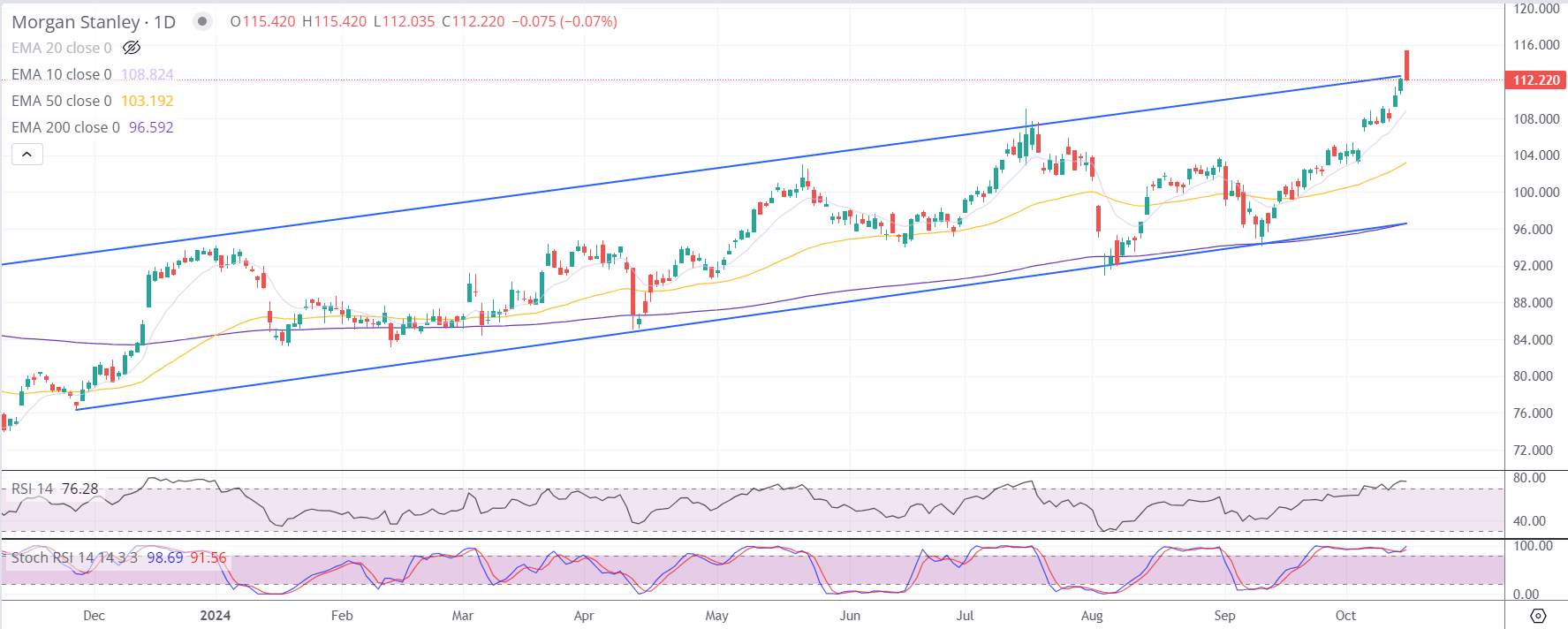

Morgan Stanley (MS) is expected to report third-quarter earnings today, with an anticipated $1.59 EPS and revenues of $14.32 billion. Investors are eager to see if Morgan Stanley’s wealth management unit, which manages $5.7 trillion in client assets, can sustain the growth seen in prior quarters. Strong earnings from its investment banking rivals set the stage for a positive outcome.

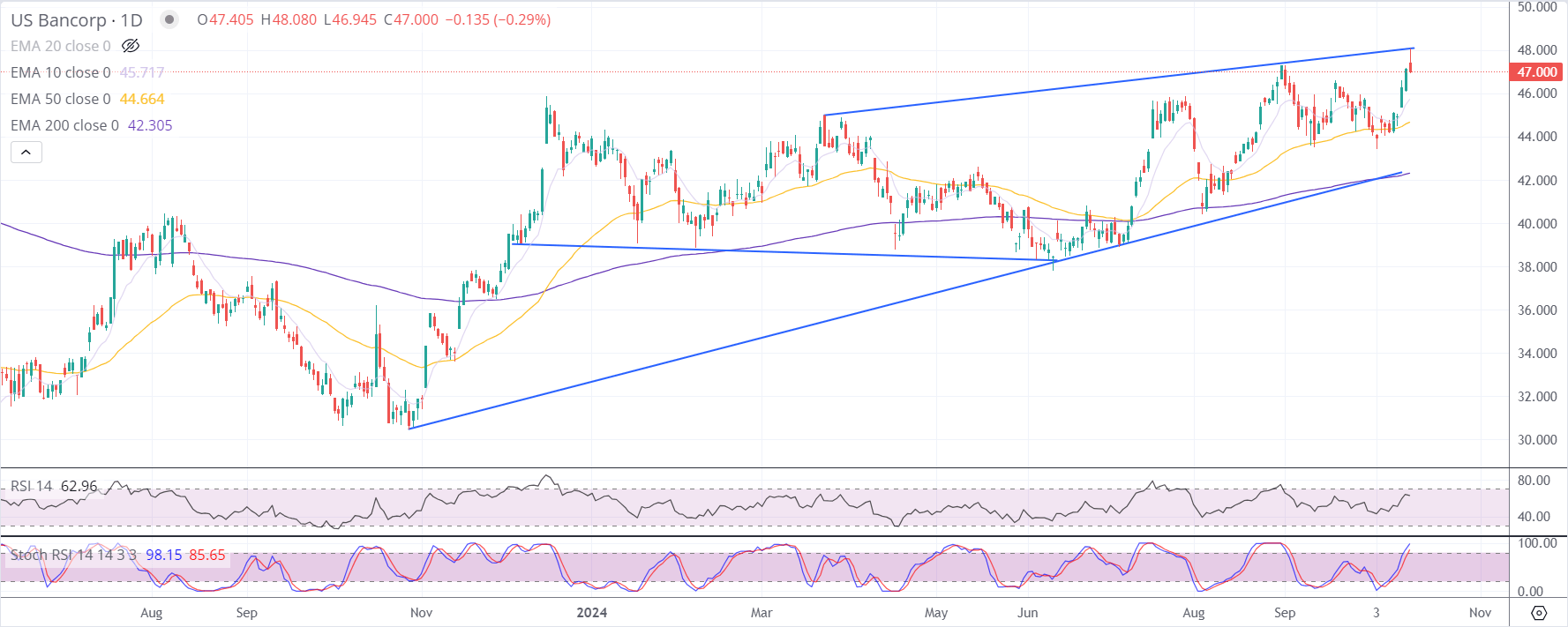

U.S. Bancorp (USB) is also reporting earnings today, with expectations of $1 EPS and revenues of $6.88 billion, reflecting a slight decline from the previous year. Wall Street forecasts a year-over-year drop in earnings due to lower revenues.

Looking Ahead

- October 17: The ECB is expected to cut interest rates from 3.65% to 3.4% during its policy meeting. Additionally, earnings from Netflix and Blackstone will drive sentiment, along with U.S. initial jobless claims data.

- October 18: China’s GDP data is highly anticipated, with expectations of 5% growth for the third quarter, up from 4.7%. Volatility could increase in European markets due to China’s strong ties to the EU’s export markets.

Conclusion

Today’s quiet economic calendar puts the spotlight on earnings and the DAX's technical movement, with key resistance levels in play. In corporate news, ASML is facing headwinds, while the UK’s inflation figures provide hope for a potential rate cut. Investors are also awaiting key earnings releases later in the week, as markets prepare for further central bank actions and macroeconomic data from China.