A big week awaits us.

Financial institutions in full swing

On Friday, the earnings season started in the United States. The figures for the past quarter were presented by four important financial institutions of the S&P 500.

JPMorgan (JPM), Wells Fargo&Co (WFC), Bank of NY Mellon (BK) and Blackrock (BLK).

Compared to the previous year, not only were profits up for all of them, but the figures for all institutions were also above analysts' expectations. The biggest positive divergence among all sectors is the S&P 500's financial sector, which, while accounting for only 13% of the index's market capitalisation, generated over 17% of price movement in the past quarter.

By contrast, the information technology sector, which accounts for nearly 32% of the index but is expected to contribute only 22% of earnings, suggests that it currently trades at a significant premium. By contrast, the financial sector is trading at a price-to-earnings ratio of 16, which is still almost 20% higher than the average for the last ten years, but 26% lower than the overall index.

This year, financial companies have already seen their value increase by almost 25% in euros. The possibility exists of an increase even further if the companies that publish their figures in the coming days and titles are above expectations. Having seen Fridays results the chances are there; however, risks may still be present.

On Tuesday 15th October more financial institutions will continue to post earnings: Bank of America, Goldman Sachs, Citigroup and Charles Schwab are up next, with results expected to come in similar to Friday’s culprits.

Corporate news

As China's demand declines, Volkswagen's worldwide deliveries fall 7%. A 7% decline in third-quarter global deliveries, fueled by waning Chinese demand and elevated European production costs, puts the corporation under increasing strain. The difficulties associated with electrification and intense competition increase as the manufacturer considers closing plants. According to Reuters.

AMD introduces an AI chip to compete with Blackwell from Nvidia.

Microsoft has announced new AI technologies to help physicians and nurses with their workloads.

Day of the week: Thursday, Eurozone

European Central Bank decides on interest rates. Analysts forecast the central bank to cut its deposit rate by 0.25 percentage points to 3.25 per cent. The fact that headline inflation recently dipped below the 2 per cent target in September makes this the most likely outcome. However, core inflation, which at 2.7 per cent is still too high, is a cause for caution. At the subsequent press conference, the monetary authorities are likely to provide information on the further interest rate path. If they rule out further rate cuts, yields on short-dated government bonds could rise.

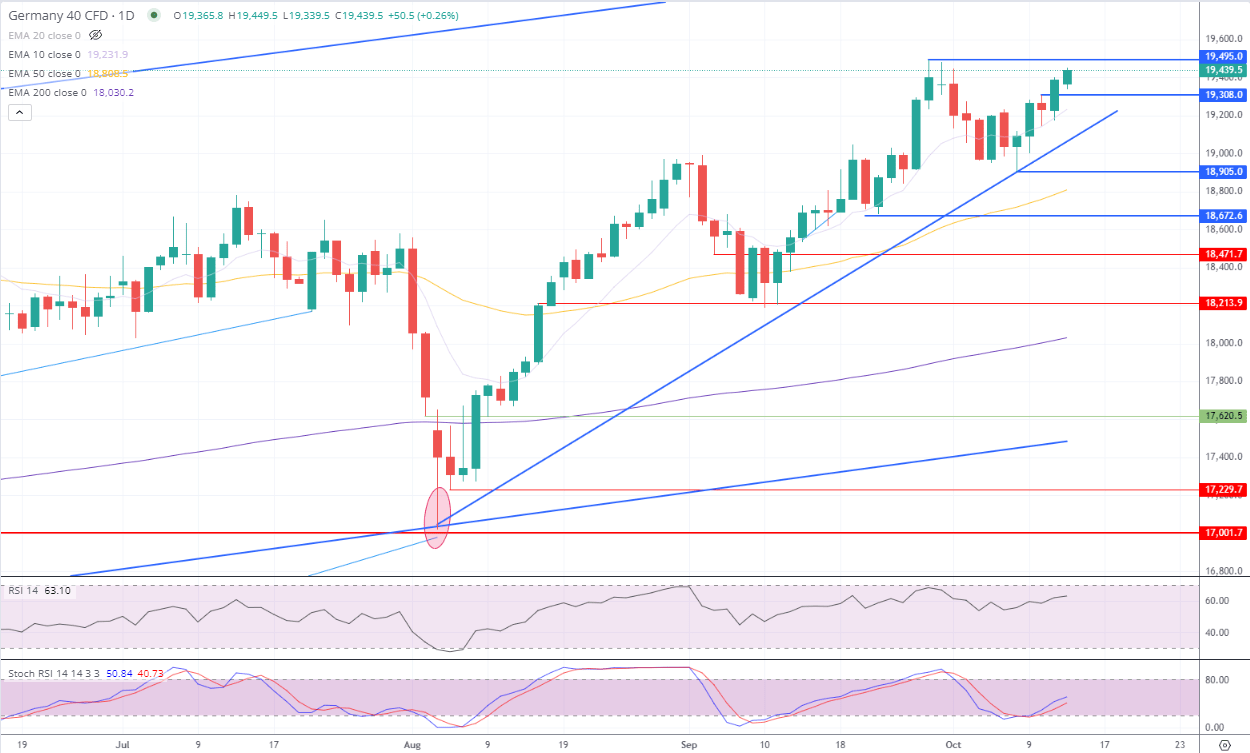

DAX Technical analysis

On 27 September, the DAX reached new highs. This was followed by a technical counter-reaction, which was successful on 8 October with 18,905 points and resulted in a higher low. At the same time, it was possible to successfully regain the 20 EMA on a closing price basis on that day. After that, the index set daily highs and lows in the chart on the last three trading days, thus laying the foundation for a trend increase to the previous all-time high. Furthermore, the current price is above the 20 EMA, 50 EMA and 200 EMA which shows lasting bullish tendencies. The RSI and the Stochastic RSI confirm the trend due to being above 50 for the former and both lines sloping upwards around the centreline for the latter. If the DAX falls below and loses momentum, then the 19,000 level acts as the continuing support.