- Alibaba Q4 earnings – Tuesday, May 14.

- Home Depot Q1 earnings – Tuesday, May 14.

- Walmart Q1 earnings – Thursday, May 16.

Last week, the US leading indices posted gains as investors weighed signs of weakness in the US labour market against hawkish commentary from Federal Reserve officials. This supported the view that interest rates need to stay higher for longer. Neil Kashkari, the Minneapolis Fed president, even raised doubts over whether the Fed could cut rates at all this year.

Still, these comments were offset by a higher-than-expected jobless claims report following Friday's softer-than-expected nonfarm payroll. Signs of weakness in the labour market have encouraged traders to price in a 50% probability of a rate cut in September.

Looking ahead to the coming week, the big focus will be on the health of the US consumer, as Starbucks, McDonald's, and Amazon sent concerning demand signals from their customers. US consumer confidence also tumbled, suggesting that discretionary spending could be slowing. US inflation figures and retail sales will be in focus.

Amid a backdrop of slowing job growth and falling consumer confidence, investors will turn to retail giants such as Walmart and Home Depot to gauge spending habits.

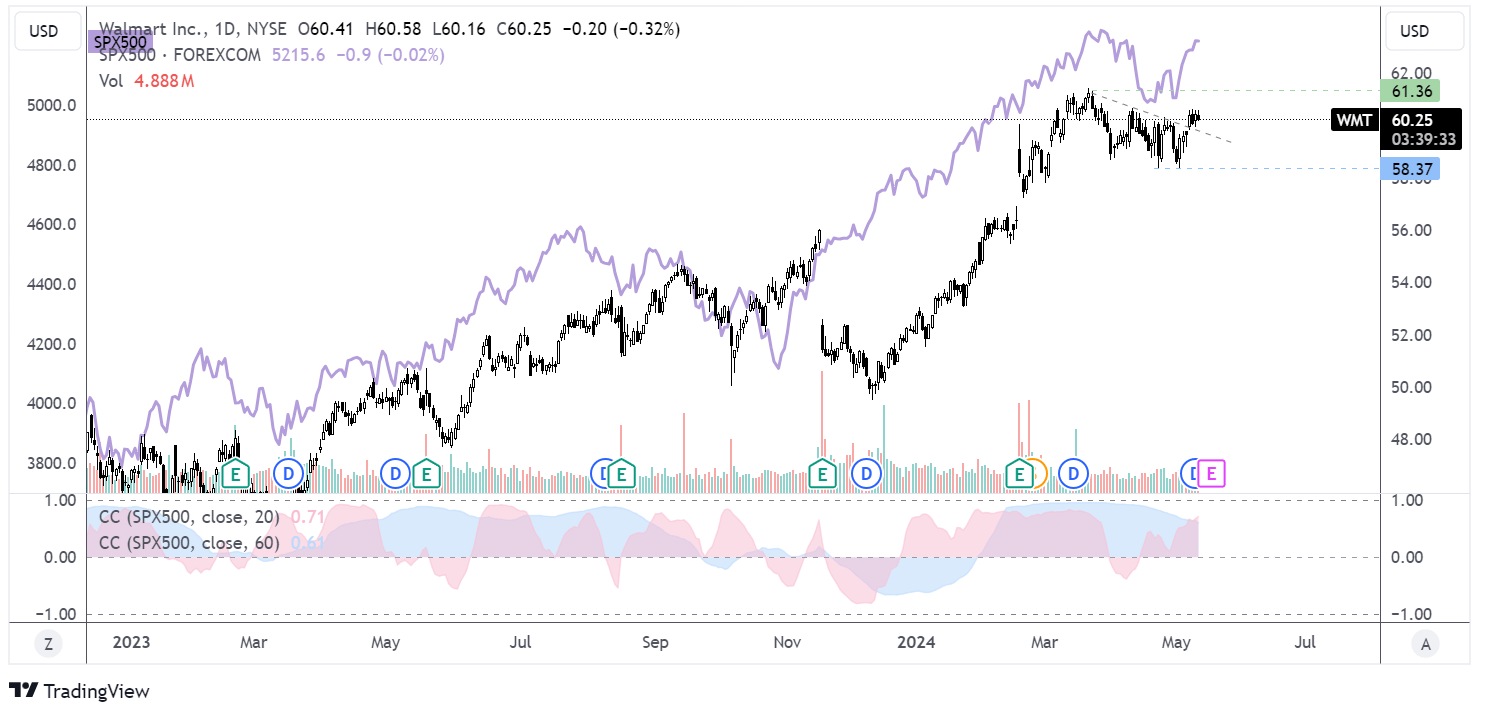

Walmart Q1 earnings preview

Walmart, considered a proxy for consumer strength, will kick off first-quarter retail earnings next week. The market will be watching to see whether consumers are reining in their spending on higher-margin products, which would be a concern. Expectations are for Walmart, the world's largest retailer, to report the slowest sales growth in three years for the 12 months to January 2025; however, earnings could be more upbeat, with the company expected to post stronger profit growth than the previous quarter.

Wall Street is expecting EPS of $0.52 on revenue of $158.00 billion, up from $0.21 in the same quarter a year earlier on revenue of $152.3 billion.

Walmart is just down from its record high of $61.40, reached in March. The share price is 13% higher this year, modestly outperforming the S&P 500, which has traded up 10% year to date.

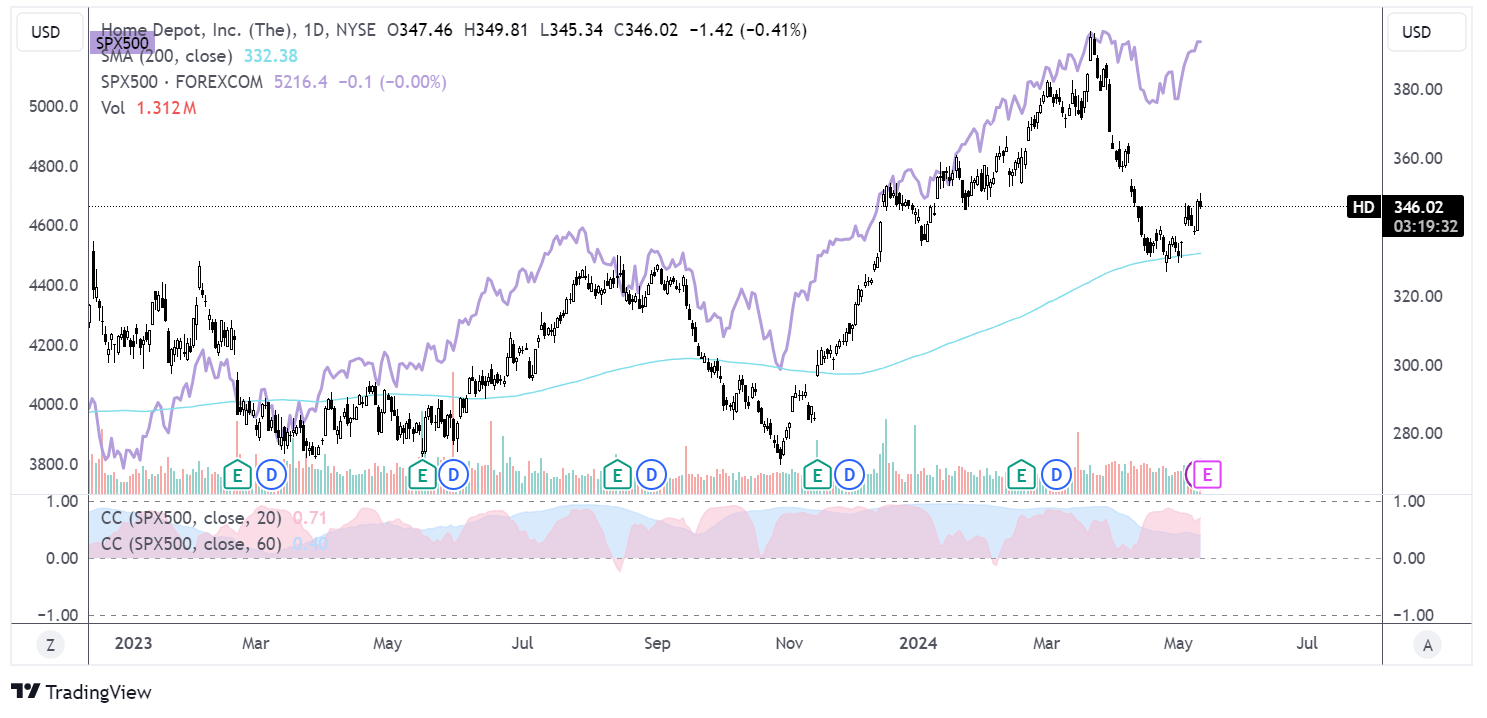

Home Depot Q1 earnings preview

Home Depot will report Q1 earnings ahead of the market opening on Tuesday and is expected to post a slight year-on-year decline in sales and earnings amid concerns about high inflation hurting consumption, particularly for big-ticket purchases (classified by Home Depot as items over $1000) as consumers are less likely to take on significant home improvement products.

Expectations are for Home Depot to report EPS of $3.58 on $36.65 billion in revenue, down from EPS of $3.82 on $37.26 billion in revenue a year ago.

After reaching a record high of just under $400 per share, Home Depot’s share price plunged 18% to a low of $325, the 200 SMA. The price has recovered to $345, but that recovery could be vulnerable to weak results. The 60-day correlation coefficient with the S&P500 is at its lowest level in a year.

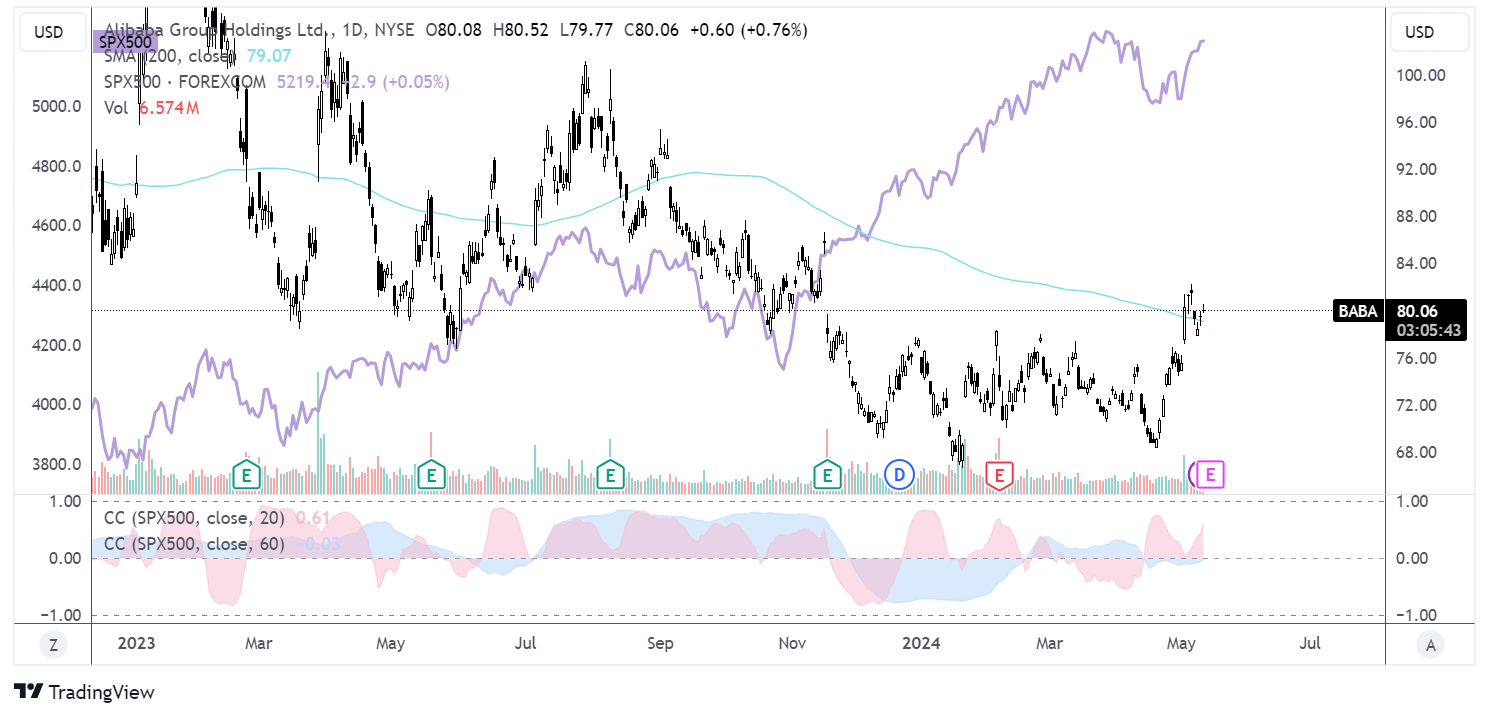

Alibaba Q4 earnings preview

Meanwhile, Chinese e-commerce and cloud giant Alibaba is set to report Q4 results on May 14th. Expectations are for modest growth amid headwinds in the domestic e-commerce market and as the company's cloud business also sees slowing growth.

EPS is expected to be $1.42, while revenue is set to come in at $30.5 billion, up 4% compared to last year amid a challenging backdrop and rising competition.

The earnings come as the Chinese economy has seen a slower-than-expected rebound from COVID lockdowns and weakness in the real estate market. The earnings come ahead of Chinese retail sales data, which is due later in the week. In March, retail sales rose 4.7% year on year as consumer spending in the spring festival surged. Meanwhile, increasing competition within the e-commerce space with PDD, which owns Pinduoduo and Temu, is also challenging as Chinese consumers are increasingly value-conscious.

Alibaba's share price has fallen 65% from $235 in early January 2021 to its current level of around $80.00 a share. The S&P 500 has seen a 35% increase across the same period as Alibaba underperformed the broader market.

The share price fell to a low of $68.35 before rebounding. The recovery is testing the 200 SMA. Upbeat results could help the share price clear the 200 SMA hurdle.