Engie, the electric utility company, announced that 9-month current operating income dropped 27.9% on year to 2.8 billion euros and EBITDA slid 13.0% to 6.2 billion euros on revenue of 39.6 billion euros, down 8.5% (-8.1% organic growth). The company said it "saw a strong financial recovery in Q3 following a significantly impacted Q2" and confirmed its full-year net recurring income guidance of 1.7 - 1.9 billion euros.

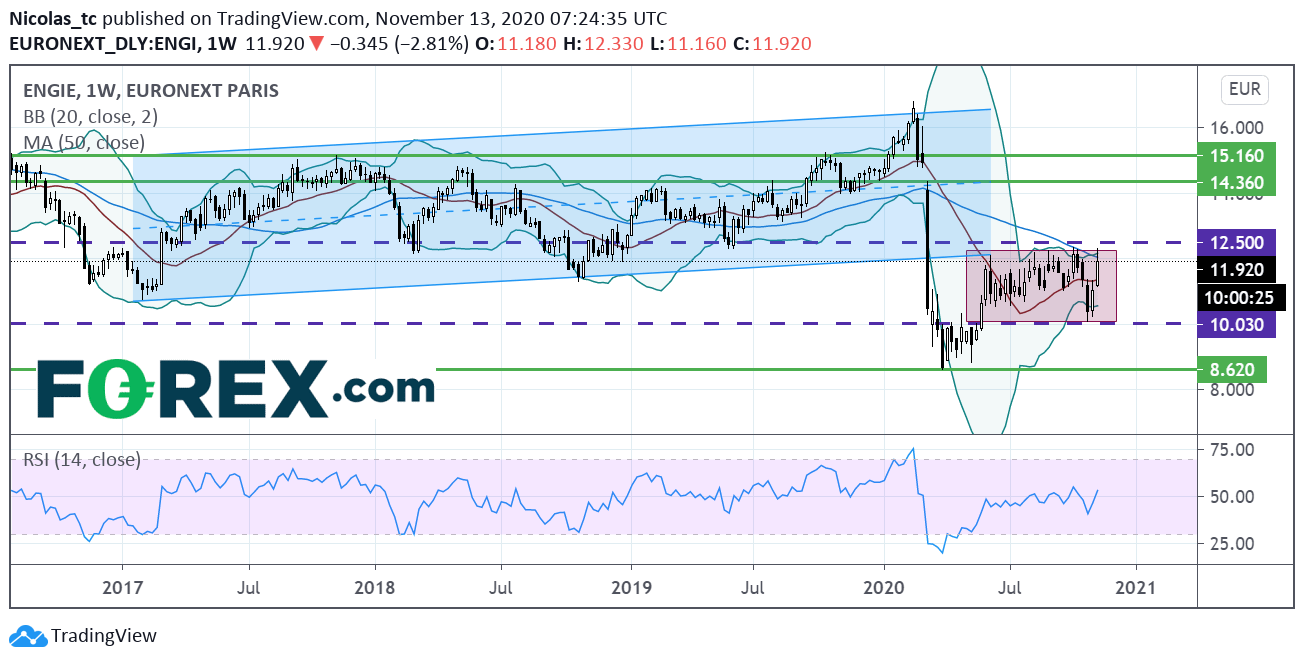

From a chartist point of view, the stock price is navigating choppy waters within a short term trading range. The 50WMA is still descending while the weekly RSI (14) is around its neutrality area at 50%. We would recommend waiting for a significant breakout in either direction for the stock to establish a bias. A weekly closing price above 12.5 would open a path to see 14.36 - 15.16 zone.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 11:57 PM

Yesterday 08:25 PM

Yesterday 07:48 PM

Yesterday 06:25 PM

Yesterday 05:30 PM