On Thursday, December 12, 2024, several significant economic events will be released which will impact both European and U.S. markets. Key developments include the European Central Bank's (ECB) monetary policy decisions, the release of the U.S. Producer Price Index (PPI) for November, and the U.S. 30-year bond auction. Let’s get right to it.

European Central Bank's Monetary Policy Decisions

At 13:15 GMT, the ECB will most probably announce a 25-basis point reduction in its key interest rates, which is currently aligning with market expectations. This adjustment would lower the deposit facility rate to 3.00% and the main refinancing operations rate to 3.15%. The decision would mark the fourth rate cut by the ECB in 2024 and is aiming to support the eurozone's stalled economic growth and to guide inflation toward the 2% target the ECB is eyeing.

For context, the eurozone has been battling with sluggish economic performance in the manufacturing and services sector and is also hindered by political uncertainties in its largest member states France and Germany, which is adding to the complications it is experiencing. Also not insignificant are potential trade tensions with the United States which are weighing down the region's economic sentiment. In this context, the ECB's rate cut could be intended to stimulate economic activity and avoid further declines in the eurozone’s economic performance.

Half an hour after the rate decision, specifically at 13:45 GMT, ECB President Christine Lagarde will hold a press conference to elaborate on the rationale behind the policy move and to provide forward guidance. President Lagarde as of recently, continued to emphasize the ECB's commitment to closely monitoring economic indicators, and if inflation remains subdued and growth prospects do not improve, then the possibility of further easing in 2025 will continue as planned.

U.S. Producer Price Index (PPI) Release

Shortly after the ECB interest rate decision at 13:30 GMT, the U.S. Bureau of Labor Statistics will also release the Producer Price Index (PPI) data for November. The PPI, which measures the average change over time in the selling prices received by domestic producers for their output, is expected to increase by 0.2% month-over-month, which would be the same reading of 0.2% for last month. This slowdown would suggest that wholesale inflation pressures are easing, which could eventually lead to a softening in consumer prices.

In contrast, the core PPI, excluding volatile food and energy prices, is expected to drop slightly to 0.2% month-over-month, where the last reading was 0.3% and which would align with expectations. On an annual basis, the core PPI is expected to increase by 3.2%, as opposed to the last reading of 3.1% which could indicate that underlying inflationary pressures do remain present in the economy.

The reason why these PPI figures are so closely watched by the Federal Reserve is because the data is used to show any persistent inflationary pressures at the producer level, which might lead the Fed to reconsider the timing of the interest rate adjustments to try balance economic activity.

U.S. 30-Year Bond Auction

Later in the day, at 18:00 GMT, the U.S. Treasury will conduct their 30-year bond auction. The last auction, resulted in a yield of 4.608%, which is still relatively high compared to pre-2020 levels.

The reason why the outcome of this auction is significant, is as it provides insights into the market by gauging the investor confidence and expectations of future economic conditions and interest rates. Generally speaking, the higher the yield of the bonds, the higher the risk associated to the debt.

Putting it all together

In response to today’s developments, European stock markets might experience a more bullish attitude, as the ECB's almost certain rate cut could signal a more growth-oriented stance and an easing of the economic outlook. However, as the rate cut had been widely anticipated, the euro and other European indices might have already priced in the cut as seen by the DAX reaching all-time highs recently.

In the U.S., stock indices might react slightly following the PPI release, and if the data falls close to expectations, it will not significantly alter expectations regarding the Federal Reserve's monetary policy trajectory of more rate cuts.

All events listed here:

13:15 EUR Deposit Facility Rate (Dec)

13:15 EUR ECB Interest Rate Decision (Dec)

13:30 USD PPI (MoM) (Nov)

13:45 EUR ECB Press Conference

15:15 EUR ECB President Lagarde Speaks

18:00 USD 30-Year Bond Auction

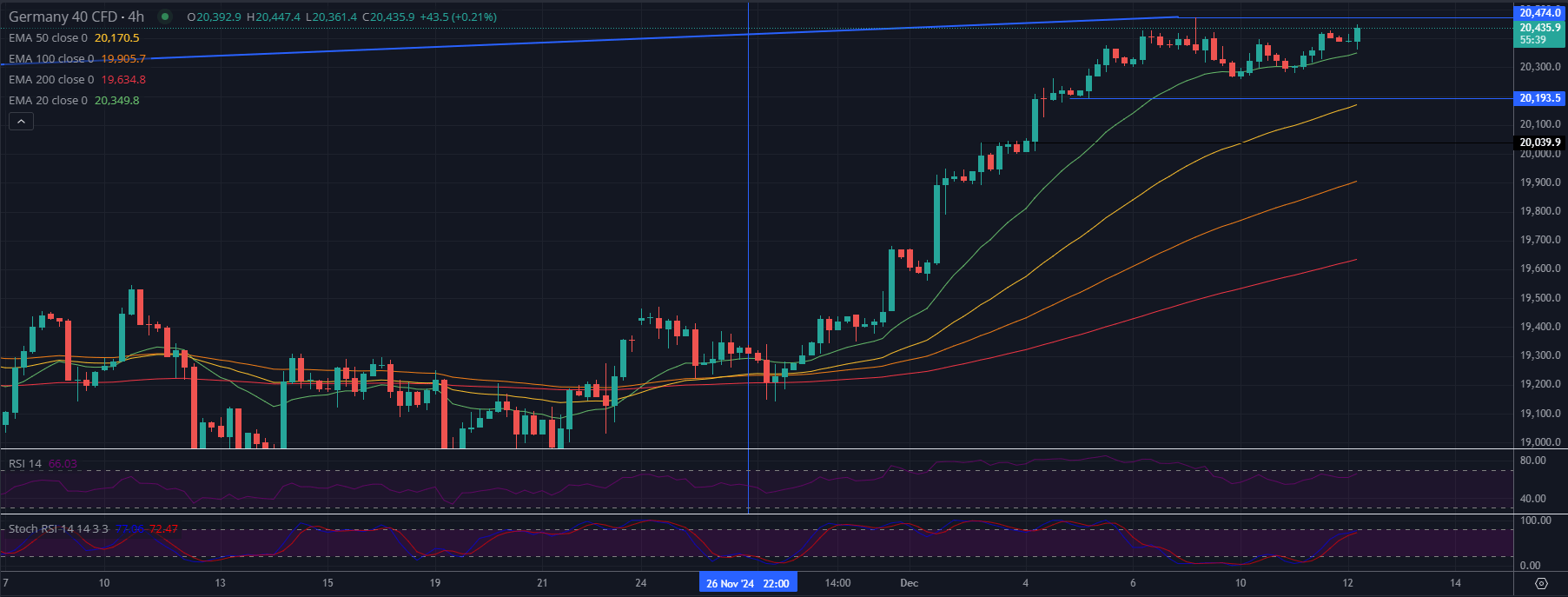

Germany 40 (DAX) Technical Analysis – 4-Hour Chart

1. Current Price Action and Trend:

- The DAX is trading at 20,435.9 and maintaining strong bullish momentum as it created the resistance at 20,474.0. The price is now trending sideways since the 4th December.

2. Support and Resistance Levels:

- Resistance:

- Immediate resistance lies at 20,474.0, which is the all-time high and just below the key psychological level of 20,500.

- Support:

- The first support is at 20,193.5, aligning with the most recent breakout from consolidation and the EMA 20.

- Deeper support lies at 20,039.9, which represents a key pivot zone.

3. Moving Averages:

- The DAX is trading well above all major moving averages, confirming a strong bullish trend:

- EMA 20 acts as immediate shorter term dynamic support.

- EMA 50 and EMA 100 provide additional layers of support in case of a pullback.

- The rising EMA 200 at 19,634.8 underscores the longer-term uptrend.

4. RSI and Stochastic RSI:

- The RSI is at 66.03, reflecting bullish momentum but nearing overbought conditions, signaling potential for either a breakout or short-term consolidation.

- The Stochastic RSI is at 77.95, also leaning toward overbought levels. This suggests that while the trend remains bullish, a pullback or consolidation could occur around these levels.

Thesis:

Scenario 1: Bullish Breakout:

- A breakout above 20,474.0 would signal continued bullish momentum, targeting 20,600.0 and potentially 20,800.0 as the next levels of resistance.

Scenario 2: Short-term Pullback:

- If the DAX fails to break 20,474.0, it could pull back to test support around 20,193.5 or 20,039.9.