AT&T: Navigating Competitive Pressures and Growth Strategies

Earnings Release Date: October 23, 2024

Expected EPS: $0.59 (-7.8% YoY)

Expected Revenue: $30 Billion

AT&T’s performance this quarter will likely reflect a blend of network infrastructure improvements and growing competition. Analysts expect earnings per share (EPS) to decline by 7.8% from the same quarter last year, hitting $0.59. The company has faced challenges in maintaining its top-line growth, as consumers increasingly shift to lower-priced alternatives in a saturated wireless market. Despite these challenges, AT&T's 5G and fiber network expansions position it for long-term growth.

Key Highlights:

- 5G and Fiber Growth: AT&T continues to invest in its 5G and fiber network, expanding capacity and coverage to foster long-term growth. Mid-band spectrum deployments and fiber densification efforts are expected to enhance service reliability and attract new customers.

- AI and IoT Expansion: Through partnerships with Unsupervised AI and Oracle, AT&T aims to leverage AI and IoT solutions, boosting operational efficiency and creating new revenue streams across its business segments.

However, AT&T continues to face pressure from rising debt levels and a shrinking wireline business, exacerbated by the decline in legacy services. The company’s stock, trading at a relatively low P/E ratio of 9.41, may appeal to value investors, but it still trails peers like T-Mobile, which has outperformed over the past year.

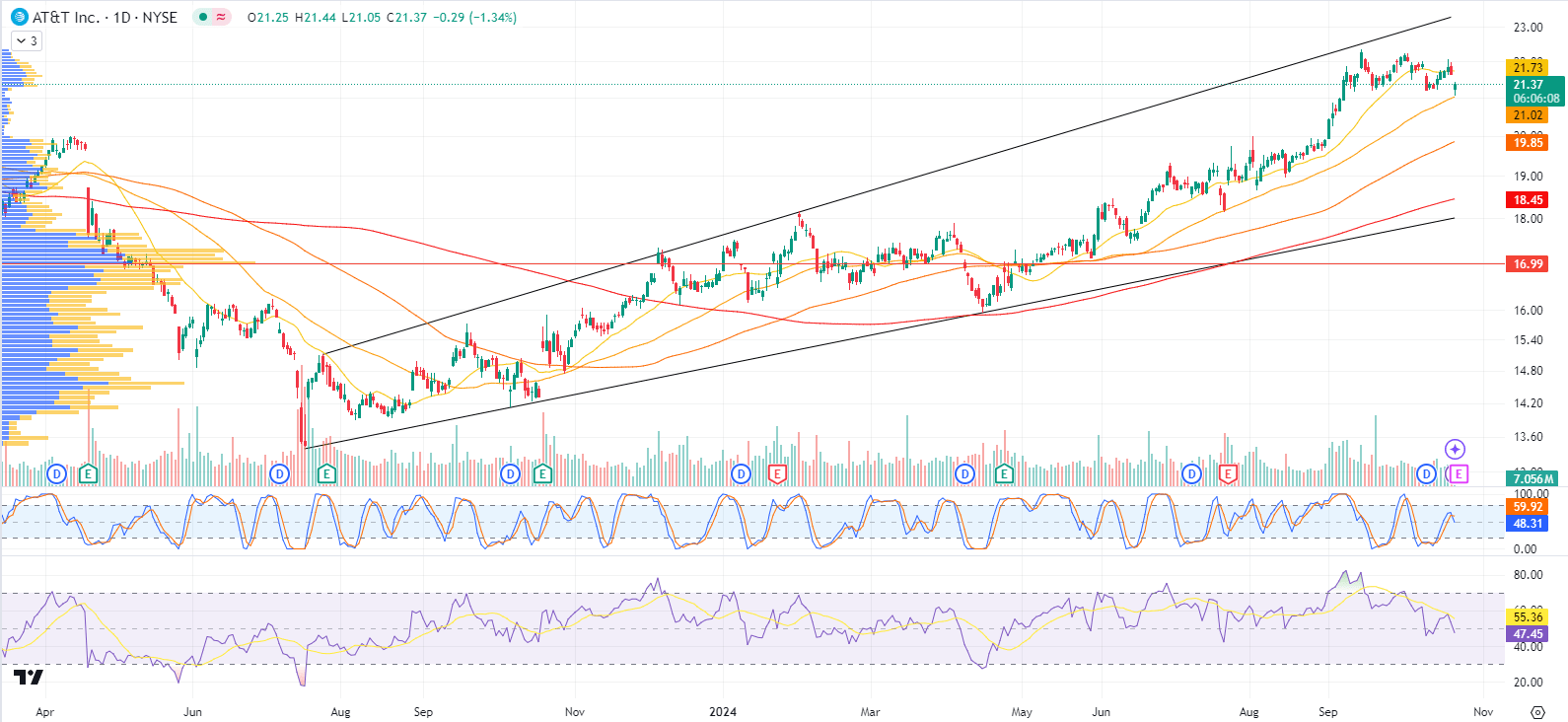

Technical

AT&T Recovered from a 20 year low around $13 in July 2023 and has been in an uptrend since then.

In the past 20 trading days, T has been trading in a range between $21.91 and $21.22. T is trading below resistance at $22.27, about 4% to the upside. There is support at $19.54, -9% to the downside. If it can break above the resistance, it could have some more upside. If the price starts to turn down and fails to get through this level, we might find further weakness in the price.

Coca-Cola: Steady Earnings Amid Revenue Decline

Earnings Release Date: October 23, 2024

Expected EPS: $0.74 (flat YoY)

Expected Revenue: $11.61 billion (-2.9% YoY)

Coca-Cola is expected to report flat earnings for the third quarter of 2024, with an EPS of $0.74, the same as in the previous year. However, revenues are expected to decline by 2.9% year-over-year, to $11.61 billion, which reflects weaker consumer demand and pressures from inflation.

Key Factors to Watch:

- Revenue Decline: Analysts are expecting lower revenues as consumer preferences shift, possibly exacerbated by higher input costs and foreign exchange headwinds. The company is focusing on increasing operational efficiencies and pushing through price increases to offset declines.

- Sustainability Initiatives: Coca-Cola continues to emphasize its sustainability goals, including packaging and water usage improvements, which could positively influence consumer perception and long-term brand value.

While Coca-Cola has managed to meet or exceed EPS expectations in its past earnings reports, this quarter could be a pivotal moment. Investors will pay close attention to management’s discussion on business conditions and any forward guidance regarding margins and cost control.

Technical

Tesla: Facing a Tough Quarter Amid Pricing Challenges

Earnings Release Date: October 23, 2024

Expected EPS: $0.52 (-30% YoY)

Expected Revenue: $25.5 billion (+2% YoY)

Tesla’s upcoming Q3 2024 earnings report will be closely watched as the electric vehicle giant grapples with declining earnings. Analysts expect Tesla to report EPS of $0.52, marking a sharp 43% decline from the same period last year. Revenue, however, is forecast to come in at $25.5 billion, up 2% year-over-year.

Key Developments:

- Margin Pressures: Tesla’s gross margins have dropped to 18%, down significantly from previous quarters. The company has been slashing prices on its models, including recent price cuts for the Cybertruck and Model 3, to stimulate demand. These price reductions have weighed heavily on profitability.

- Production and Deliveries: Tesla aims to meet its 1.8 million unit estimate for 2024. However, the company continues to face challenges related to rising costs and intense competition in the electric vehicle market.

Despite these difficulties, Tesla continues to tout its record quarterly revenues, but the focus will likely shift to how well it can manage profitability going forward. Investors will also be looking for updates on Cybertruck production and AI initiatives as key growth drivers in the coming years.

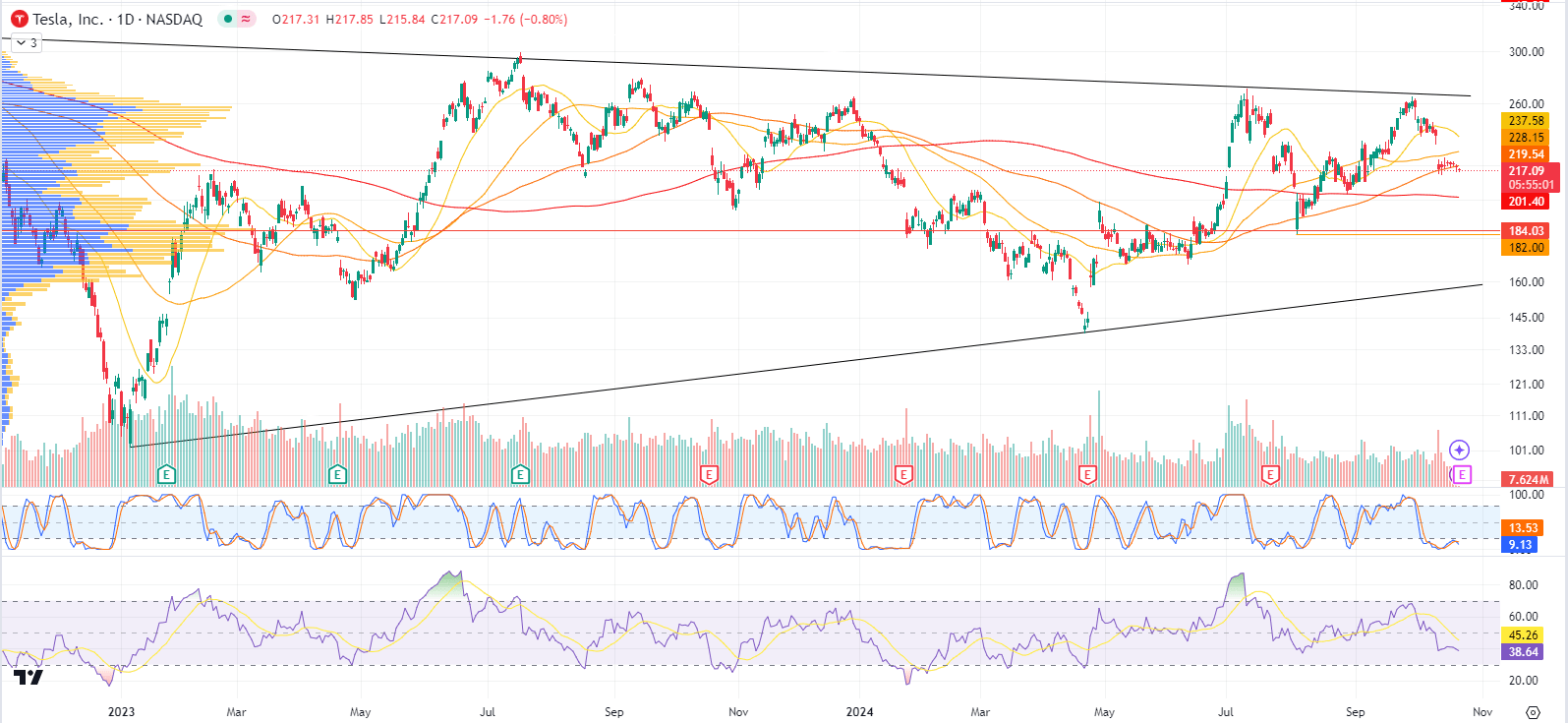

Technical

Conclusion: Mixed Outlook for Earnings Releases

- AT&T is focusing on long-term investments in 5G and fiber, but faces headwinds from competitive pressures and declining legacy services.

- Coca-Cola is expected to deliver flat earnings, with investors eyeing revenue trends and management's guidance for the future.

- Tesla faces a tough quarter with declining margins, but will focus on record revenues and production targets for 2024.