US financial services and banks continue to release earnings.

In the United States, earnings season began on Friday with significant S&P 500 financial firms having provided the numbers for the most recent quarter. Those that reported were Blackrock (BLK), Bank of NY Mellon (BK), Wells Fargo & Co. (WFC), and JPMorgan (JPM).

All of them reported higher earnings numbers when compared to last year.

Financial Services at an upswing

It is good to note that in the last quarter, the financial firm’s sector of the S&P 500 made more than 17% of the price movement. This makes it the sector with the largest positive divergence overall.

If we compare the financial sector which makes up 13% of the market capitalization of the S&P 500 and the information technology sector which makes up 32% of the sector, we can see that the IT sector is trading at a premium, given it makes up about 32% of the index but only generated 22% of the price increase.

Fundamentally the banking sector is currently trading at a price-to-earnings ratio of 16, which is 26% below the S&P 500 price to earnings ratio, yet it is still about 20% higher than the average for the previous ten years.

Overall, the financial sector has been doing great recently, as they have increased by over 25% in this year alone. If the businesses that release their numbers in the next few days surpass expectations, there is a chance that the number will rise even more.

Given Friday's earnings report, there are opportunities, but there may also be remaining risks.

Financial institutions reporting 15th October 2024

Bank of America

Before the market opens on October 15, 2024, Bank of America Corporation is anticipated to release its earnings. The fiscal quarter that ends in September 2024 will be covered in the report. The consensus EPS expectation for the quarter is $0.78, which is a -13.3% year-over-year change based on the projections of eight analysts. Data from Benzinga Pro indicates that the company's last quarter's sales was predicted to be $25.29 billion, while the reported EPS for the same period last year was $0.9.

In the last four quarterly earnings reports, Bank of America has posted real earnings per share that are greater than anticipated.

Warren Buffet, the Oracle of Omaha, sold off $10 billion worth of Bank of America stock a few weeks before. Is he on the right track?

He might wish to get his company ready because he fears the market is overpriced in general. It's becoming more and more illogical to him. According to his letter to shareholders in 2023, "markets now exhibit far more casino-like behavior than they did when [he] was young."

How to trade the earnings of Bank of America

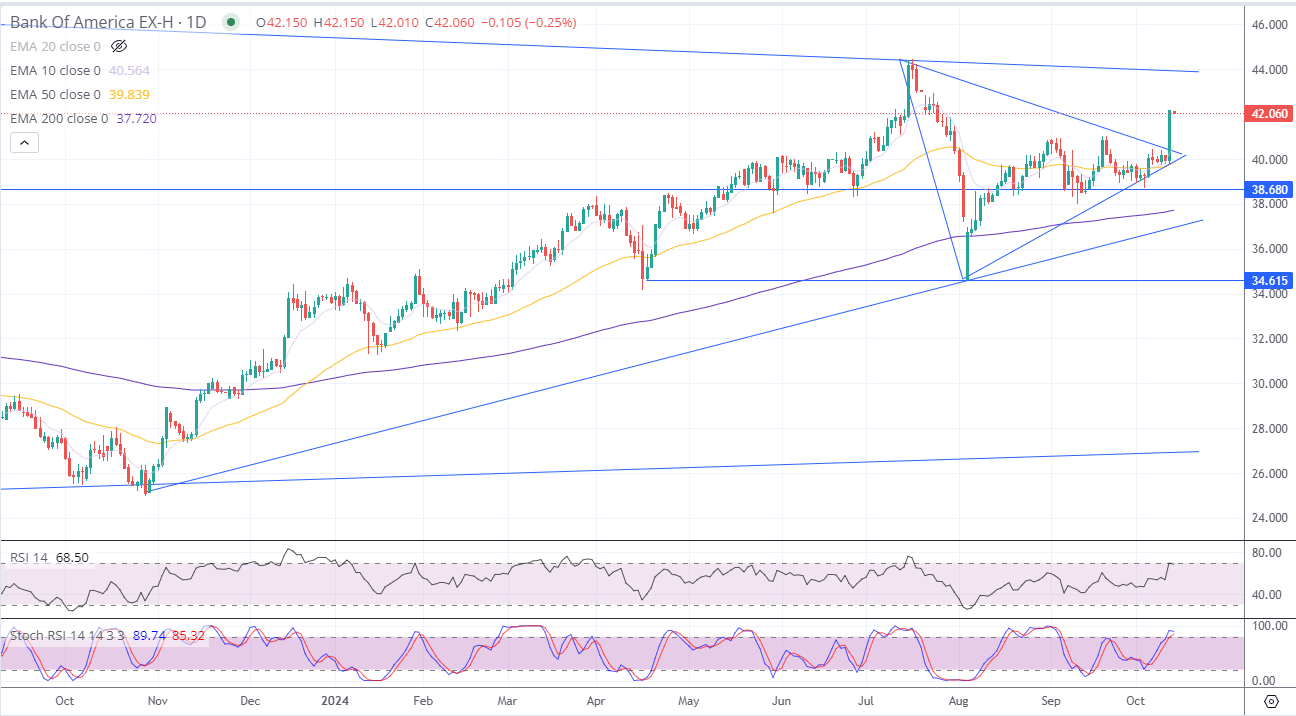

Source: FOREX.com. You can trade before and aftermarket on our Extended Hours chart.

Since October 2023, the price has been rising. Due to the prior results release, there was a significant whipsaw around August 2024, but the price kept rising. The price has attempted to fall below the 38.5 level for the last three months, but it has failed, and it is currently trading above this level.

In addition to being above the 200 EMA, the price also found support at the 50 EMA and above the 10 EMA.

The Stochastic RSI is already in overbought areas, suggesting a possible consolidation or weakness, and the RSI shows positive biases while around overbought levels.

Goldman sachs

On October 15, Goldman Sachs will report its earnings as the share price tries to reach new all-time highs.

For the previous quarter, Goldman Sachs is anticipated to report $11.79 billion in sales with an EPS of $7.31. The findings stem from Goldman Sachs' reported second-quarter profits, which increased 167% over the same period last year due to a boom in its investment banking division.

Goldman Sachs has been performing well due to increasing client activity during increased market volatility, increasing activity in the mergers and acquisitions during Q3. Projections say that the trend will continue.

According to CEO David Solomon "We are in the early stages of the capital markets and recovery, which is encouraging for the investment bank's prospects."

Trading strategies for Goldman Sachs

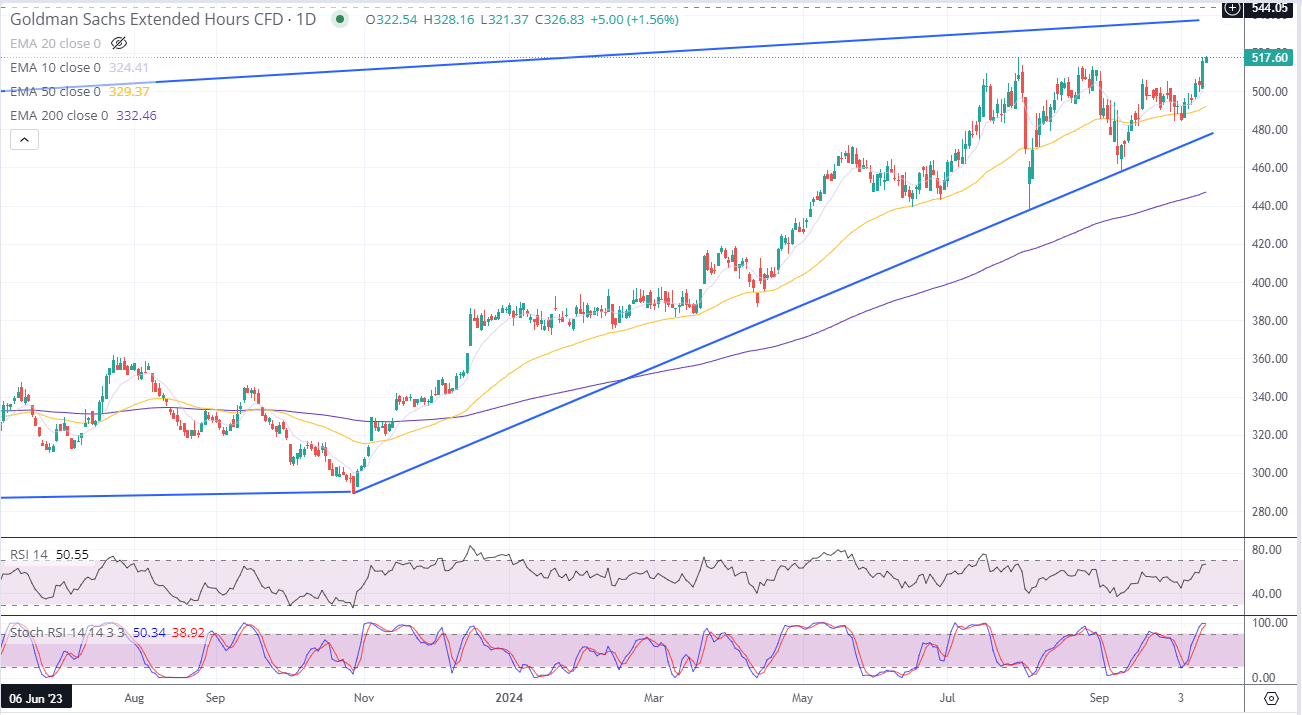

Goldman Sachs has been trending higher towards past all-time highs. As a matter of fact, we are currently right on the all-time high levels. This marks levels that we have not seen previously making this a new territory. Towards the upside we have a weak resistance around 540, due to the top of the trendline. Too the downside we have the 480 level as support.

We are currently above the 10, 50 and 200 EMA indicating bullish tendencies. The RSI is also above the centreline at bullish levels, without being overbought.

The Stochastic RSI is in overbought territory indicating potential weakness or consolidation at these levels.

Citigroup

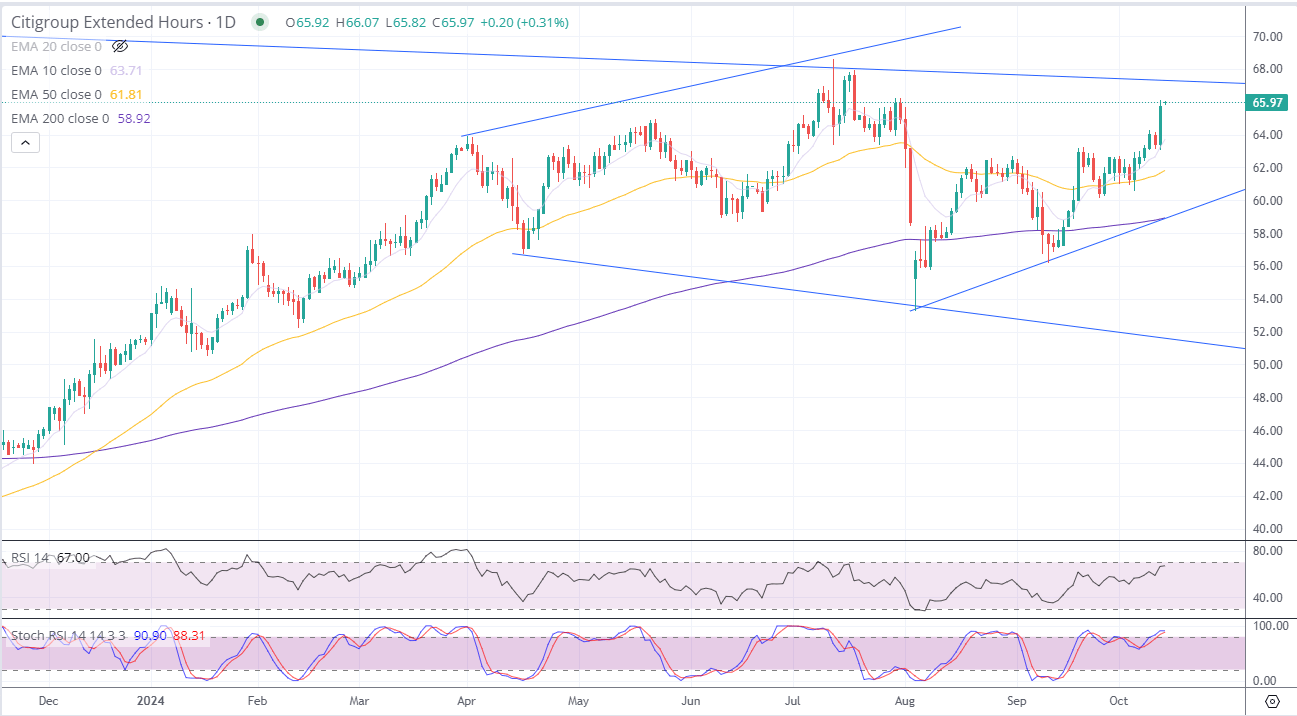

In its next report, Wall Street analysts anticipate Citigroup (C) to announce quarterly earnings of $1.36 per share, representing a 10.5% year-over-year fall. It is anticipated that revenues would be $19.91 billion, a 1.2% decrease from the same quarter last year.

At 65.74 USD, the stock price of Citigroup Inc. is now strong, showing a notable trading session increase of +3.56% and a great year-to-date performance with a percentage change of +27.80%. Citigroup (C), a market leader with a large trading volume of 15.48 million, continues to draw in investors from all over the world.

According to a recent memo, Citigroup Inc. has been making strategic movements lately, as demonstrated by the creation of a new banking management team. Another important factor that has affected the stock price is the agreement between Mastercard and Citigroup for cross-border debit card payments. Citigroup has also been embroiled in legal disputes, defending itself against a fraud scam lawsuit filed in New York. Investors are keeping a careful eye on stock movements in anticipation of earnings season as a result of Citigroup lowering target prices for a number of firms and entering into international transactions.

The last four quarterly earnings releases have shown higher-than-expected earnings. Compared to previous year's profits, this release is expected to generate stronger expectations.

Charles schwab

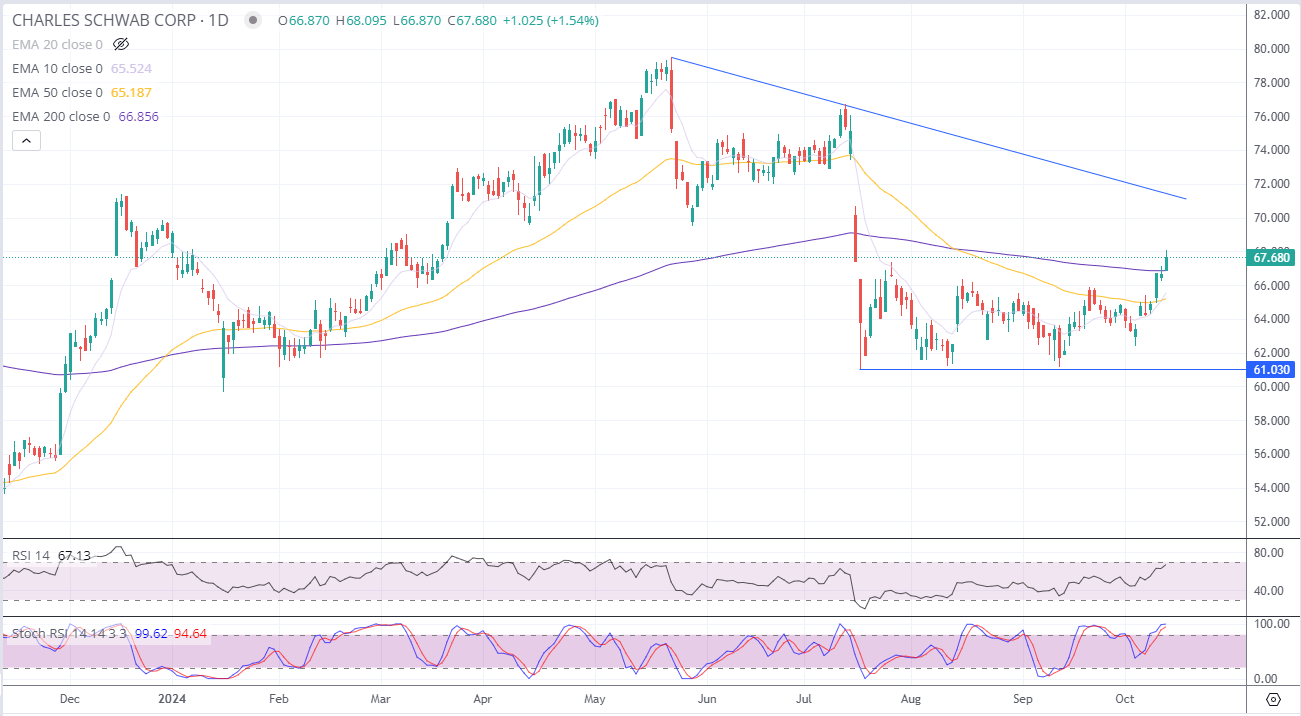

Before the market opens on October 15, 2024, Charles Schwab Corporation (The) Common Stock is anticipated to release its earnings. The fiscal quarter that ends in September 2024 will be covered in the report. The consensus EPS estimate for the quarter is $0.75 which is based on the projections of nine analysts. For the same period previous year, the reported EPS was $0.77.

Schwab's results for the second quarter were in line with the Consensus Estimate. The asset management company's strong performance improved the results. Tailwinds included strong brokerage account numbers and the lack of fee waivers. The undermining causes, however, were an increase in adjusted expenses and greater finance costs.

The third quarter saw a strong level of client activity. Client activity was primarily driven by lowering inflation, the possibility of a gentle landing for the US economy, and clarity over the interest rate path. SCHW's core net new assets increased significantly in July and August compared to the same months last year.

Additionally, on a year-over-year basis, the number of newly opened brokerage accounts increased by 8% in July and 4% in August.

The business has a strong track record of surprising investors with its earnings.

Charles Schwab generated profits figures for the last six quarters that were either slightly over or exactly on predictions.

That’s a wrap for these,

As if that weren't enough, Morgan Stanley and US Bancorp will also be reporting on Wednesday, October 16. Watch this space for additional details.