US futures

Dow future 0.06% at 41837

S&P futures 0.12% at 5721

Nasdaq futures 0.13% at 19998

In Europe

FTSE -0.28% at 8165

Dax 0.07% at 19178

- Stocks quiet as America goes to the polls

- US polls show the race is still too tight to call

- Trump Media & Technology rises on Trump trade

- Oil rises adding to yesterday’s gains

US election count down….

U.S. stocks are edging higher in quiet trade in the calm before the storm as Americans head to the polls to vote for the next U.S. President.

In the tightly contested US election, traders are bracing themselves for volatility over the coming sessions until a clear winner is declared.

The latest polls continue to show the race is extremely close, although the betting odds market, which investors appear to have been following to predict the outcome, shows that Trump is the front-runner.

Even if there was a clear winner, a blue sweep or a red sweep is far from certain. This means that Washington could face gridlock, which could limit the president's ability to implement significant policy changes. The market usually likes this outcome.

A Trump win and a red sweep is considered the most bullish outcome for stocks and the USD, while a Kamala Harris win and a blue sweep could see stocks and the USD fall as the Trump trade unwinds.

While all eyes are on the US election, US ISM services PMI data is also due to be released today and is expected to show that the dominant sector in the US saw activity slow slightly to 53.8, down from 54.9 in September.

The data comes ahead of Thursday's Federal Reserve interest rate decision. The central bank is widely expected to cut interest rates by 25 basis points, marking the second straight rate cut. Given that the move is priced in, the market will be watching guidance from the Federal Reserve as inflation has cooled 2.1% and the jobs market shows signs of gradual slowing.

Corporate news

Planatir shares jumped over 14% after the data analytics firm lifted its annual revenue guidance revenue forecast for a third time, raising confidence that the AI boom was fuelling demand for its services.

Boeing rises over 1.5% after striking workers accepted a new contract following a vote on Monday. This brings to an end the crippling strike, which started in early September.

Trump media and technology has jumped over 11% suggesting investors are once again confident about the former president's chances of winning the race to the White House.

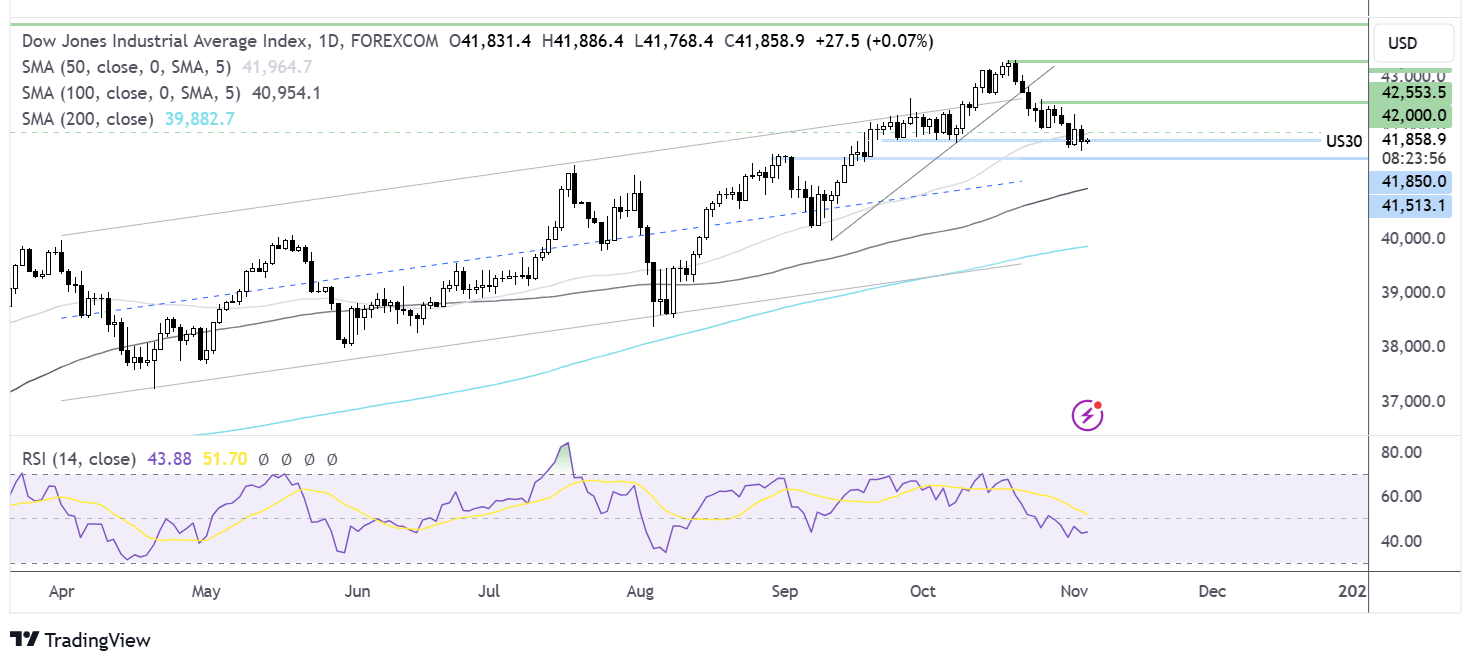

Dow Jones forecast – technical analysis.

The Dow has traded in an upward trend since April with a series of higher highs and higher lows. After running into resistance at 43,325, an all-time high, the Dow Jones has traded lower, taking out 42.5, and is testing the 50 SMA and the October low around 41,700. Supported by the RSI below 50, sellers will look to break below this level and 41560, the August high, to create a lower low. Should buyers defend the 41.7k level, a move back towards 42.5k brings the ATH back into focus.

FX markets – USD falls, EUR/USD rises

The USD is falling further amid the unwinding of the Trump trade and as investors wait nervously for the election outcome. A Trump win, with his inflationary policies, could boost the USD.

EUR/USD is rising for a third straight day U.S. dollar and as investors look ahead to a speech from ECB president Christine Lagarde. While a Kamala Harris win could be beneficial for the euro, at least in the short term, gains may be short-lived as attention turns back to central banks and growth divergence.

GBP/USD is rising, capitalizing on a weaker U.S. dollar despite the UK service sector PMI slowing to an 11-month low of 52 in October, down from 52.4 in September, although this was an upward revision from 51.8 in the initial reading. BRC consumer spending also slowed to 0.6% YoY in October from 2% in September amid caution ahead of the Budget.

Oil rises as OPEC+ delays oil production increase.

After rising just below 3% in the previous session, oil prices are inching higher on Tuesday, trading within a narrow range ahead of the US presidential elections.

The outcome of the elections will be important for the oil market as a Donald Trump victory could have consequences for geopolitical relations, global trade and energy policy.

Oil booked strong gains yesterday after OPEC+ announced over the weekend that they would push back a production increase by a month from December to January amid weak demand and concerns over a supply glut.