- Dollar analysis: USD weakness is lacking fundamental justification

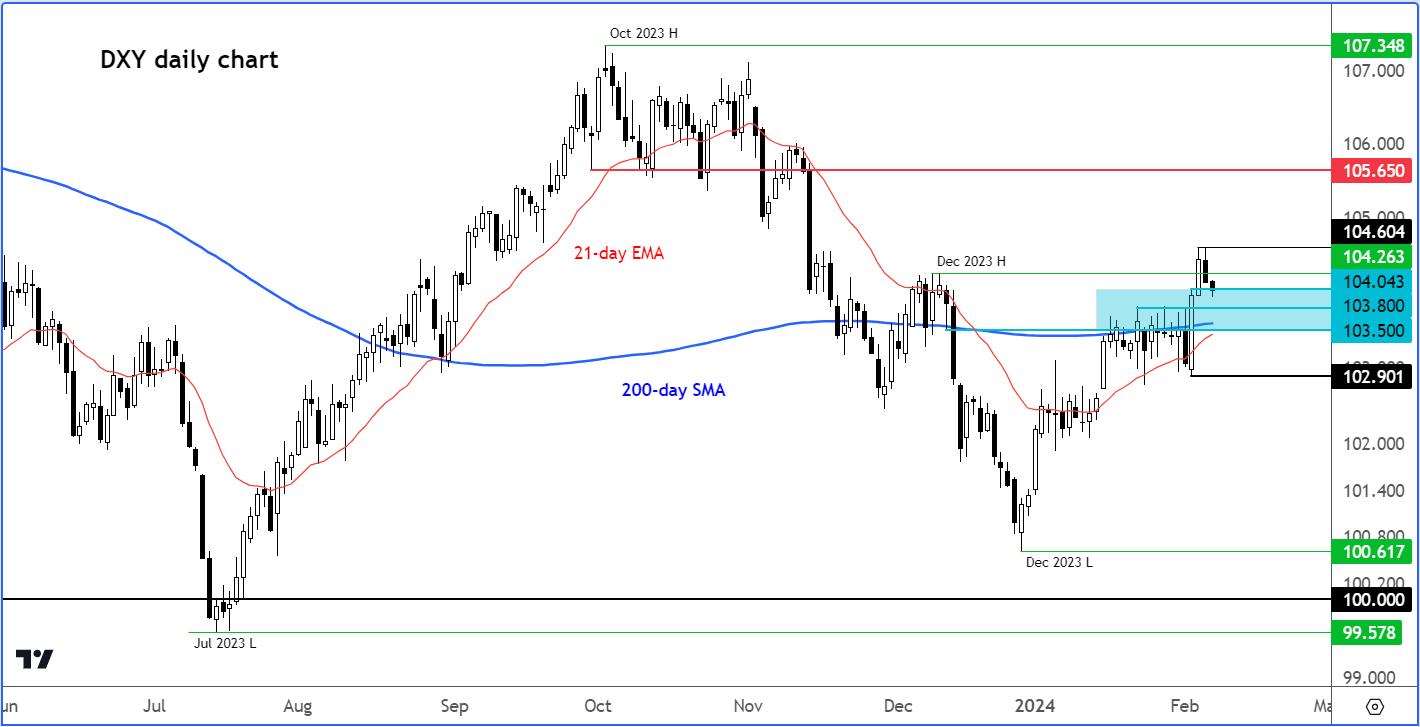

- Dollar Index looking to bounce back as it tests key support

- EUR/USD analysis: Euro rises to test 1.0780 resistance

The US dollar fell back further in the first half of Wednesday’s session, giving back more of the gains it had made following strong data at the back end of last and start of this week. Profit taking has been among the reasons behind the greenback’s mild losses in the last couple of days. We have also seen continued strength in US equity markets, reducing the appeal of the safe haven dollar, while the rebound in bond prices has also caused yields to fall back a little. Still, the path of least resistance is to the upside for the dollar, meaning currency pairs like the EUR/USD may well resume lower after this respite. For now, the subdued economic calendar means traders can afford the luxury of refraining from exerting significant directional pressure.

Dollar analysis: USD weakness is lacking fundamental justification

The US dollar was down for the second session, following its sharp NFP-driven gains on Friday and the further follow-up technical buying observed on Monday. The greenback’s losses in the last couple of days have been driven in part because of continued strength in equity markets reducing the appeal of the safe haven dollar, while the rebound in bond prices has also caused yields to fall back a little. The latter may have been due to the stress in New York Community Bancorp's (NYBC) shares, which were suspended today after another big drop in response to Moody’s cutting its ratings to junk last night. For US dollar traders, the next focal point is likely to be tonight’s $42 billion 10-year US Treasury auction. If it goes smoothly, then risk appetite should remain firm, while a rise in yields could send the dollar higher again.

The dollar index is now within the 103.50 to 104.05 support area where we could see a rebound in the coming days. Previously it has struggled to get through this region. Here, we also have the 200-day average converging. However, in the event the bulls fail to defend their ground here, and we move below Friday’s low at 102.90, then that would represent a big failure, which could see the dollar plunge across the board. That is not my base case scenario, but is a possibility one cannot ignore.

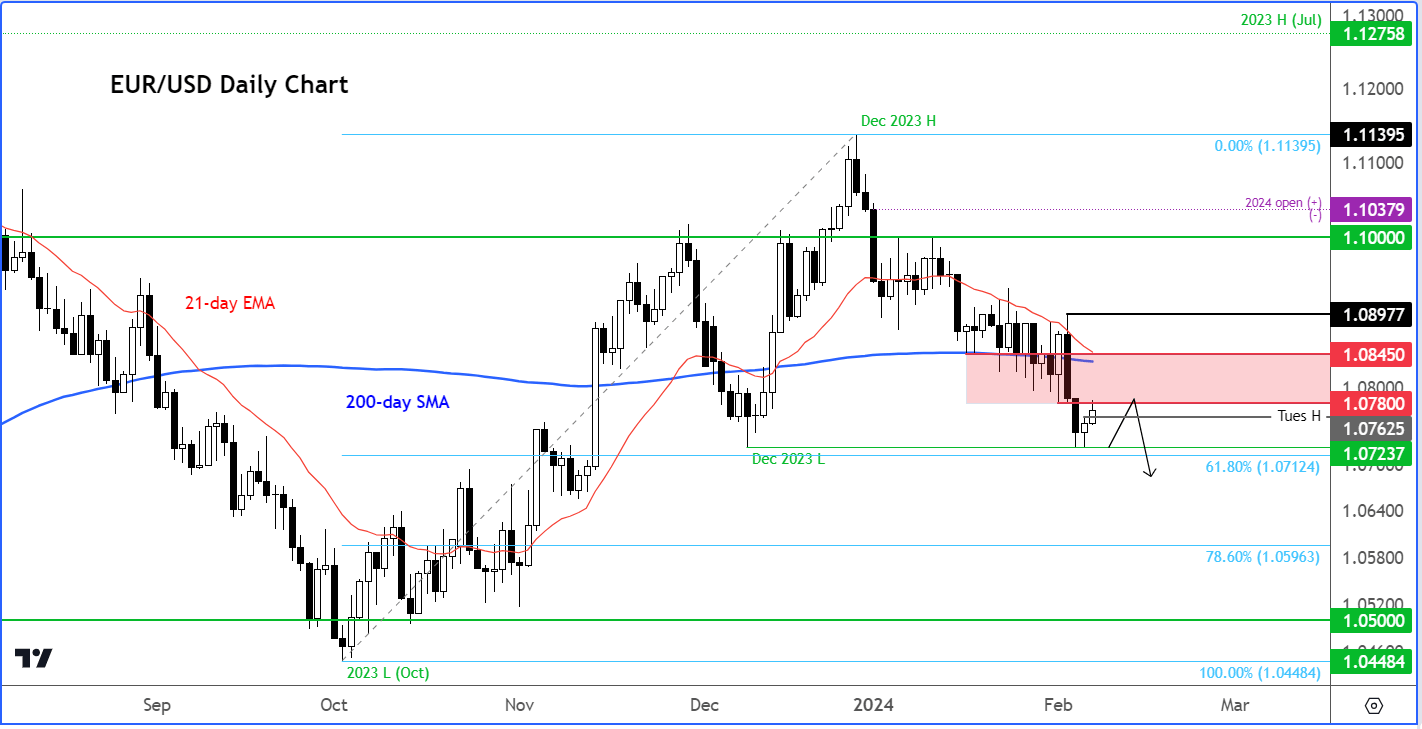

EUR/USD analysis: Euro rises to test key resistance

Among the dollar pairs to watch is the EUR/USD, which, despite its rebound today, maintains a downward trajectory. The subdued economic calendar means traders can afford the luxury of refraining from exerting significant directional pressure, as sentiments regarding the Federal Reserve's potential easing oscillate.

But it is important to note that the respite in the dollar rally is lacking substantial fundamental backing. This pullback follows Monday's extension of the greenback's rally that has been spurred by robust jobs, and a stronger ISM services PM report. Those data releases merely reinforced the notion that the Federal Reserve would adopt a cautious stance in adjusting its policy. Recent hawkish remarks from Fed officials, notably from Cleveland Fed President Loretta Mester and Chairman Jerome Powell, underscored the Fed's reluctance to lower interest rates sooner than later.

Therefore, I reckon the dollar may be able to find support during short-term pullbacks until a substantial shift occurs in underlying fundamentals. As a result, the pressure on the EUR/USD pair should resume.

The single currency has struggled to main previous attempts to recover, hampered by persistently weak data from the Eurozone. This week, Eurozone retail sales fell short of expectations, while German Industrial Production recorded a significant decline in December, highlighting the ongoing challenges faced by the Eurozone's economic powerhouse. Despite this, German Factory Orders surprisingly exhibited resilience, registering a robust increase compared to expectations. Still, that was akin to a drop in the Ocean.

EUR/USD technical analysis

The EUR/USD has for now found support where it had formed a low in December, at 1.0723. But it could break this level in due course. At the time of writing, the EUR/USD was back up against potential resistance starting in the 1.0780 to 1.0845 region. The lower end of this range marks the low of Thursday, which was taken out following a strong US nonfarm payrolls report the following day. The upper end of the range is where the 200-day moving average comes into play. I would not be surprised if the EUR/USD were to start its next leg lower from here, and go on to take out the December low more decisively this time.

While it is possible the EUR/USD may have formed a double bottom, there’s little fundamental justification for the dollar to start trending lower in light of the recent data surprises and hawkish Fed commentary. So, as things stand, I would only entertain bullish trades on the EUR/USD if we see a clear bullish reversal pattern emerge first, or we see a potential break back above the most recent high at just below the 1.09 handle to invalidate this bearish EUR/USD trend.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R