What happened in the DAX components

Evotec (ETR: EVTG) is the focus of investor attention due to emerging takeover speculation, which was already initiated at the beginning of the week. US company Halozyme Therapeutics has expressed an interest in acquiring the Hamburg-based drug discovery company, offering 11 euros per share in cash. As a result, Evotec shares rose to 10.80 euros in pre-market trading, an increase of around 25% compared to the Xetra close. With the participation of international players such as Triton, Novo Nordisk and Mubadala, Evotec could become the target of intense takeover competition, which is further fuelled by the takeover speculation.

TALANX (TLX100) – closed yesterday’s trading day with +7%. The insurance company announced revenue increases of +12%, to 36 billion EUR in the last 9 months. Earnings per share also increased by 25% over analysts’ expectations, with EBIT increasing 33%.

INFINEON (WKN: 623100) – Gained 4.6% yesterday, as good news from ASML and INTEL which have maintained interest in the manufacturing plants in Magdeburg. Goldman Sachs also raised their target for 2025.

Germany against NATO Expansion

The majority of Germans are reportedly opposed to Germany playing a bigger role in NATO. Only 33% of respondents to the YouGov (LON:YOU) survey for "Süddeutsche Zeitung Dossier" said that Germany should be more involved in the leadership of the defence budget if Donald Trump was elected president of the United States, showing a strong objection of Trumps plan to increase defence spending for NATO members.

To Watch today

Today the economic calendar is quiet in the European session, so our focus shifts to US economic data.

14:30 CET – US -Core Retail Sales (MoM) (Oct)

14:30 CET – US - Export Price Index (MoM) (Oct)

14:30 CET – US - Import Price Index (MoM) (Oct)

14:30 CET – US - Retail Sales (MoM) (Oct)

16:00 CET – EU - ECB's Lane Speaks

DAX Technical Analysis

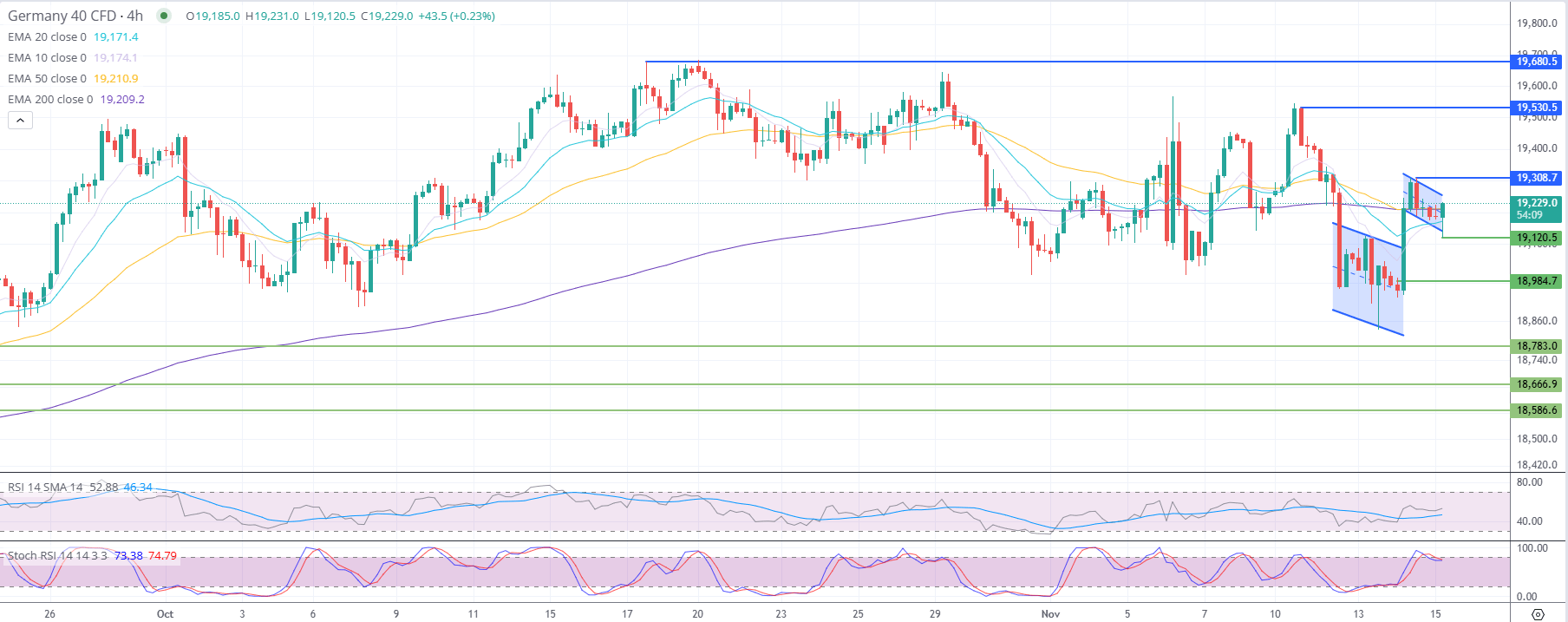

Germany 40 CFD (DAX) 4-hour chart

- The DAX is currently trading around 19,200, showing consolidation after a recent pullback and testing support levels around 19,150.

1. Support and Resistance Levels:

- Resistance:

- The immediate resistance level is 19,308. A break above this level could suggest a short-term bullish reversal.

- The next significant resistance is at 19,530, which could act as an upper limit in a bullish scenario.

- A major resistance level lies at 19,680.5, which represents the recent high and would signal a strong bullish continuation if broken.

- Support:

- The closest support is at today’s low of 19,120. A break below this level could indicate further short-term bearish pressure.

- Additional support is found at 18,983, which aligns with the average of the previous lows and could act as a stabilizing level if the price declines further.

- Lower support levels at 18,666.9, 18,625.0, and 18,586.6 provide further downside protection in the event of an extended sell-off.

2. Moving Averages (EMA 10, 20, 50, and 200):

- The DAX is currently trading near the EMA 50 at 19,209.4 and the EMA 200 at 19,202.4, indicating a balance between bullish and bearish pressures.

- The EMA 10 at 19,057.1 and EMA 20 at 19,122.2 provide short-term support if the price manages to stay above them, potentially supporting a consolidation or recovery.

- A sustained move above the EMA 50 and EMA 200 would be necessary to confirm any bullish reversal.

3. RSI and Stochastic RSI:

- The RSI is at 46.19, indicating a neutral outlook, as it hovers just below the 50 level, showing neither overbought nor oversold conditions.

- The Stochastic RSI is at 69.40 for the fast line, suggesting a mildly bullish stance, but a move toward higher levels would confirm stronger momentum.

4. Consolidation Range and Potential for Breakout:

- The DAX is showing signs of consolidation within a range, with 19,495 as an upper limit and 18,783.0 as the lower boundary. A breakout above or below these levels would likely determine the next directional move.

The DAX is currently consolidating within a defined range. A break above 19,308 could lead to a bullish recovery, while a break below 18,928.6 would confirm further downside. Traders should watch these levels closely for directional cues.

On another note if you want to find out why Bitcoin reached to all time highs and the way forward for digital currencies, you can read my article here: Bitcoin soars past silver in value. Is the Trump-effect just beginning?

--Written by Philip Papageorgiou – Market Analyst

-Follow me on X ex Twitter: PhilipForexCom