Market Overview: US Sessions

US Markets Recap

- Dow Jones (DJI): -0.13%

- S&P 500: -0.39%

- NASDAQ: +0.60%

Metals and Bitcoin:

- Copper (+0.61%) and gold (+0.58%) lead gains, indicating hedging activity and safe-haven demand.

- Bitcoin (+0.64%) continues to climb, reflecting broader crypto market enthusiasm, particularly after renewed institutional interest post-election.

Market Overview: European Session

Focus on Germany:

The DAX closed at 19,189 points yesterday, not far from the DAX opening level, showing the cautious approach from market participants ahead of events that could cause volatility.

- Today, final Euro Area CPI readings will dominate sentiment:

- Headline CPI is expected to confirm a rise from 1.7% to 2.0% YoY, aligning with ECB targets.

- Core CPI likely remains unchanged at 2.7% YoY.

Impact:

- If CPI aligns with expectations, the euro could find support above 1.0500, potentially boosting export-driven sectors like autos and industrials from Germany.

- Inflation stabilization may keep ECB policy expectations steady, which is supportive for equities overall.

Focus on the UK:

BoE Governor Andrew Bailey’s testimony before the Treasury Committee might inject volatility into GBP-related forex pairs:

- Any dovish tone on inflation could pressure GBP/USD lower, while hawkish signals may provide support.

- Domestic-focused sectors like UK homebuilders and retailers could react positively to hints of sustained accommodative policy.

Central Bank Notes: Key ECB Updates

- The ECB's rate cut on October 17 marked its second consecutive 25 bps reduction, with rates now at:

- Main refinancing operations: 3.40%

- Marginal lending facility: 3.65%

- Deposit facility: 3.25%

- Outlook:

- Inflation is expected to rise temporarily before stabilizing near 2% in 2025.

- Wage pressures remain elevated but are expected to ease, while PEPP reinvestments will be discontinued by the end of 2024.

DAX leaders today

Sartorius AG +1.20%

E.ON SE +0.86%

Bayer +0.84%

Merck KGaA +0.63%

DAX laggards today

Siemens AG -1.79%

Brenntag AG -1.48%

Siemens Energy AG -1.49%

Zalando SE -1.42%

On the agenda today (MET):

14:00 EUR German Buba Mauderer Speaks

14:30 USD Building Permits (Oct)

14:30 USD Housing Starts (MoM) (Oct)

17:45 EUR German Buba Balz Speaks

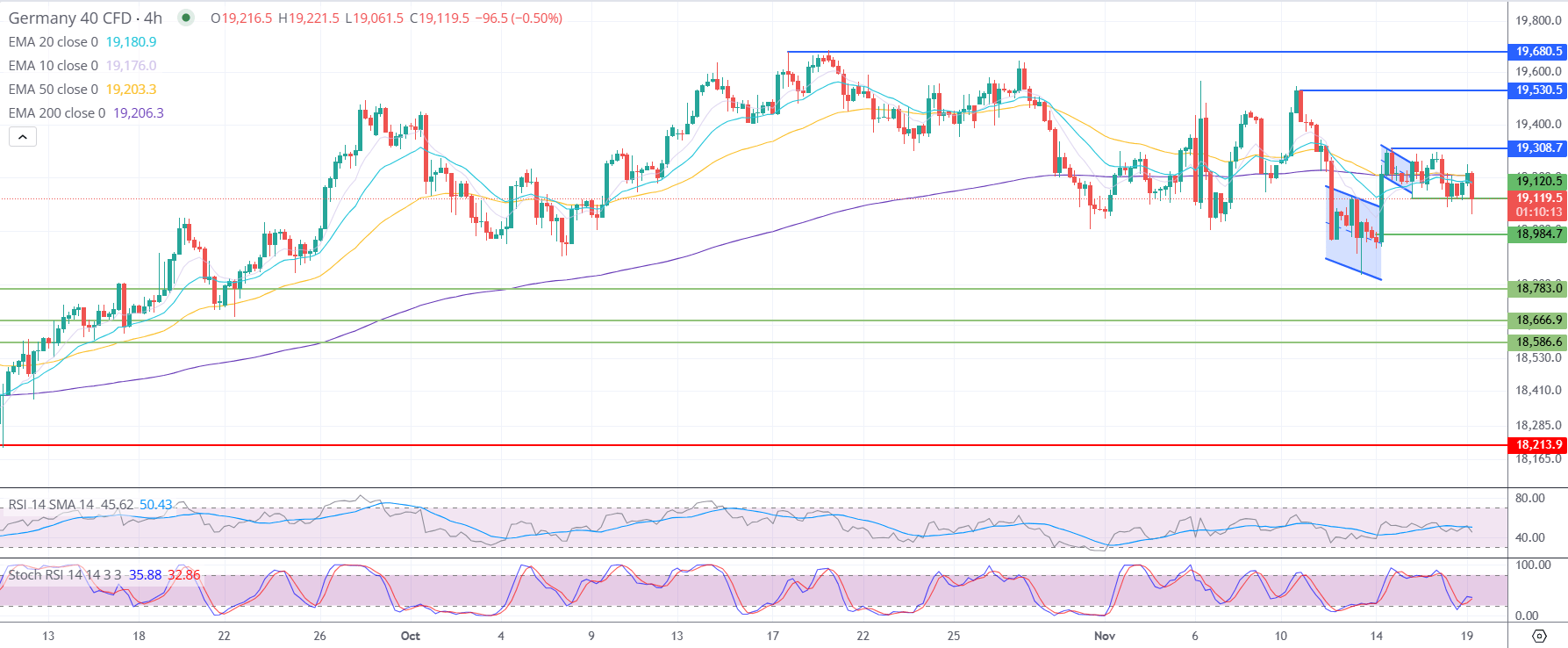

Germany 40 (DAX) Technical analysis – 4H

Support and Resistance Levels:

- Resistance:

- The nearest resistance is at 19,308.7, which aligns with the recent consolidation zone.

- Beyond that, 19,530.5 serves as the next target, followed by a major resistance level at 19,680.5, signaling a stronger bullish continuation.

- Support:

- Immediate support lies at 18,984.7.

- Additional support levels include 18,783.0, 18,666.9, and 18,586.6, providing significant downside targets in case of extended selling pressure.

- A critical support zone lies at 18,213.9, the base for any substantial bearish movement.

Moving Averages (EMA 10, 20, 50, and 200):

- The DAX is trading below the EMA 10 (19,176.0) and EMA 20 (19,180.9), indicating short-term bearish pressure.

- The EMA 50 at 19,203.3 and EMA 200 at 19,206.3 are slightly above the current price, acting as dynamic resistance levels.

- Sustained trading below these EMAs supports a bearish outlook.

RSI and Stochastic RSI:

- The RSI is at 45.62, reflecting a slightly bearish sentiment. It is not yet oversold, suggesting room for further declines.

- The Stochastic RSI is at 35.88, leaning toward oversold conditions. This could imply a short-term bounce or consolidation near support levels.

Thesis:

Scenario 1: Bearish Continuation:

- If the DAX breaks below 18,984.7, further downside toward 18,783.0 and 18,666.9 becomes likely.

- Sustained bearish momentum would target 18,586.6 and potentially 18,213.9, signaling a stronger correction.

Scenario 2: Short-term Bounce and Recovery:

- If the DAX holds above 18,984.7 and reclaims 19,180.9 (EMA 20), it may consolidate and retest 19,308.7.

- A breakout above 19,308.7 could open the door to a rally toward 19,530.5 and possibly 19,680.5.