Its Monday again.

Eurozone: price fluctuations based on sentiment data

In November, the stock markets reacted to the purchasing managers' indices in the eurozone. The cross-sector indicator fell unexpectedly sharply to 48.1 points – the lowest level in ten months and below the expansion threshold of 50 points.

Sentiment deteriorated particularly in France, but also in Germany, especially in the services sector. Business prospects are at their weakest in over three years, putting further pressure on the indicator for industry, which is already struggling.

A large interest rate cut of 0.5 percentage points by the European Central Bank in December is now priced in with a probability of more than 50% in the interest rate futures markets, as the disappointing data have led to this. In the short term, yields on two-year German government bonds fell to less than two per cent.

DAX leaders

Adidas +2.50%

Sartorius +1.95%

BMW AG +1.50%

Infineon +1.45%

DAX laggards

Commerzbank -5.60%

Symrise AG -0.95%

Daimler Truck Holding -0.80%

E.ON SE

On the agenda today:

Not much happening for the European session today, other than (GMT+1) :

16:30 EUR ECB's Lane Speaks

18:30 EUR German Buba President Nagel Speaks

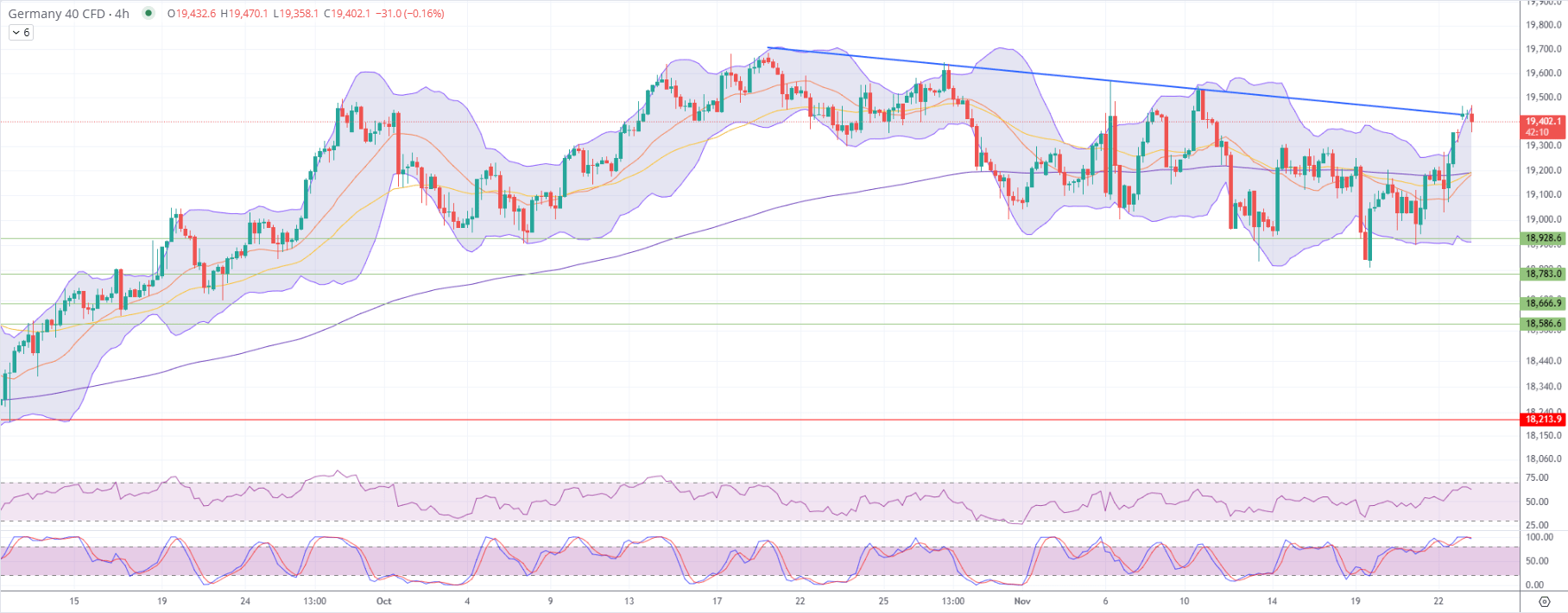

Germany 40 (DAX) Technical Analysis – 4H

The DAX is currently trading at 19,402.1, showing consolidation near a key resistance level after breaking above short-term moving averages. A downward sloping trendline (in blue) is still exerting resistance on price movements, and the index has not yet confirmed a breakout.

Resistance:

Immediate resistance is at the downward sloping trendline, near 19,430. A breakout above this level would indicate renewed bullish momentum. Further resistance is at 19,530.5 and the key upper level at 19,680.5, representing major hurdles for a bullish continuation.

Support:

Immediate support lies at 19,308.7. A break below this level could suggest weakening momentum and lead to further declines. Additional support levels include 18,984.7, 18,783.0, and 18,666.9, with 18,586.6 providing a deeper downside cushion.

Bollinger Bands:

The price is nearing the upper Bollinger Band, suggesting overextension in the short term. A pullback to the middle band (around 19,200) could act as a reversion point if the price fails to break the trendline resistance.

RSI and Stochastic RSI:

The RSI is at 57.47, indicating a neutral-to-bullish sentiment with room for further upside if the price breaks resistance.

The Stochastic RSI is at 88.67, signaling overbought conditions. This could indicate a pause or minor pullback before any further upward movement.

Moving Averages:

The DAX is trading above the EMA 10, EMA 20, and EMA 50, signaling improving bullish momentum.

The important EMA 200 at 19,194.3 is acting as dynamic support, further supporting the bullish case if the price stays above this level.

Scenario 1: Bullish Breakout:

If the DAX breaks above the downward trendline near 19,430, it could target 19,530.5 and potentially test 19,680.5 in the coming sessions.

Sustained trading above the upper Bollinger Band would confirm strong bullish momentum.

Scenario 2: Short-term Pullback:

Overbought Stochastic RSI conditions suggest a potential pullback toward 19,308.7 or the middle Bollinger Band at 19,200.

A break below 19,308.7 would signal renewed bearish pressure, with 18,984.7 as the next target.

Happy Monday and trade informed,

--Written by Philip Papageorgiou – Market Analyst

-Follow me on X ex Twitter: PhilipForexCom